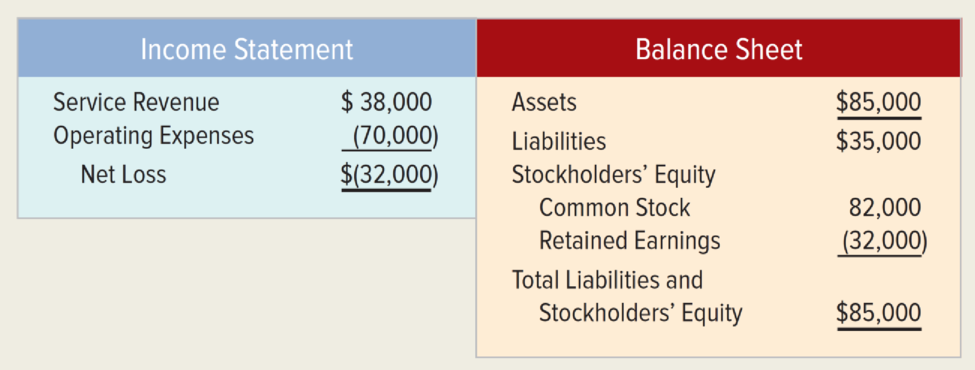

Glenn’s Cleaning Services Company is experiencing cash flow problems and needs a loan. Glenn has a friend who is willing to lend him the money he needs provided she can be convinced that he will be able to repay the debt. Glenn has assured his friend that his business is viable, but his friend has asked to see the company’s financial statements. Glenn’s accountant produced the following financial statements:

Glenn made the following adjustments to these statements before showing them to his friend. He recorded $82,000 of revenue on account from Barrymore Manufacturing Company for a contract to clean its headquarters office building that was still being negotiated for the next month. Barrymore had scheduled a meeting to sign a contract the following week, so Glenn was sure that he would get the job. Barrymore was a reputable company, and Glenn was confident that he could ultimately collect the $82,000. Also, he subtracted $30,000 of accrued salaries expense and the corresponding liability. He reasoned that since he had not paid the employees, he had not incurred any expense.

Required

a. Reconstruct the income statement and balance sheet as they would appear after Glenn’s adjustments.

b. Write a brief memo explaining how Glenn’s treatment of the expected revenue from Barrymore violated the revenue recognition concept.

c. Write a brief memo explaining how Glenn’s treatment of the accrued salaries expense violates the matching concept.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Survey Of Accounting

- 6 Becky and Carl work for a marketing firm. The two accountants discuss the organization’s financial performance. Carl asks Becky, “What’s the bottom line?” Becky reviews a financial report that shows the firm’s profitability over the last quarter. The document Becky reviews is called the Multiple Choice tax return. ledger. audit. income statement. 7 Diedre works at Sally’s Autobody Workshop. Her main job responsibility is to record the routine, day-to-day business transactions of the firm. Based on this information, Diedre is a Multiple Choice tax accountant. forensic accountant. bookkeeper. CMA. 8 A new fitness company called Jump Athletics receives a trademark for its brand name. The trademark received by Jump Athletics is a Multiple Choice return on asset. current asset. liquid asset. fixed asset. 9 Rowena, a senior manager at Top of the Line Publishing, wants a quick snapshot of the company’s financial position before she goes to a manager’s meeting. In this case, which of the…arrow_forwardA CPA prepares tax returns for clients and bills them after the work is completed. It usually takes two weeks of work to prepare the tax returns. It takes 30 days on average to receive payment from the clients. The CPA uses cash-basis accounting. The revenue should be recorded when the CPA: O A. receives payments from the clients O B. bills the clients. OC. starts working on the tax returns O D. completes working on the tax returns. Click to select your answer. 11-50nm 99+arrow_forwardAnswer the following questionsYou were hired to assist Oman based Company in designing an accounting system for Oman Co., Ltd. has developed a list of the journals, ledgers, reports and documents that he thinks Oman Co., Ltd. The company asks you to complete the following tasks:c) Design a report to assist in managing credit sales and cash collections.d) What types of journals, ledgers and blank forms for various documents ( Sales invoices, purchase orders etc)arrow_forward

- Ethics and Cash Flows You are the accountant for Nello Company, which manufactures specialty equipment. Nello has been in financial difficulty, so its suppliers require purchases to he paid in cash. Furthermore, Nello has long-term debt with a debt covenant that requires it to maintain a 1:1 acid-test (quick) ratio. Nellos employees work a 5-day week, Monday through Friday. On Wednesday morning during the last week of the current year, Sam (the production supervisor) comes to you and says, I dont understand it. We have this large special order from a customer that must be delivered at the end of the first week in January. Once we get the raw materials, it is going to take 5 solid days of work without overtime to produce the order. If Bob (the president) would let me order the raw materials this morning, we could have them by late today. This would give us 2 days this week and the 4 days after New Years Day (Monday) of next week to complete the order without incurring overtime costs. But Bob says we must wait until next Tuesday to order the materials. This means we will have to work double time that Wednesday through Friday to finish the order. That overtime cost is going to really increase next years factory salary expense, so our profit and operating cash flows from that order will be very low. Please talk to him. When you approach Bob about buying the raw materials this morning, he says, If we purchase those materials today, we will have to write a check. And that means our cash flow from operating activities for this year will be much lower, which our shareholders wont like. Furthermore, our quick ratio will go down from 1.01:1 to 0.90:1, so our creditors may be upset. I know our profit and operating cash flows for next year will be lower if we delay the purchase, but that seems to be the best decision. Dont you agree? Required: From financial reporting and ethical perspectives, how would you respond to Bob?arrow_forwardWhat Would You Do? You are responsible for preparing all of the journal entries for Regional Financial Services. You have correctly prepared the following entry for financial services provided on December 15: Your boss has asked you to change the date from December 15 to January 15 so that the business’s profit, and thus taxes, would be lower. Are you allowed to do this? What is your response to your boss? How should you handle this situation?arrow_forwardAn accountant recommends a local computer company to a client that is trying to upgrade its computerized sales records. The client purchases $25,000 worth of equipment and sends a check to the accountant for 5 percent of the total sales. This is an example of aa. Commission.b. Contingent fee.c. Referral fee.d. Nonaudit fee.arrow_forward

- Scenario Jane is the accounts payable clerk for ABC Corporation. One of her job duties is to process the travel expenses of the chief financial officer and pay the associated business credit card bill. Jane has noticed lately that the CEO’s expense reports are steadily increasing in amount and frequency. From receipts and other documentation that Jane processes, she suspects the CEO is running personal expenses through the company; however, she is not 100% sure. Questions 1. What responsibility or role does the accountant have in this process? 2. Should information provided by management and other non-accounting personnel be assumed accurate or is it the accountant’s responsibility to investigate each item submitted for legitimacy? 3. In the situation that follows, does Jane have any responsibility to find out the legitimacy of the expenses she is processing or is her job to just pay the bill?arrow_forwardPeter the Plumber comes to you to ask your expert accounting advice. Peter has been researching about Bad Debts on the internet and has decided to do his own accounting. Peter has chosen to use the 'Direct Writeoff' method when accounting for his Bad Debts, because it appears simple and easy to record. Can you advise Peter whether this is a good idea? If yes, explain why you think it is a good idea. If no, explain why, and provide Peter with an alternative method or approach to account for his Bad Debts.arrow_forwardCHALLENGE PROBLEM In this chapter, you learned about three important financial statements: the income statement, statement of owners equity, and balance sheet. As mentioned in the margin note on page 34, most firms also prepare a statement of cash flows. Part of this statement reports the cash received from customers and cash paid for goods and services. REQUIRED Take another look at the Demonstration Problem for Kenny Youngs Home and Away Inspections. Note that when revenues are measured based on the amount earned, and expenses are measured based on the amount incurred, net income for the period was 4,165. Now, compute the difference between cash received from customers and cash paid to suppliers of goods and services by completing the form provided below. Are these measures different? Which provides a better measure of profitability?arrow_forward

- Working It Out Ann Kerrigan mistakenly recorded the collection of a $1,000 receivable as a debit to Cash and a credit to Service Revenue for $1,000. 1. Prepare the correcting entry. 2. Assume that Kerrigan's net income before the correction was $26,000. How much is her corrected net income?arrow_forwardPart A: If Stacy Lynn wants to show the bank the maximum profit over the previous 2-year period, which costing method should be presented? Part B: However, the bank requires that all financial statements conform to Generally Accepted Accounting Principles (GAAP). Based on that requirement, which costing method should be presented? Part C: The bank has delivered a memo in preparation for the meeting to negotiate the Credit Line; the memo states that they will expect a significant Net Income. Based on your responses to Parts A and B, what are some of the legal and ethical issues that may be of importance to Stacy Lynn?arrow_forward

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning