Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 17E

Evaluating selling and administrative cost allocations

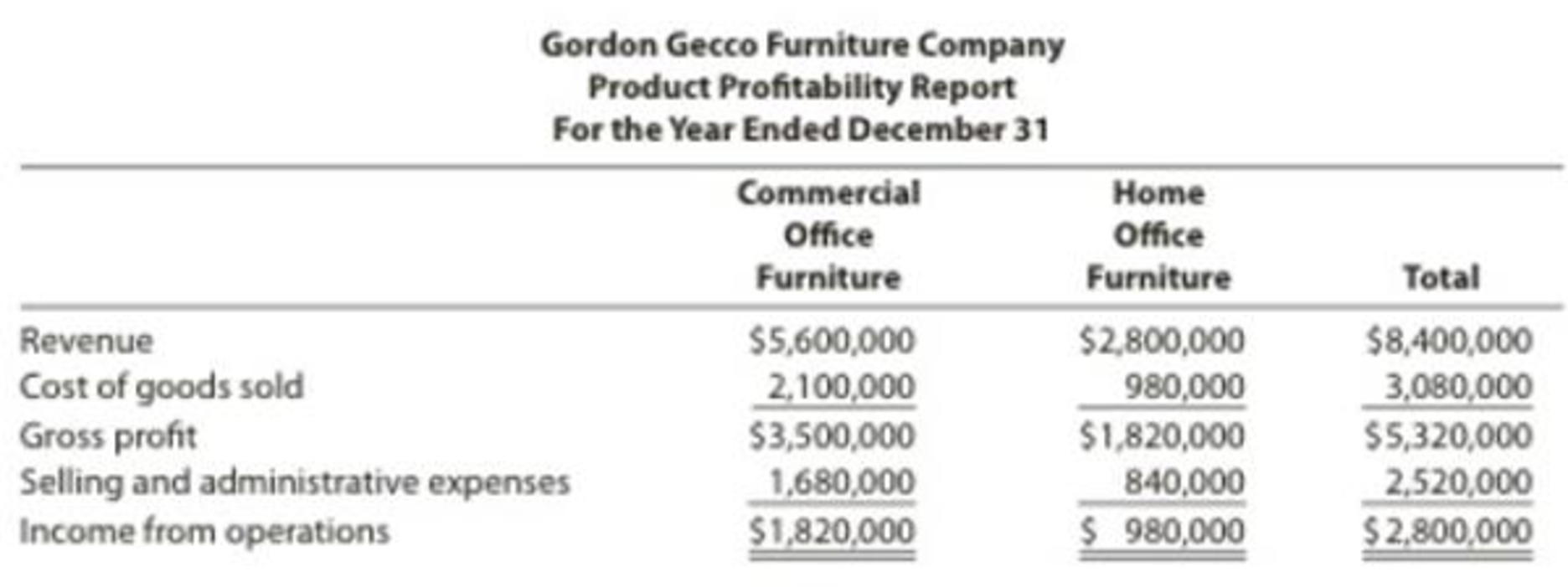

Gordon Gecco Furniture Company has two major product lines with the following characteristics:

Commercial office furniture: Few large orders, little advertising support, shipments in full truckloads, and low handling complexity

Home office furniture: Many small orders, large advertising support, shipments in partial truckloads, and high handling complexity

The company produced the following profitability report for management:

The selling and administrative expenses are allocated to the products on the basis of relative sales dollars.

Evaluate the accuracy of this report and recommend an alternative approach.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Activity-Based Customer-Driven Costs

Suppose that Stillwater Designs has two classes of distributors: JIT distributors and non-JIT distributors. The JIT distributor places small, frequent orders, and the non-JIT

distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product. Stillwater Designs provides the following information about

customer-related activities and costs for the most recent quarter:

Sales orders

Sales calls

Service calls

Average order size

Manufacturing cost/unit

Customer costs:

Processing sales orders

Selling goods

Servicing goods

Total

Sales (in units)

JIT

Distributors

JIT

1,000

70

350

750

$125

$3,330,000

1,120,000

1,050,000

$5,500,000

Non-JIT

Distributors

100

Non-JIT

70

175

Required:

1. Calculate the total revenues per distributor category, and assign the customer costs to each distributor type by using revenues as the allocation base. Selling price for

one unit is $150. Round calculations to the nearest dollar.

7,500…

Activity-Based Customer-Driven Costs

Suppose that Stillwater Designs has two classes of distributors: JITdistributors and non -JIT distributors. The JIT distributor places small,frequent orders, and the non -JIT distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product.Stillwater Designs provides the following information about customer-related activities and costs for the most recent quarter:

Required:1. Calculate the total revenues per distributor category, and assignthe customer costs to each distributor type by using revenues asthe allocation base. Selling price for one unit is $150.

2. CONCEPTUAL CONNECTION Calculate the customer cost perdistributor type using activity-based cost assignments. Discuss themerits of offering the non -JIT distributors a $2 price decrease(assume that they are agitating for a price concession).

3. CONCEPTUAL CONNECTION Assume that the JIT distributors are simply imposing the frequent orders on…

Activity-Based Customer-Driven Costs

Suppose that Stillwater Designs has two classes of distributors: JIT distributors and non-JIT distributors. The JIT distributor places small, frequent orders, and the non-JIT distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product. Stillwater Designs provides the following information about customer-related activities and costs for the most recent quarter:

JITDistributors

Non-JITDistributors

Sales orders

1,100

110

Sales calls

70

70

Service calls

350

175

Average order size

750

7,500

Manufacturing cost/unit

$125

$125

Customer costs:

Processing sales orders

$3,330,000

Selling goods

1,120,000

Servicing goods

1,050,000

Total

$5,500,000

Required:

1. Calculate the total revenues per distributor category, and assign the customer costs to each distributor type by using revenues as the allocation base. Selling price for one unit is $150. Round…

Chapter 18 Solutions

Financial And Managerial Accounting

Ch. 18 - Why would management be concerned about the...Ch. 18 - Why would a manufacturing company with multiple...Ch. 18 - How do the multiple production department and the...Ch. 18 - Under what two conditions would the multiple...Ch. 18 - How does activity-based costing differ from the...Ch. 18 - Shipping, selling, marketing, sales order...Ch. 18 - Prob. 7DQCh. 18 - Under what circumstances might the activity-based...Ch. 18 - When might activity-based costing be preferred...Ch. 18 - Prob. 10DQ

