1.

Compute the basic earnings per share for Company M.

1.

Explanation of Solution

Earnings per share (EPS): The amount of net income available to each shareholder per common share outstanding is referred to as earnings per share (EPS).

Compute the basic earnings per share for Company M.

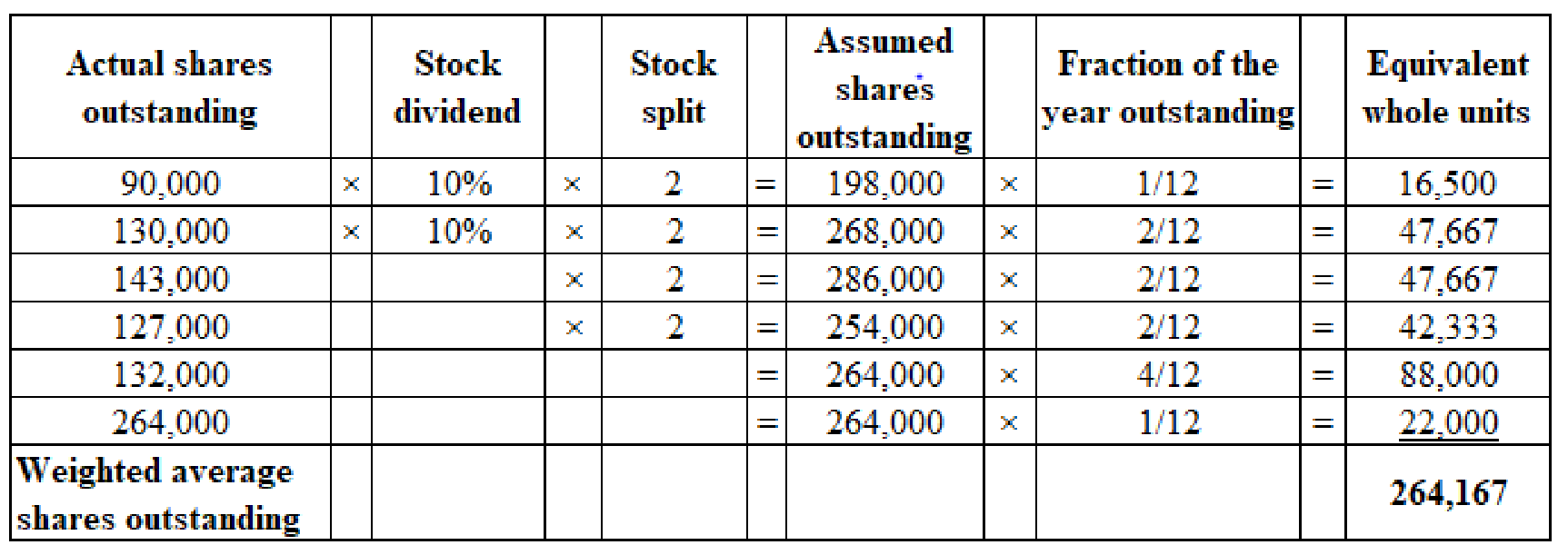

Working note: (1) Calculation of weighted average shares outstanding:

(Table1)

2.

Compute the tentative and incremental dilutive earnings per share for each dilutive security.

2.

Explanation of Solution

Compute tentative diluted EPS for stock options.

Compute the incremental diluted EPS for stock options.

Compute the incremental diluted EPS for convertible bonds.

Compute the incremental diluted EPS of convertible preferred stock.

Compute tentative diluted EPS assuming for 12% convertible preferred stock.

Compute tentative diluted EPS assuming, exercisable options, 9% convertible bonds, and 12% convertible preferred stock.

Working notes (1): Calculate the value of exercisable options:

Working notes (2): Compute the number of shares required:

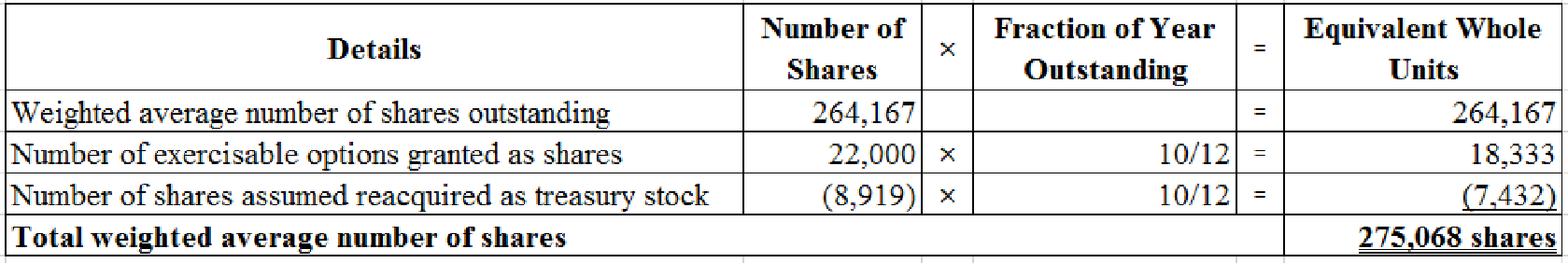

Working notes (3): Compute the total weighted average number of common shares.

(Figure 2)

Working notes (4): Compute the amount of interest expense, net of income tax on 9% bonds.

Working notes (5): Compute the number of common shares due to conversion of 9% bonds.

Working notes (6): Compute the number of common shares due to conversion of preferred shares.

3.

Identify the amount that will be reported as basic and diluted earnings per share for the year 2016.

3.

Explanation of Solution

The Company M must report an amount of $1.95 as basic earnings per share and $1.64 as diluted earnings per share in its 2016 income statement.

Want to see more full solutions like this?

Chapter 16 Solutions

Cengagenowv2, 1 Term Printed Access Card For Wahlen/jones/pagach’s Intermediate Accounting: Reporting And Analysis, 2017 Update, 2nd

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.arrow_forwardSelected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)arrow_forwardMonona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.arrow_forward

- On January 1, 2016, Wade Corporation had 24,000 shares of common stock outstanding. On April 1, it reacquired 2,400 shares; on July 1, it issued 10,800 shares; on October 1, it issued another 9,600 shares; and on December 1, it reacquired 900 shares. What was the weighted average number of common shares outstanding for 2016?arrow_forwardJanuary 1, 2016, Hage Corporation granted options to purchase 9,000 of its common shares at $7 each. The market price of common stock was $9 per share on March 31, 2016, and averaged $9 per share during the quarter then ended. There was no change in the 50,000 shares of outstanding common stock during the quarter ended March 31, 2016. Net income for the quarter was $8,268. The number of shares to be used in computing diluted earnings per share for the quarter is a. 50,000 b. 52,000 c. 53,000 d. 59,000arrow_forwardDouglas Corporation had 120,000 shares of stock outstanding on January 1, 2017. On May 1, 2017, Douglas issued 60,000 shares. On July 1, Douglas purchased 10,000 treasury shares, which were reissued on October 1. Compute Douglas’s weighted-average number of shares outstanding for 2017.arrow_forward

- Fechter Corporation had the following stockholders’ equity accounts on January 1, 2015: Common Stock ($5 par) $536,900, Paid-in Capital in Excess of Par—Common Stock $221,330, and Retained Earnings $117,620. In 2015, the company had the following treasury stock transactions. Mar. 1 Purchased 5,800 shares at $8 per share. June 1 Sold 1,500 shares at $13 per share. Sept. 1 Sold 1,840 shares at $10 per share. Dec. 1 Sold 1,290 shares at $6 per share. Fechter Corporation uses the cost method of accounting for treasury stock. In 2015, the company reported net income of $28,720. Journalize the treasury stock transactions, and prepare the closing entry at December 31, 2015, for net income. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Open accounts for Paid-in Capital from Treasury Stock, Treasury…arrow_forwardDuring 2016, Moore Corp. had the following two classes of stock issued and outstanding for the entire year: • 100,000 shares of common stock, $1 par. • 1,000 shares of 4% preferred stock, $100 par, convertible share for share into common stock. Moore’s 2016 net income was $900,000, and its income tax rate for the year was 30%. In the computation of diluted earnings per share for 2016, the amount to be used in the numerator is a. $896,000 b. $898,800 c. $900,000 d. $901,200arrow_forwardOn January 1, 2020, Ivanhoe Corporation had $1,470,000 of common stock outstanding that was issued at par. It also had retained earnings of $741,500. The company issued 41,500 shares of common stock at par on July 1 and earned net income of $400,000 for the year.Journalize the declaration of a 15% stock dividend on December 10, 2020, for the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) a. Par value is $10, and market price is $18. b. Par value is $5, and market price is $21.arrow_forward

- Lerner Company had the following transactions in 2017, its first year of operations: Issued 20,000 shares of common stock. Stock has par value of $1.00 per share and was issued at $14.00 per share Issued 1,000 shares of $100 par value preferred stock. Shares were issued at par Earned Net Income of $35,000 Paid no dividends. At the end of 2017, what is the total amount of stockholders' equity? (Remember that we have TWO Stockholder's Equity accounts) A $ 260,000.00 B $ 415,000.00 C $ 380,000.00 D $ 120,000.00arrow_forwardOn January 1, 2022, Skysong, Inc. had $1,190,000 of common stock outstanding that was issued at par and retained earnings of $749,000. The company issued 43,000 shares of common stock at par on July 1 and earned net income of $395,000 for the year. Journalize the declaration of a 15% stock dividend on December 10, 2022, for the following two independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (a) (b) No. Account Titles and Explanation (a) Par value is $10 and market price is $15. Par value is $5 and market price is $8. (b) Retained Earnings Common Stock Dividends Distributable Paid-in Capital in Excess of Par-Common Stock Retained Earnings Common Stock Dividends Distributable Paid-in Capital in Excess of Par-Common Stock Debit 277,425 147,960 Credit 184,950 277,425 92,475 332,910arrow_forwardCambridge Corp. has a single class of shares. As its year ended December 31, 2015, the company had 2,500,000 shares issued and outstanding. On the stock exchange, these shares are trading for $10 per share. In the company's accounts, these shares had a value of $30,000,000. The equity accounts also show $450,000 of contributed surplus from previous repurchases of shares. On January 15, 2016, Cambridge repurchased and cancelled 100,000 shares at a cost of $10 per share. Later in the year, on August 20, the company repurchased and cancelled a further 300,000 shares at $15 per share. Record the journal entries for August 20, 2016 under ASPE. Please round your final answer to the nearest dollar. Do not round intermediary answers. Do not use $ signs in your final answer. Enter $0 for any journal entries that do not apply. DR. Common shares - Type your answer here DR. Cash- Type your answer here DR. Contributed surplus - Type your answer here DR. Retained earnings - CR. Common shares - F12…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning