Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 36P

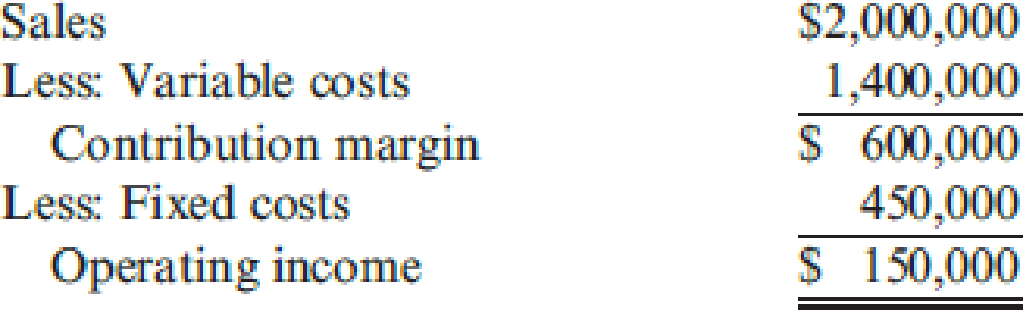

Faldo Company produces a single product. The

Required:

- 1. Compute the unit contribution margin and the units that must be sold to break even. Suppose that 30,000 units are sold above the break-even point. What is the profit?

- 2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are $200,000 greater than expected. What would the total profit be?

- 3. Compute the margin of safety in sales revenue.

- 4. Compute the operating leverage. Compute the new profit level if sales are 20 percent higher than expected.

- 5. How many units must be sold to earn a profit equal to 10 percent of sales?

- 6. Assume the income tax rate is 40 percent. How many units must be sold to earn an after-tax profit of $180,000?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Jellico Inc.’s projected operating income (based on sales of 450,000 units) for the coming year is as follows:Required:1. Compute: (a) variable cost per unit, (b) contribution margin per unit, (c)contribution margin ratio, (d) break-even point in units, and (e) break-even point in sales dollars.2. How many units must be sold to earn operating income of $296,400?3. Compute the additional operating income that Jellico would earn if sales were $50,000 more than expected.4. For the projected level of sales, compute the margin of safety in units, and then in sales dollars.5. Compute the degree of operating leverage. (Note: Round answer to two decimal places.)6. Compute the new operating income if sales are 10% higher than expected.

ABC Company manufactures the product XE-17. The product is sold at a unit price of $70.Variable expenses are $13.50 per unit and fixed expenses are $220,000 per year.Required :a. What should be the product’s CM ratio? b. Calculate the BEP is sales dollars and in units for ABC Company. c. The manager of ABC company estimates that in the coming year, the company’s sales willincrease by $80,000 (from the current sales). How much should the net profit / loss increase/decrease if the fixed costs remain constant? d. The manager of ABC company predicts that by spending an additional $80,000 per year onadvertising and using higher quality raw material (which will in turn increase the raw materialcost per unit by $3), and increasing selling price per unit by 2% (to compensate for theincreased costs), unit sales will increase by two- thirds of the current sales units. Should thecompany go with the manager’s proposed plan? Explain your answer. (Assume that in thecurrent year, the company sold…

Klamath Company produces a single product. The projected income statement for the comingyear is as follows:

Required:1. Compute the unit contribution margin and the units that must be sold to break even.2. Suppose 10,000 units are sold above break-even. What is the operating income?3. Compute the contribution margin ratio. Use the contribution margin ratio to computethe break-even point in sales revenue. (Note: Round the contribution margin ratio to fourdecimal places, and round the sales revenue to the nearest dollar.) Suppose that revenuesare $200,000 more than expected for the coming year. What would the total operatingincome be?

Chapter 16 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 16 - Prob. 1DQCh. 16 - Describe the difference between the units-sold...Ch. 16 - Define the term break-even point.Ch. 16 - Explain why contribution margin per unit becomes...Ch. 16 - A restaurant owner who had yet to earn a monthly...Ch. 16 - What is the variable cost ratio? The contribution...Ch. 16 - Prob. 7DQCh. 16 - Suppose a firm with a contribution margin ratio of...Ch. 16 - Prob. 9DQCh. 16 - Explain how CVP analysis developed for single...