Ch. 18 - Single plantwide factory overhead rate The total...Ch. 18 - Multiple production department factory overhead...Ch. 18 - Activity-based costing: factory overhead costs The...Ch. 18 - Activity-based costing: selling and administrative...Ch. 18 - Activity-based costing for a service business...Ch. 18 - Kennedy Appliance Inc.s Machining Department...Ch. 18 - Bach Instruments Inc. makes three musical...Ch. 18 - Scrumptious Snacks Inc. manufactures three types...Ch. 18 - Isaac Engines Inc. produces three productspistons,...Ch. 18 - Handy Leather, Inc., produces three sizes of...Ch. 18 - Eclipse Motor Company manufactures two types of...Ch. 18 - The management of Nova Industries Inc....Ch. 18 - Comfort Foods Inc. uses activity-based costing to...Ch. 18 - Nozama.com Inc. sells consumer electronics over...Ch. 18 - Hercules Inc. manufactures elliptical exercise...Ch. 18 - Lonsdale Inc. manufactures entry and dining room...Ch. 18 - Activity cost pools, activity rates, and product...Ch. 18 - Handbrain Inc. is considering a change to...Ch. 18 - Prob. 14ECh. 18 - Activity-based costing and product cost distortion...Ch. 18 - Single plantwide rate and activity-based costing...Ch. 18 - Evaluating selling and administrative cost...Ch. 18 - Construct and interpret a product profitability...Ch. 18 - Metroid Electric manufactures power distribution...Ch. 18 - Activity-based costing for a service company...Ch. 18 - Bounce Back Insurance Company carries three major...Ch. 18 - Gwinnett County Chrome Company manufactures three...Ch. 18 - The management of Gwinnett County Chrome Company,...Ch. 18 - Activity-based and department rate product costing...Ch. 18 - Activity-based product costing Mello Manufacturing...Ch. 18 - Allocating selling and administrative expenses...Ch. 18 - Product costing and decision analysis for a...Ch. 18 - Single plantwide factory overhead rate Spotted Cow...Ch. 18 - Multiple production department factory overhead...Ch. 18 - Activity-based department rate product costing and...Ch. 18 - Activity-based product costing Sweet Sugar Company...Ch. 18 - Allocating selling and administrative expenses...Ch. 18 - Product costing and decision analysis for a...Ch. 18 - Life Force Fitness, Inc., assembles and sells...Ch. 18 - Activity-based product cost improvement Gourmet...Ch. 18 - Labor classification trade-off Skidmore...Ch. 18 - Production run size and activity improvement...Ch. 18 - Hospital activity-based costing analysis Lancaster...Ch. 18 - Ethics in Action The controller of Tri Con Global...Ch. 18 - Communication The controller of New Wave Sounds...Ch. 18 - Pelder Products Company manufactures two types of...Ch. 18 - The Chocolate Baker specializes in chocolate baked...Ch. 18 - Young Company is beginning operations and is...Ch. 18 - Cynthia Rogers, the cost accountant for Sanford...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Chocolate Baker specializes in chocolate baked goods. The firm has long assessed the profitability of a product line by comparing revenues to the cost of goods sold. However, Barry White, the firms new accountant, wants to use an activity-based costing system that takes into consideration the cost of the delivery person. Following are activity and cost information relating to two of Chocolate Bakers major products: Using activity-based costing, which of the following statements is correct? a. The muffins are 2,000 more profitable. b. The cheesecakes are 75 more profitable. c. The muffins are 1,925 more profitable. d. The muffins have a higher profitability as a percentage of sales and, therefore, are more advantageous.arrow_forwardAssume you are the department B manager for Marleys Manufacturing. Marleys operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only o department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. (Hint: It may be helpful to perform a vertical analysis.)arrow_forwardAssign the customer-related activity costs to each customer type using activity rates. Now calculate the profitability of each customer category. As a manager, how would you use this information? Emery Company sells small machine parts to heavy equipment manufacturers for an average price of 1.05 per part. There are two types of customers: those who place small, frequent orders and those who place larger, less frequent orders. Each time an order is placed and processed, a setup is required. Scheduling is also needed to coordinate the many different orders that come in and place demands on the plants manufacturing resources. Emery also inspects a sample of the products each time a batch is produced to ensure that the customers specifications have been met Inspection takes essentially the same time regardless of the type of part being produced. Emerys Cost Accounting Department has provided the following budgeted data for customer-related activities and costs (the amounts expected for the coming year): Required: 1. Assign the customer-related activity costs to each category of customers in proportion to the sales revenue earned by each customer type. Calculate the profitability of each customer type. Discuss the problems with this measure of customer profitability.arrow_forward

- Assume you are the warehouse manager for Vinnies Vinyls, a multi-location business specializing in vinyl records. Vinniess operates under a cost-based transfer structure and the warehouse supplies all stores with the records. The stores can purchase records only from the warehouse, and the warehouse can only sell to Vinnies stores. The manager of the West store has some concerns relating to the stores financial performance and has asked for your help analyzing transfer costs. After calculating the operating income in dollars and the operating income percent, analyze the following financial information to determine costs that may need further investigation. (Hint: it may be helpful to perform a vertical analysis.)arrow_forwardActivity-Based Customer-Driven Costs Suppose that Stillwater Designs has two classes of distributors: JIT distributors and non-JIT distributors. The JIT distributor places small, frequent orders, and the non-JIT distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product. Stillwater Designs provides the following information about customer-related activities and costs for the most recent quarter: JITDistributors Non-JITDistributors Sales orders 1,000 100 Sales calls 70 70 Service calls 350 175 Average order size 550 5,500 Manufacturing cost/unit $125 $125 Customer costs: Processing sales orders $3,430,000 Selling goods 1,120,000 Servicing goods 1,050,000 Total $5,600,000 Required: 1. Calculate the total revenues per distributor category, and assign the customer costs to each distributor type by using revenues as the allocation base. Selling price for one unit is $150. Round…arrow_forwardThe following is a financial information from MayPagAsaPa Company: Additional information:The company purchase office supplies from big manufacturers and distributes among different segments. Cost of goods sold and shipping expenses are both variable. 1.Prepare a new contribution format segmented income statement. 2.Analyze your requirement #1. What points that might help to improve the company’s performance would you bring to management’s attention? 3.Compare your output with Requirement 1 with the information above. List the items you think that is an error/disadvantage/weakness of the given data.arrow_forward

- Can you help me with the Shawnee Motors Inc variable costing income statement. The choices are: Contribution Margin Fixed Selling & admin expenses Manufacturing margin Sales Variable selling & admin expenses Variable cost of goods sold Income from operations total fixed costs loss from operationsarrow_forwardProduct Profitability Analysis Galaxy Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVS), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: Conquistador Hurricane Sales price $4,800 $3,200 Variable cost of goods sold (3,020) (2,140) Manufacturing margin $1,780 $1,060 Variable selling expenses (964) (548) Contribution margin $816 $512 Fixed expenses (380) (200) Operating income $436 $312 In addition, the following sales unit volume information for the period is as follows: Conquistador 2,800 Hurricane 2,000 Sales unit volume a. Prepare a contribution margin by product report. Compute the contribution margin ratjo for each product as a whole percent. Galaxy Sports Inc. Contribution Margin by Productarrow_forwardThe managerial accountant at Fast and Mean Manufacturing reported that the organization contains an automated production line to manufacture and produce its products for consumers to enjoy in the marketplace. The managerial accountant reported that the company uses the high-low method to estimate the costs in the new budget. The managerial accountant reported the following information: Compute the slope of the mixed cost, or the variable cost per unit of activity. Compute the vertical intercept, or the fixed cost component of the mixed cost. What is the mixed cost equation? Month Total machine hours total cost January 250,000 $5,500,000 February 248,000 $5,260,000 March 249,000 $5,400,000 April 248,000 $5,220,000 May 238,000 $5,180,000 June 230,000 $5,130,000arrow_forward

- APPLY THE CONCEPTS: Target income (sales revenue) Another useful method for figuring out the type of performance your company will need to reach a target income is by using sales revenue. Rather than using the number of units, this method uses total sales revenue. In companies for which the total set of goods produced and sold is more varied, this would be the preferred method, as opposed to a business in which only one product is sold. Assume a company has pricing and cost information as follows: Price and Cost Information Amount Selling Price per Unit $30 Variable Cost per Unit $15 Total Fixed Cost $15,000 For the upcoming period, the company wishes to generate operating income of $40,000. Given the cost and pricing structure for the company’s product, how much sales revenue must it generate to attain its target income? Step 1: Calculate the contribution margin ratio: The contribution margin ratio is the contribution margin in proportion to the selling price on a…arrow_forwardQue. No. 1a. When production is greater than sales which method’s net operating income will be higher, AC or VC and why? Be precise and to the point in writing the answer. Que. No. 1b. Sharp Company manufactures a product for which the following data and information related to inventory is available. The company uses variable costing for internal management reports and absorption costing for external reports to the shareholders, creditors, and the government. The company has provided the following data:Year-1Year-2Year-3Inventories:Beginning (units)200160180Ending (units)160180220Variable Costing net operating income$1,080,400$1,032,400$996,400The company’s fixed manufacturing overhead per unit was constant at $650 for all the three years.Required: 1. Determine each year’s absorption costing net operating income. Present your answer in the form of a reconciliation report. (you must show all calculations)2. In year four, the company’s variable costing net operating income was $984,400…arrow_forwardProduct Cost Method of Product Costing Voice Com, Inc. uses the product cost method of applying the cost-plus approach to product pricing. The costs of producing and selling 5,390 cell phones are as follows: Variable costs per unit: Direct materials Direct labor Factory overhead Selling and administrative expenses Total variable cost per unit Voice Com desires a profit equal to a 15% rate of return on invested assets of $600,200. a. Determine the amount of desired profit from the production and sale of 5,390 cell phones. $90 38 27 19 Markup Selling price $174 Fixed costs: Factory overhead Selling and administrative expenses b. Determine the product cost per unit for the production of 5,390 of cell phones. Round your answer to the nearest whole dollar. per unit c. Determine the product cost markup percentage for cell phones. Round your answer to two decimal places. % d. Determine the selling price of cell phones. Round your answers to the nearest whole dollar. Total Cost per unit per…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Profitability index; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Md5ocNqKHq8;License: Standard Youtube License