KarlAuto Corporation manufactures automobiles, vans, and trucks. Among the various KarlAuto plants around the United States is the Bloomington plant, where vinyl covers and upholstery fabric are sewn. These are used to cover interior seating and other surfaces of KarlAuto products.

Pam Teegin is the plant manager for the Bloomington cover plant—the first KarlAuto plant in the region. As other area plants were opened, Teegin, in recognition of her management ability, was given the responsibility to manage them. Teegin functions as a regional manager, although the budget for her and her staff is charged to the Bloomington plant.

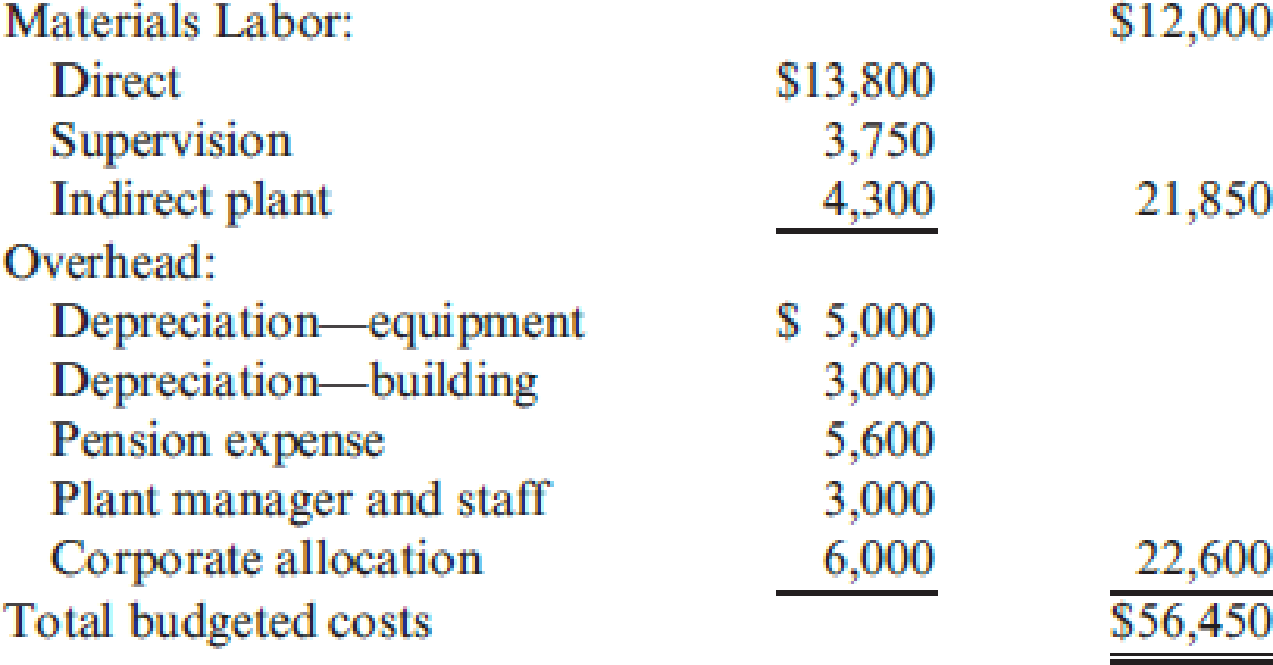

Teegin has just received a report indicating that KarlAuto could purchase the entire annual output of the Bloomington cover plant from outside suppliers for $32 million. Teegin was astonished at the low outside price, because the budget for the Bloomington plant’s operating costs was set at $56.45 million. Teegin believes that the Bloomington plant will have to close down operations in order to realize the $24.45 million in annual cost savings.

The budget (in thousands) for the Bloomington plant’s operating costs for the coming year follows:

Additional facts regarding the plant’s operations are as follows:

Due to the Bloomington plant’s commitment to use high-quality fabrics in all of its products, the Purchasing Department was instructed to place blanket orders with major suppliers to ensure the receipt of sufficient materials for the coming year. If these orders are canceled as a consequence of the plant closing, termination charges would amount to 18 percent of the cost of direct materials.

Approximately 600 plant employees will lose their jobs if the plant is closed. This includes all direct laborers and supervisors as well as the plumbers, electricians, and other skilled workers classified as indirect plant workers. Some would be able to find new jobs, but many others would have difficulty. All employees would have difficulty matching the Bloomington plant’s base pay of $29.40 per hour, the highest in the area. A clause in the Bloomington plant’s contract with the union may help some employees; the company must provide employment assistance to its former employees for 12 months after a plant closing. The estimated cost to administer this service would be $1 million for the year.

Some employees would probably elect early retirement because the company has an excellent pension plan. In fact, $4.6 million of next year’s pension expense would continue whether or not the plant is open.

Teegin and her staff would not be affected by the closing of the Bloomington plant. They would still be responsible for administering three other area plants.

Equipment

Required:

- 1. Prepare a quantitative analysis to help in deciding whether or not to close the Bloomington plant. Explain how you treated the nonrecurring relevant costs.

- 2. Consider the analysis in Requirement 1, and add to it the qualitative factors that you believe are important to the decision. What is your decision? Would you close the plant? Explain. (CMA adapted)

Trending nowThis is a popular solution!

Chapter 17 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Compu Limited is a company that manufactures computer monitors, keyboards, computer boxes and modems (both internal and external). These four products are sold all over the country and in a few overseas markets. The head office is situated in Sandton, South Africa, with three plants in other parts of the country. Four years ago, a fourth plant was opened in Zimbabwe to take advantage of the inexpensive labour available. 90% of the items manufactured in Zimbabwe are shipped back to South Africa and the remaining 10% are sold in other African countries. Compu Limited advertises its products in computer magazines, on the internet and over the television. It shares are traded on the Johannesburg Stock Exchange (JSE). Three major organisations account for almost 50% of Compu’s sales and the remaining sales are made to other smaller computer manufacturers. Lately one of these customers is constantly complaining about the lack of new technology in Compu’s products. A total of 900 plant…arrow_forwardCompu Limited is a company that manufactures computer monitors, keyboards, computer boxes and modems (both internal and external). These four products are sold all over the country and in a few overseas markets. The head office is situated in Sandton, South Africa, with three plants in other parts of the country. Four years ago, a fourth plant was opened in Zimbabwe to take advantage of the inexpensive labour available. 90% of the items manufactured in Zimbabwe are shipped back to South Africa and the remaining 10% are sold in other African countries. Compu Limited advertises its products in computer magazines, on the internet and over the television. It shares are traded on the Johannesburg Stock Exchange (JSE). Three major organisations account for almost 50% of Compu’s sales and the remaining sales are made to other smaller computer manufacturers. Lately one of these customers is constantly complaining about the lack of new technology in Compu’s products. A total of 900 plant…arrow_forwardWhile attending night school to earn a degree in computer engineering, Stan Wilson worked for Morlot Container Company (MCC) as an assembly line supervisor. MCC was located near Wilson’s hometown and had been a prominent employer in the area for many years.MCC’s main product was milk cartons that were distributed throughout the Midwest for milk processing plants.The technology at MCC was stable, and the assembly lines were monitored closely. MCC employed a standard cost system because cost control was considered important. The employees who manned the assembly lines were generally unskilled workers who had been with the company for many years; the majority of these workers belonged to the local union.Wilson was glad he was nearly finished with school because he found the work at MCC to be repetitive and boring, even as a supervisor. The supervisors were monitored almost as closely as the line workers, and standard policies and procedures existed that applied to most situations. Most of…arrow_forward

- Miller Manufacturing (2M) makes a variety of components for mechanized agricultural equipment. The products are similar but not identical, and all go through many of the same processes. 2M sells products worldwide and has to comply with various regulations regarding environmental and health and safety compliance. For the most part, 2M manufacturing practices comply with or exceed requirements in the countries to which it ships its products, but depending on the specific part ordered, it might have to go through additional certification processes to make the sale. The company produces to order and never has any work-in-process inventories. The manufacturing facility uses a job costing system for product costing. Manufacturing overhead is applied to jobs based on direct labor cost. The cost analyst at 2M recently put together an estimate of overhead for the coming year, which is shown in the following table: Category Amount Fabricating $ 480,000 Machining 960,000 Machine setup…arrow_forwardContemporary Interiors (CI) manufactureshigh-quality furniture in factories in North Carolina for sale to top American retailers. In 1995, CIpurchased a lumber operation in Indonesia, and shifted from using American hardwoods to Indonesian raminin its products. The ramin proved to be a cheaper alternative, and it was widely accepted by Americanconsumers. CI management credits the early adoption of Indonesian wood for its ability to keep its NorthCarolina factories open when so many competitors closed their doors. Recently, however, consumers havebecome increasingly concerned about the sustainability of tropical woods, including ramin. CI has seensales begin to fall, and the company was even singled out by an environmental group for boycott. It appearsthat a shift to more sustainable woods before year-end will be necessary, and more costly.In response to the looming increase in material costs, CEO Geoff Armstrong calls a meeting of upper management.The group generates the following…arrow_forwardWhat are some of the qualitative factors that Riverside Clippers Corp should consider when deciding whether to outsource the garden tools manufacturing to Taiwan?arrow_forward

- Dogarrow_forwardThe Blair Company’s three assembly plants are located in California, Georgia, and New Jersey. Previously, the company purchased a major subassembly, which becomes part of the final product, from an outside firm. Blair has decided to manufacture the subassemblies within the company and must now consider whether to rent one centrally located facility (e.g., in Missouri, where all the subassemblies would be manufactured) or to rent three separate facilities, each located near one of the assembly plants, where each facility would manufacture only the subassemblies needed for the nearby assembly plant. A single, centrally located facility, with a production capacity of 18,000 units per year, would have fixed costs of $900,000 per year and a variable cost of $250 per unit. Three separate decentralized facilities, with production capacities of 8,000, 6,000, and 4,000 units per year, would have fixed costs of $475,000, $425,000, and $400,000, respectively, and variable costs per unit of only…arrow_forwardSpeed Racer in Victoria makes bicycles for people of all ages. The frames division makes and paints the frames and supplies them to the assembly division where the bicycles are assembled. Speed Racer is a successful and profitable corporation that attributes much of its success to its decentralized operating style. Each division manager is compensated on the basis of division operating income. The assembly division currently acquires all its frames from the frames division. The assembly division manager could purchase similar frames in the market for $480. The frames division is currently operating at 80% of its capacity of 4,000 frames (units) and has the following details: Voltage Regulator Direct materials ($150 per unit x 320 units) $480,000 Direct manufacturing labour ($60 per unit x 3,200 units) 192,000 Variable manufacturing overhead costs ($30 per unit × 3,200 units) 96,000 Fixed manufacturing overhead costs $624,000 All the frames division’s…arrow_forward

- Speed Racer in Victoria makes bicycles for people of all ages. The frames division makes and paints the frames and supplies them to the assembly division where the bicycles are assembled. Speed Racer is a successful and profitable corporation that attributes much of its success to its decentralized operating style. Each division manager is compensated on the basis of division operating income. The assembly division currently acquires all its frames from the frames division. The assembly division manager could purchase similar frames in the market for $480. The frames division is currently operating at 80% of its capacity of 4,000 frames (units) and has the following details: Voltage Regulator Direct materials ($150 per unit x 320 units) $480,000 Direct manufacturing labour ($60 per unit x 3,200 units) 192,000 Variable manufacturing overhead costs ($30 per unit × 3,200 units) 96,000 Fixed manufacturing overhead costs $624,000 All the frames division’s…arrow_forwardSpeed Racer in Victoria makes bicycles for people of all ages. The frames division makes and paints the frames and supplies them to the assembly division where the bicycles are assembled. Speed Racer is a successful and profitable corporation that attributes much of its success to its decentralized operating style. Each division manager is compensated on the basis of division operating income. The assembly division currently acquires all its frames from the frames division. The assembly division manager could purchase similar frames in the market for $480. The frames division is currently operating at 80% of its capacity of 4,000 frames (units) and has the following details: Voltage Regulator Direct materials ($150 per unit x 320 units) $480,000 Direct manufacturing labour ($60 per unit x 3,200 units) 192,000 Variable manufacturing overhead costs ($30 per unit × 3,200 units) 96,000 Fixed manufacturing overhead costs $624,000 All the frames division’s…arrow_forwardSpeed Racer in Victoria makes bicycles for people of all ages. The frames division makes and paints the frames and supplies them to the assembly division where the bicycles are assembled. Speed Racer is a successful and profitable corporation that attributes much of its success to its decentralized operating style. Each division manager is compensated on the basis of division operating income. The assembly division currently acquires all its frames from the frames division. The assembly division manager could purchase similar frames in the market for $480. The frames division is currently operating at 80% of its capacity of 4,000 frames (units) and has the following details: Voltage Regulator Direct materials ($150 per unit x 320 units) $480,000 Direct manufacturing labour ($60 per unit x 3,200 units) 192,000 Variable manufacturing overhead costs ($30 per unit × 3,200 units) 96,000 Fixed manufacturing overhead costs $624,000 All the frames…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning