Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN: 9781305627734

Author: Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 5P

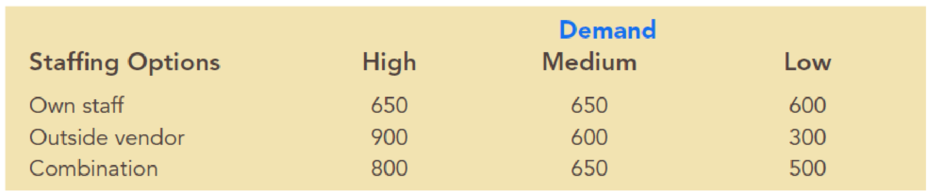

Hudson Corporation is considering three options for managing its data warehouse: continuing with its own staff, hiring an outside vendor to do the managing, or using a combination of its own staff and an outside vendor. The cost of the operation depends on future demand. The annual cost of each option (in thousands of dollars) depends on demand as follows:

- a. If the demand probabilities are 0.2, 0.5, and 0.3, which decision alternative will minimize the expected cost of the data warehouse? What is the expected annual cost associated with that recommendation?

- b. Construct a risk profile for the optimal decision in part (a). What is the probability of the cost exceeding $700,000?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Hudson Corporation is considering three options for managing its data processing operation: continue with its own staff, hire an outside vendor to do the managing (referred to as outsourcing), or use a combination of its own staff and an outside vendor. The cost of the operation depends on future demand. The annual cost of each option (in thousands of dollars) depends on demand as follows:

a. If the demand probabilities are .2, .5,and .3, which decision alternative will minimize the expected cost of the data processing operation? What is the expected annual cost associated with your recommendation?

b. What is the expected value of perfect information?

XYZ Manufaturing company has hired a new VP (D.A.King) for managing capacity investment decisions. Mr. King reviews the situation after he comes on board and decides that he can invest in Batch manufacturing, Custom manufacturing or Group technology. Mr. King will not be able to forecast demand accurately till after the technology choices are made. Demand will be classified into four scenarios: poor, fair, good and excellent. The table below indicates the payoffs for each combination of technology choice and demand scenario.

POOR

FAIR

GOOD

EXCELLENT

PROBABILITY

0.1

0.4

0.3

0.2

Batch

- $200,000

$1,000,000

$1,200,000

$1,300,000

Custom

$100,000

$300,000

$700,000

$800,000

Group Technology

- $1,000,000

-$500,000

$500,000

$2,000,000

1.What is the expected monetary value of choosing the Group Technology option?

2.What is the expected monetary value of choosing the Batchoption?

3What is the BEST decision based on…

Hemmingway, Inc., is considering a $5 million research and development (R&D) project. Profit projections appear promising, but Hemmingway's president is concerned because the probability that the R&D project will be successful is only 0.50. Furthermore, the president knows that even if the project is successful, it will require that the company build a new production facility at a cost of $20 million in order to manufacture the product. If the facility is built, uncertainty remains about the demand and thus uncertainty about the profit that will be realized. Another option is that if the R&D project is successful, the company could sell the rights to the product for an estimated $25 million. Under this option, the company would not build the $20 million production facility.

The decision tree is shown in Figure 4.16. The profit projection for each outcome is shown at the end of the branches. For example, the revenue projection for the high demand outcome is $59 million.…

Chapter 15 Solutions

Essentials of Business Analytics (MindTap Course List)

Ch. 15 - Prob. 1PCh. 15 - Southland Corporation’s decision to produce a new...Ch. 15 - Amy Lloyd is interested in leasing a new Honda and...Ch. 15 - Investment advisors estimated the stock market...Ch. 15 - Hudson Corporation is considering three options...Ch. 15 - Prob. 6PCh. 15 - Myrtle Air Express decided to offer direct service...Ch. 15 - Video Tech is considering marketing one of two new...Ch. 15 - Seneca Hill Winery recently purchased land for the...Ch. 15 - Hemmingway, Inc. is considering a $5 million...

