Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN: 9781337902571

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 7P

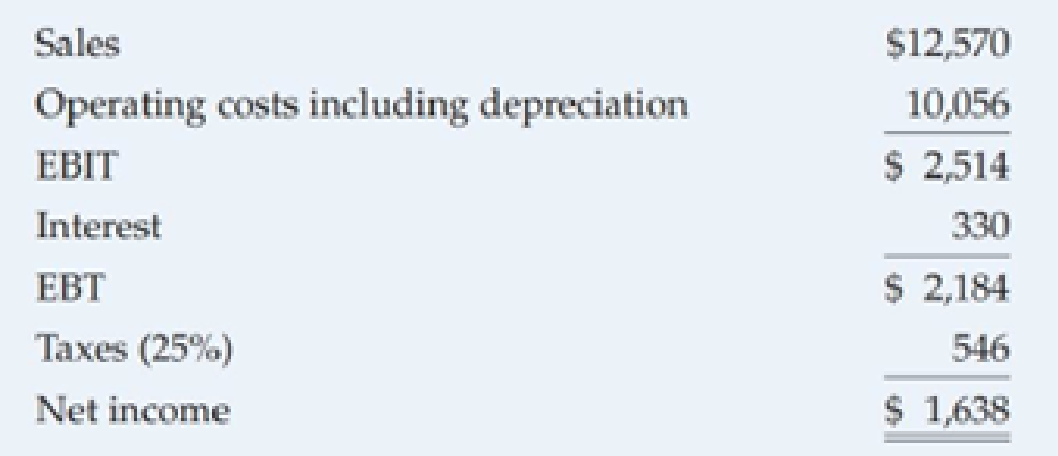

DIVIDENDS Brooks Sporting Inc. is prepared to report the following 2019 income statement (shown in thousands of dollars).

Prior to reporting this income statement, the company wants to determine its annual dividend. The company has 320,000 shares of common stock outstanding, and its stock trades at $37 per share.

- a. The company had a 25% dividend payout ratio in 2018. If Brooks wants to maintain this payout ratio in 2019, what will be its per-share dividend in 2019?

- b. If the company maintains this 25% payout ratio, what will be the current dividend yield on the company’s stock?

- c. The company reported net income of $1.35 million in 2018. Assume that the number of shares outstanding has remained constant. What was the company’s per-share dividend in 2018?

- d. As an alternative to maintaining the same dividend payout ratio. Brooks is considering maintaining the same per-share dividend in 2019 that it paid in 2018. If it chooses this policy, what will be the company’s dividend payout ratio in 2019?

- e. Assume that the company is interested in dramatically expanding its operations and that this expansion will require significant amounts of capital. The company would like to avoid transactions costs involved in issuing new equity. Given this scenario, would it make more sense for the company to maintain a constant dividend payout ratio or to maintain the same per-share dividend? Explain.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 14 Solutions

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

Ch. 14 - Prob. 1QCh. 14 - Prob. 2QCh. 14 - Would it ever be rational for a firm to borrow...Ch. 14 - Modigliani and Miller (MM), on the one hand, and...Ch. 14 - Prob. 5QCh. 14 - One position expressed in the financial literature...Ch. 14 - Prob. 7QCh. 14 - What is the difference between a stock dividend...Ch. 14 - Most firms like to have their stock selling at a...Ch. 14 - Prob. 10Q

Ch. 14 - Prob. 11QCh. 14 - RESIDUAL DIVIDEND MODEL Altamonte...Ch. 14 - Prob. 2PCh. 14 - STOCK REPURCHASES Gamma Industries has net income...Ch. 14 - Prob. 4PCh. 14 - EXTERNAL EQUITY FINANCING Coastal Carolina Heating...Ch. 14 - RESIDUAL DIVIDEND MODEL Walsh Company is...Ch. 14 - DIVIDENDS Brooks Sporting Inc. is prepared to...Ch. 14 - Prob. 8PCh. 14 - ALTERNATIVE DIVIDEND POLICIES In 2018, Keenan...Ch. 14 - Prob. 10SPCh. 14 - Prob. 11ICCh. 14 - Prob. 1TCLCh. 14 - Prob. 2TCLCh. 14 - Prob. 3TCLCh. 14 - Investors are more concerned with future dividends...Ch. 14 - Prob. 5TCL

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License