Ch. 16 - Prob. 11DQCh. 16 - How do income taxes affect the break-even point...Ch. 16 - Explain how a change in sales mix can change a...Ch. 16 - Explain how a change in sales mix can change a...Ch. 16 - Prob. 15DQCh. 16 - Prob. 1CECh. 16 - Prob. 2CECh. 16 - Health-Temp Company is a placement agency for...Ch. 16 - Olivian Company wants to earn 420,000 in net...Ch. 16 - Vandenberg, Inc., produces and sells two products:...Ch. 16 - Prob. 6CECh. 16 - Prob. 7CECh. 16 - Prob. 8ECh. 16 - Gelbart Company manufactures gas grills. Fixed...Ch. 16 - Schylar Pharmaceuticals, Inc., plans to sell...Ch. 16 - Prob. 11ECh. 16 - Prob. 12ECh. 16 - Big Red Motors, Inc., employs 15 sales personnel...Ch. 16 - Sports-Reps, Inc., represents professional...Ch. 16 - Campbell Company manufactures and sells adjustable...Ch. 16 - Prob. 16ECh. 16 - Sara Pacheco is a sophomore in college and earns a...Ch. 16 - Carmichael Corporation is in the process of...Ch. 16 - Choose the best answer for each of the following...Ch. 16 - Prob. 20ECh. 16 - Income statements for two different companies in...Ch. 16 - Prob. 22ECh. 16 - Prob. 23ECh. 16 - Busy-Bee Baking Company produces a variety of...Ch. 16 - Prob. 25ECh. 16 - Jester Company had unit contribution margin on...Ch. 16 - Loessing Company produced and sold 12,000 units...Ch. 16 - Junior Company has a breakeven point of 34,600...Ch. 16 - Prob. 29ECh. 16 - If a companys variable cost per unit increases,...Ch. 16 - Prob. 31PCh. 16 - More-Power Company has projected sales of 75,000...Ch. 16 - Consider the following information on four...Ch. 16 - Hammond Company runs a driving range and golf...Ch. 16 - Prob. 35PCh. 16 - Faldo Company produces a single product. The...Ch. 16 - Katayama Company produces a variety of products....Ch. 16 - Prob. 38PCh. 16 - Prob. 39PCh. 16 - Prob. 40PCh. 16 - Salem Electronics currently produces two products:...Ch. 16 - Good Scent, Inc., produces two colognes: Rose and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Klamath Company produces a single product. The projected income statement for the coming year is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. 2. Suppose 10,000 units are sold above break-even. What is the operating income? 3. Compute the contribution margin ratio. Use the contribution margin ratio to compute the break-even point in sales revenue. (Note: Round the contribution margin ratio to four decimal places, and round the sales revenue to the nearest dollar.) Suppose that revenues are 200,000 more than expected for the coming year. What would the total operating income be?arrow_forwardSchylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22 each in the coming year. Total variable costs equal 1,086,800. Total fixed costs equal 8,000,000. (Round all ratios to four significant digits, and round all dollar amounts to the nearest dollar.) Required: 1. What is the contribution margin per unit? What is the contribution margin ratio? 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 245,000. 4. What if the average price per unit increased to 23.50? Recalculate: a. Contribution margin per unit b. Contribution margin ratio (rounded to four decimal places) c. Sales revenue needed to break even d. Sales revenue needed to achieve a target profit of 245,000arrow_forwardDelta Co. sells a product for $150 per unit. The variable cost per unit is $90 and fixed costs are $15,250. Delta Co.s tax rate is 36% and the company wants to earn $44,000 after taxes. What would be Deltas desired pre-tax income? What would be break-even point in units to reach the income goal of $44,000 after taxes? What would be break-even point in sales dollars to reach the income goal of $44000 after taxes? Create a contribution margin income statement to show that the break-even point calculated in B, generates the desired after-tax income.arrow_forward

- ABC Company manufactures the product XE-17. The product is sold at a unit price of $70.Variable expenses are $13.50 per unit and fixed expenses are $220,000 per year.Required :a. What should be the product’s CM ratio? b. Calculate the BEP is sales dollars and in units for ABC Company. c. The manager of ABC company estimates that in the coming year, the company’s sales willincrease by $80,000 (from the current sales). How much should the net profit / loss increase/decrease if the fixed costs remain constant? d. The manager of ABC company predicts that by spending an additional $80,000 per year onadvertising and using higher quality raw material (which will in turn increase the raw materialcost per unit by $3), and increasing selling price per unit by 2% (to compensate for theincreased costs), unit sales will increase by two- thirds of the current sales units. Should thecompany go with the manager’s proposed plan? Explain your answer. (Assume that in thecurrent year, the company sold…arrow_forwardBaker Company has a product that sells for $20 per unit. The variable expenses are $12 per unit, and fixed expenses total $30,000 per year. Compute for the following:c. If total sales increase by $20,000 and fixed expenses remain unchanged, by how much would net operating income be expected to increase?d. The marketing manager wants to increase advertising by $6,000 per year. How many additional units would have to be sold to increase overall net operating income by $2,000?arrow_forwardHarrison Co. expects to sell 200,000 units of its product next year, which would generate total sales of $17 million. Management predicts that pretax net income for next year will be $1,250,000 and that the contribution margin per unit will be $25. Use this information to compute next year’s total expected (a) variable costs and (b) fixed costs.arrow_forward

- Klamath Company produces a single product. The projected income statement for the coming year is as follows: Sales (54,600 units @ $34) $1,856,400 Total variable cost 1,064,700 Contribution margin $ 791,700 Total fixed cost 801,850 Operating income $(10,150) Suppose that revenues are $200,000 more than expected for the coming year. What would the total operating income be?$_________arrow_forwardJasmine Inc. makes a single product that it sells for $25 each. Variable costs are $13 per unit and annual fixed costs total $30,000 per year. The company would like to realize operating income next year of $60,000. What level of sales in dollars must the company achieve to reach its target profit?arrow_forwardSuper Sales Company is the exclusive distributor for a high-quality knapsack. The product sells for $60 per unit and has a CM ratio of 40%. The company’s fixed expenses are $540,000 per year. The company plans to sell 26,000 knapsacks this year. Required: What are the variable expenses per unit? Use the equation method for the following: What is the break-even point in units and in sales dollars? What sales level in units and in sales dollars is required to earn an annual profit of $108,000? What sales level in units is required to earn an annual after-tax profit of $108,000 if the tax rate is 20%? Assume that through negotiation with the manufacturer, Super Sales Company is able to reduce its variable expenses by $3 per unit. What is the company’s new break-even point in units and in sales dollars? (Do not round intermediate calculations. Round your final answers to the nearest whole number.)arrow_forward

- For the coming year, Bepis Inc. anticipates fixed costs of $700,000, a unit variable cost of $85, and a unit selling price of $105. The maximum sales within the relevant range are $2,500,000. a. Construct a cost-volume-profit chart. b.Estimate the break-even sales (dollars) by using the cost-volume-profit chart constructed in part (A). c. What is the main advantage of presenting the cost-volume-profit analysis in graphic form rather than equation form?arrow_forwardKreter, Inc. earned net income of $300,000 last year. This year it wants to earn net income of $450,000. The company's fixed costs are expected to be $300,000, and variable costs are expected to be 70% of sales. Determine the required sales to meet the target net income of $450,000 using the mathematical equation. Required sales $ Using a CVP income statement format, prove your answer. Fixed costsTarget net income / (Loss)SalesVariable costsContribution margin $ Contribution marginFixed costsTarget net income / (Loss)SalesVariable costs Contribution marginSalesVariable costsFixed costsTarget net income / (Loss) Fixed costsVariable costsSalesTarget net income / (Loss)Contribution margin SalesFixed costsContribution marginVariable costsTarget net income / (Loss) $arrow_forwardP Company has provided the following data: Sales Price per unit: $50. Variable Cost per unit: $30; Fixed Cost: $135,000 Expected Sales: 20,000 units. a. What is the breakeven point in sales dollars? b. What is the break-even point in units? c. Calculate the expected profit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License