Ch. 15 - The following profit payoff table was presented in...Ch. 15 - Suppose that you are given a decision situation...Ch. 15 - A firm has three investment alternatives. Payoffs...Ch. 15 - Alexander Industries is considering purchasing an...Ch. 15 - In a certain state lottery, a lottery ticket costs...Ch. 15 - Three decision makers have assessed utilities for...Ch. 15 - In Problem 22, if P(s1) = 0.25, P(s2) = 0.50, and...Ch. 15 - Translate the following monetary payoffs into...Ch. 15 - Consider a decision maker who is comfortable with...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Similar questions

- The marketing department of a soft drink company wishes to determine the best investment level (Low, High) for introducing a new crystal-clear drink. The payoffs depending on market share for the two decision alternatives is given below: Market Share Investment Level < 1% 1% - 4% > 4% Low 300,000 400,000 500,000 High -400,000 300,000 3,000,000 The probability for a market share less than 1% is 0.3 and the probability for a market share more than 4% is 0.2. a) To minimize the maximum regret, which investment level should the department choose? b) To maximize expected values, which investment level should the department choose? c) What is the maximum amount the department should spend to get more information about the possible market share?arrow_forwardGeneral Buck Turgidson is preparing to make his annual budget presentation to the U.S. Senate and is speculating about his chances of getting all or part of his requested budget approved. From his 20 years of experience in making these requests, he has deduced that his chances of getting between 50 and 74 percent of his budget approved are twice as good as those of getting between 75 and 99 percent approved, and two and one-half times as good as those of getting between 25 and 49 percent approved. Further, the general believes that there is no chance of less than 25 percent of his budget being approved. Finally, the entire budget has been approved only once during the general’s tenure, and the general does not expect this pattern to change. What are the probabilities of 0–24 percent, 25–49 percent, 50–74 percent, 75–99 percent, and 100 percent approval, according to the general?arrow_forwardIf the data analyst hypothesizes that grocery sales are higher when payment is made using credit cards compared to cash payment, the null hypothesis would likely state that grocery sales are lower when payment is made using credit cards compared to cash payment. T/Farrow_forward

- 1. Expenses for Joey's college attendance next year are as follows (in $): Tuition = 8400 Dormitory = 5400 Meals ~Unif(900,1350) Entertainment ~Unif(600,1200) Transportation ~Unif(200,600) Books ~Unif(400,800) Here are the income streams the student has for next year: Scholarship = 3000 Parents = 4000 Waiting Tables ~Unif(3000,5000) Library Job ~Unif(2000,3000) Use Monte Carlo simulation to estimate the expected value of the loan that will be needed to enable Joey to go to college next year.arrow_forwardMike, a lumber wholesaler, is considering the purchase of a (railroad) car- load of varied dimensional lumber. He calculates that the probabilities of reselling the load for $10,000, $9000, and for $8000 are 0.22, 0.33, and 0.45 respectively. In order to ensure an expected profit of $3000, how much can Mike pay for the loadarrow_forwardA store manager observes that the morale of employees in her supermarket is low. She thinks that if their working conditions are improved, pay scales rose, and the vacation benefits made more attractive, the morale will be boosted. She doubts, however, if an increase in pay scales would raise the morale of all employees. Her conjecture is that those who have supplemental incomes will just not be “turned on” by higher pay, and only those without side incomes will be happy with increased pay, with a resultant boost in morale Based on the scenario presented, answer the following questions: A) Identify the Independent, Dependent, Moderating, and Mediating Variables. Also provide justification for your choice. B) Create a schematic diagram (i.e., conceptual framework) that depicts the relationships among the variables. C) Based on the above conceptual framework develops at least four alternate hypotheses.arrow_forward

- Consider the following payoff matrix.arrow_forwardPinkerton Mining Company is analyzing the purchase of two silver mines. Both projects are 5 years. The cost of capital is 10%. The Rhodes Mine will cost $12,000 and the anticipated after tax cash flows are projected as follows: YEARLY AFTER TAX CASH FLOW PROBABILITY $3,200 .05 3,000 .2 4,000 .3 5,000 .3 6,000 .15 The Denis Mine will cost $14,500 and the anticipated after tax cash flows are projected as follows: YEARLY AFTER TAX CASH FLOW PROBABILITY $3,000 .1 2,700 .5 5,000 .2 6,000 .2 What is the expected value for Rhodes Mine? Round to the nearest dollar. No commas. What is the standard deviation of Rhodes mine? Round to the nearest dollar. No commas. What is the coefficient of variation of Rhodes mine? Round to 2 decimal places. What is the NPV of Rhodes mine? Round to the nearest dollar. No commas. What is the expected value of Denis mine? Round to the…arrow_forwardFollowing is the payoff table for the Pittsburgh Development Corporation (PDC) Condominium Project. Amounts are in millions of dollars. State of Nature Decision Alternative Strong Demand S1 Weak Demand S2 Small complex, d1 9 8 Medium complex, d2 13 3 Large complex, d3 19 -9 Suppose PDC is optimistic about the potential for the luxury high-rise condominium complex and that this optimism leads to an initial subjective probability assessment of 0.8 that demand will be strong (S1) and a corresponding probability of 0.2 that demand will be weak (S2). Assume the decision alternative to build the large condominium complex was found to be optimal using the expected value approach. Also, a sensitivity analysis was conducted for the payoffs associated with this decision alternative. It was found that the large complex remained optimal as long as the payoff for the strong demand was greater than or equal to $16 million and as long as the payoff for the weak demand was greater…arrow_forward

- According to a study administered by the National Bureau of Economic Research, half of Americans would struggle to come up with $2000 in the event of a financial emergency. The majority of the 1900 Americans surveyed said they would rely on more than one method to come up with emergency funds if required. In the survey, 397 people said that they "certainly" would not be able to cope with an unexpected $2000 bill if they had to come up with the money in 30 days, and 553 people said they "probably" would not be able to cope. Step 1 of 2 : What percentage of Americans "certainly" would not be able to produce $2000 in the event of an emergency according to the study? Round your answer to one decimal place, if necessary.arrow_forwardIn the study of evolutionary behavior, the Trivers-Willard hypothesis indicates that healthyparents should tend to have more male offspring than female, and that weaker parents should tendto have more female offspring than male. This tendency may maximize the number of each parent’sgrandchildren (and thus help to ensure that its genetic code is preserved) since a healthy maleoffspring can win many mates, but a relatively unhealthy offspring has the best chance of mating ifit is female. In an experiment to examine this hypothesis, a group of 40 opossums were monitoredand 20 of them were given an enhanced diet. After a certain period of time, the opossums with theenhanced diet had raised 19 male offspring and 14 female offspring, and the opossums without theenhanced diet had raised 15 male offspring and 15 female offspring. Does this finding provideevidence in support of the Trivers-Willard hypothesis? (a) Describe the unknown parameters ?1 and ?2. Then state the null and…arrow_forwardAs these researchers state, “Robbing a bank is the staple crime of thrillers, movies and newspapers. But . . . bank robbery is not all it is cracked up to be.” The researchers concentrated on the factors that determine the amount of proceeds from bank robberies, and thus were able to work out both the economics of attempting one and of preventing one. In particular, the researchers revealed that the return on an average bank robbery per person per raid is modest indeed—so modest that it is not worthwhile for the banks to spend too much money on such preventative measures as fast-rising screens at tellers’ windows. The researchers obtained exclusive data from the British Bankers’ Association. In one aspect of their study, they analyzed the data from a sample of 364 bank raids over a several-year period in the United Kingdom. The following table repeats a portion of Table 1 on page 19 of the article. ariable Mean standar deviation Amount stolen (pounds sterling) 20,330.50 53,510,2…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman

Mod-01 Lec-01 Discrete probability distributions (Part 1); Author: nptelhrd;https://www.youtube.com/watch?v=6x1pL9Yov1k;License: Standard YouTube License, CC-BY

Discrete Probability Distributions; Author: Learn Something;https://www.youtube.com/watch?v=m9U4UelWLFs;License: Standard YouTube License, CC-BY

Probability Distribution Functions (PMF, PDF, CDF); Author: zedstatistics;https://www.youtube.com/watch?v=YXLVjCKVP7U;License: Standard YouTube License, CC-BY

Discrete Distributions: Binomial, Poisson and Hypergeometric | Statistics for Data Science; Author: Dr. Bharatendra Rai;https://www.youtube.com/watch?v=lHhyy4JMigg;License: Standard Youtube License