Concept explainers

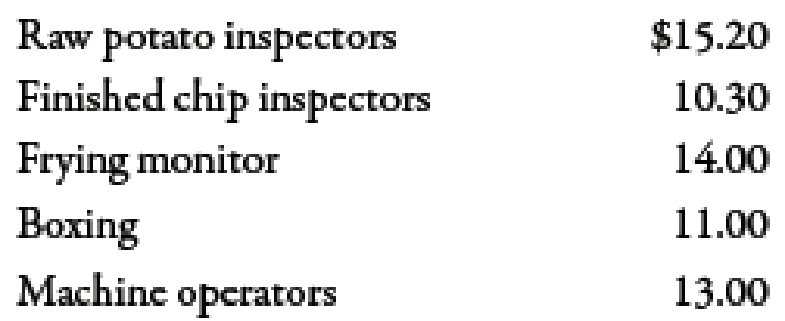

Paul Golding and his wife, Nancy, established Crunchy Chips in 1938. Over the past 60 years, the company has established distribution channels in 11 western states, with production facilities in Utah, New Mexico, and Colorado. In 1980, Paul’s son, Edward, took control of the business. By 2017, it was clear that the company’s plants needed to gain better control over production costs to stay competitive. Edward hired a consultant to install a

The manufacturing process for potato chips begins when the potatoes are placed into a large vat in which they are automatically washed. After washing, the potatoes flow directly to an automatic peeler. The peeled potatoes then pass by inspectors, who manually cut out deep eyes or other blemishes. After inspection, the potatoes are automatically sliced and dropped into the cooking oil. The frying process is closely monitored by an employee. After the chips are cooked, they pass under a salting device and then pass by more inspectors, who sort out the unacceptable finished chips (those that are discolored or too small). The chips then continue on the conveyor belt to a bagging machine that bags them in 1-pound bags. After bagging, the bags are placed in a box and shipped. The box holds 15 bags.

The raw potato pieces (eyes and blemishes), peelings, and rejected finished chips are sold to animal feed producers for $0.16 per pound. The company uses this revenue to reduce the cost of potatoes. We would like this reflected in the price standard relating to potatoes.

Crunchy Chips purchases high-quality potatoes at a cost of $0.245 per pound. Each potato averages 4.25 ounces. Under efficient operating conditions, it takes four potatoes to produce one 16-ounce bag of plain chips. Although we label bags as containing 16 ounces, we actually place 16.3 ounces in each bag. We plan to continue this policy to ensure customer satisfaction. In addition to potatoes, other raw materials are the cooking oil, salt, bags, and boxes. Cooking oil costs $0.04 per ounce, and we use 3.3 ounces of oil per bag of chips. The cost of salt is so small that we add it to overhead. Bags cost $0.11 each and boxes $0.52 each.

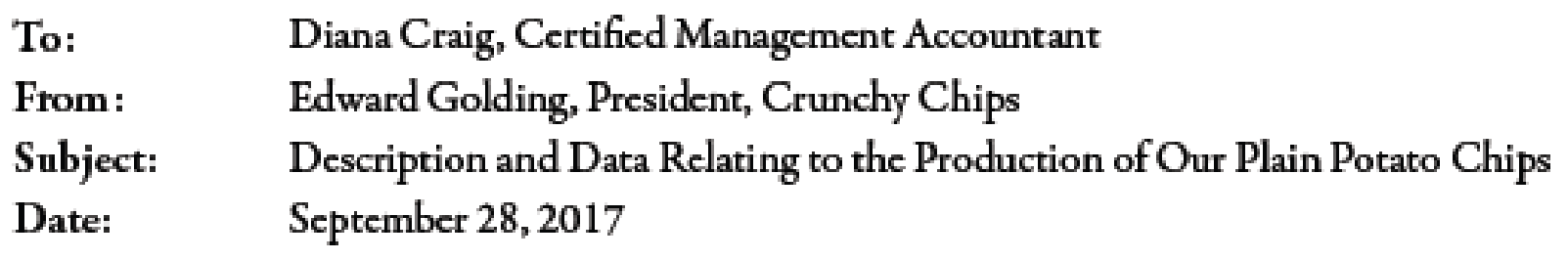

Our plant produces 8.8 million bags of chips per year. A recent engineering study revealed that we would need the following direct labor hours to produce this quantity if our plant operates at peak efficiency:

I’m not sure that we can achieve the level of efficiency advocated by the study. In my opinion, the plant is operating efficiently for the level of output indicated if the hours allowed are about 10% higher.

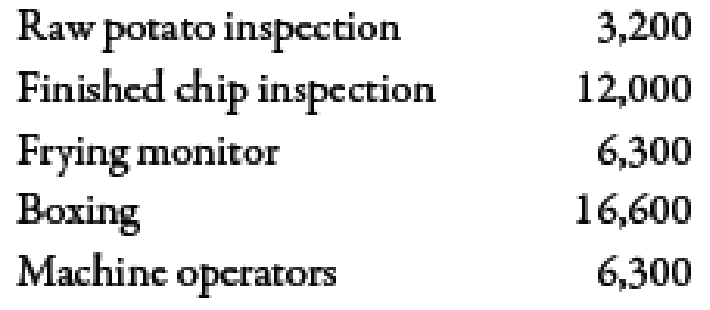

The hourly labor rates agreed upon with the union are:

Overhead is applied on the basis of direct labor dollars. We have found that variable overhead averages about 116% of our direct labor cost. Our fixed overhead is budgeted at $1,135,216 for the coming year.

Required:

- 1. Discuss the benefits of a standard costing system for Crunchy Chips.

- 2. Discuss the president’s concern about using the result of the engineering study to set the labor standards. What standard would you recommend?

- 3. Form a group with two or three other students. Develop a standard cost sheet for Crunchy Chips’ plain potato chips. Round all computations to four decimal places.

- 4. Suppose that the level of production was 8.8 million bags of potato chips for the year as planned. If 9.5 million pounds of potatoes were used, compute the materials usage variance for potatoes.

1.

Explain the benefits of a standard costing for Company CC.

Explanation of Solution

Variance:

The amount obtained when actual cost is deducted from budgeted cost is known as variance. Variance is calculated to find whether the cost is over applied or under applied.

The benefits of standard costing system for Company CC are explained below:

- Company CC is able to increase the control of its manufacturing inputs by using the standard costing.

- Company CC is able to evaluate the price and usage variances with the help of the price and quantity variances.

- Company CC is able to enhance its information by using the standard costing.

2.

Explain the concern of president about using the result of the engineering study to set the labor standards. Also, identify the best standard for the company.

Explanation of Solution

The concern of president is that whether the company is able to achieve its labor standards or not. If company is giving pressure on its workers for achieving the perfect standards, then it gives negative impact on the production of the workers. As a result, the outcome of the work of the workers is negative or unsatisfactory because workers get irritated and lower their performance. The best standard for the company is ideal standard because ideal standard is the most desired, highest quality or best standard that could easily achieve.

3.

Prepare a standard cost sheet for Company CC.

Explanation of Solution

Standard cost sheet for one box of chips:

| Particulars |

Quantity (Q) |

Price (P) ($) |

Amount ($) |

| Direct materials | |||

| Potatoes | 15.93751 | 0.238 | 3.7931 |

| Cooking oil | 49.5 | 0.04 | 1.9800 |

| Bags | 15 | 0.11 | 1.6500 |

| Boxes | 1 | 0.52 | 0.5200 |

| Total | 7.9431 |

Table (1)

Standard cost sheet of direct labor:

| Particulars |

Quantity (Q) |

Price (P) ($) |

Amount ($) |

| Direct labor | |||

| Potato inspection | 0.0062 | 15.20 | 0.0912 |

| Chip inspection | 0.02253 | 10.30 | 0.2318 |

| Frying monitor | 0.01184 | 14.00 | 0.1652 |

| Boxing | 0.03115 | 11.00 | 0.3421 |

| Machine operators | 0.01186 | 13.00 | 0.1534 |

| Variable overhead | 0.9837 | 1.16 | 1.1411 |

| Fixed overhead | 0.9837 | 1.96717 | 1.9350 |

| Direct material | 7.9431 | ||

| Total(A) | 12.0029 | ||

| Units of bags(B) | 15 | ||

|

Cost per bag | 0.8002 |

Table (2)

Working Note:

1.

Calculation of quantity of potatoes:

2.

Calcualtion of hours of potato inspection:

For calcualting the hours of potato inspection, first need to calculate the number of boxes per hour:

3.

Calcualtion of hours of Chips inspection:

4.

Calcualtion of hours of frying monitor:

5.

Calcualtion of hours of boxing:

6.

Calcualtion of hours of machine operators:

7.

Calculation of Fixed overhead rate:

4.

Calculate the material usage variances for potatoes.

Explanation of Solution

Use the following formula to calculate material usage variance of potato:

Substitute $9,500,000 for actual quantity, $9,350,000 for standard quantity and $0.238 for standard price in the above formula.

Therefore, the material usage variance is $37,500 (U).

Working Note:

1.

Calculation of standard quantity:

Want to see more full solutions like this?

Chapter 10 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Quincy Farms is a producer of items made from farm products that are distributed to supermarkets. For many years, Quincys products have had strong regional sales on the basis of brand recognition. However, other companies have been marketing similar products in the area, and price competition has become increasingly important. Doug Gilbert, the companys controller, is planning to implement a standard costing system for Quincy and has gathered considerable information from his coworkers on production and direct materials requirements for Quincys products. Doug believes that the use of standard costing will allow Quincy to improve cost control and make better operating decisions. Quincys most popular product is strawberry jam. The jam is produced in 10-gallon batches, and each batch requires six quarts of good strawberries. The fresh strawberries are sorted by hand before entering the production process. Because of imperfections in the strawberries and spoilage, one quart of strawberries is discarded for every four quarts of acceptable berries. Three minutes is the standard direct labor time required for sorting strawberries in order to obtain one quart of strawberries. The acceptable strawberries are then processed with the other ingredients: processing requires 12 minutes of direct labor time per batch. After processing, the jam is packaged in quart containers. Doug has gathered the following information from Joe Adams, Quincys cost accountant, relative to processing the strawberry jam. a. Quincy purchases strawberries at a cost of 0.80 per quart. All other ingredients cost a total of 0.45 per gallon. b. Direct labor is paid at the rate of 9.00 per hour. c. The total cost of direct material and direct labor required to package the jam is 0.38 per quart. Joe has a friend who owns a strawberry farm that has been losing money in recent years. Because of good crops, there has been an oversupply of strawberries, and prices have dropped to 0.50 per quart. Joe has arranged for Quincy to purchase strawberries from his friends farm in hopes that the 0.80 per quart will put his friends farm in the black. Required: 1. Discuss which coworkers Doug probably consulted to set standards. What factors should Doug consider in establishing the standards for direct materials and direct labor? 2. Develop the standard cost sheet for the prime costs of a 10-gallon batch of strawberry jam. 3. Citing the specific standards of the IMA Statement of Ethical Professional Practice described in Chapter 1, explain why Joes behavior regarding the cost information provided to Doug is unethical. (CMA adapted)arrow_forwardMirabel Manufacturing is a small but growing company that manufactures and sells marine sonar equipment. They employee a national sales force and their primary customers are marine retailers and boat dealerships. The company has expanded over the last 5 years and Paul Mirabel, the founder and CEO has become concerned that he no longer has a clear picture of their cost structure. He calls his CFO, Mary Jane Montgomery in for a meeting. “Mary Jane, I am concerned that I am not current on our cost structure and how that is impacting our bottom line,” Paul begins. “Well, Paul, the company has grown considerably over the past 5 years, so I’m not surprised that you feel a little disconnected with how things are going,” Mary Jane replied. She continued “In fact, I’ve been meaning to talk to you about a couple of big items such as increasing the sales commission to 15%. We’ve lost two of our best account managers in the last 9 months. It seems like we are behind the curve paying only 12% on…arrow_forwardMirabel Manufacturing is a small but growing company that manufactures and sells marine sonar equipment. They employee a national sales force and their primary customers are marine retailers and boat dealerships. The company has expanded over the last 5 years and Paul Mirabel, the founder and CEO has become concerned that he no longer has a clear picture of their cost structure. He calls his CFO, Mary Jane Montgomery in for a meeting. “Mary Jane, I am concerned that I am not current on our cost structure and how that is impacting our bottom line,” Paul begins. “Well, Paul, the company has grown considerably over the past 5 years, so I’m not surprised that you feel a little disconnected with how things are going,” Mary Jane replied. She continued “In fact, I’ve been meaning to talk to you about a couple of big items such as increasing the sales commission to 15%. We’ve lost two of our best account managers in the last 9 months. It seems like we are behind the curve paying only 12% on…arrow_forward

- Mirabel Manufacturing is a small but growing company that manufactures and sells marine sonar equipment. They employee a national sales force and their primary customers are marine retailers and boat dealerships. The company has expanded over the last 5 years and Paul Mirabel, the founder and CEO has become concerned that he no longer has a clear picture of their cost structure. He calls his CFO, Mary Jane Montgomery in for a meeting. “Mary Jane, I am concerned that I am not current on our cost structure and how that is impacting our bottom line,” Paul begins. “Well, Paul, the company has grown considerably over the past 5 years, so I’m not surprised that you feel a little disconnected with how things are going,” Mary Jane replied. She continued “In fact, I’ve been meaning to talk to you about a couple of big items such as increasing the sales commission to 15%. We’ve lost two of our best account managers in the last 9 months. It seems like we are behind the curve paying only 12% on…arrow_forwardMirabel Manufacturing is a small but growing company that manufactures and sells marine sonar equipment. They employee a national sales force and their primary customers are marine retailers and boat dealerships. The company has expanded over the last 5 years and Paul Mirabel, the founder and CEO has become concerned that he no longer has a clear picture of their cost structure. He calls his CFO, Mary Jane Montgomery in for a meeting. “Mary Jane, I am concerned that I am not current on our cost structure and how that is impacting our bottom line,” Paul begins. “Well, Paul, the company has grown considerably over the past 5 years, so I’m not surprised that you feel a little disconnected with how things are going,” Mary Jane replied. She continued “In fact, I’ve been meaning to talk to you about a couple of big items such as increasing the sales commission to 15%. We’ve lost two of our best account managers in the last 9 months. It seems like we are behind the curve paying only 12% on…arrow_forwardMary Jones and Jack Smart have joined forces to start M&J Food Products, a processor of packaged shredded lettuce for institutional use. Jack has years of food processing experience, and Mary has extensive commercial food preparation experience. The process will consist of opening crates of lettuce and then sorting, washing, slicing, preserving, and finally packaging the prepared lettuce. Together, with help from vendors, they think they can adequately estimate demand, fixed costs, revenues, and variable cost per 5-pound bag of lettuce. They think a largely manual process will have monthly fixed cost of $50,000 and a variable cost of $2.50 per bag. They expect to sell 75,000 bags of lettuce per month. They expect to sell the shredded lettuce for $3.25 per 5-pound bag. Jack and Mary has been contacted by a vendor to consider a more mechanized process. This new process will have monthly fixed cost of $125,000 per month with a variable cost of $1.75 per bag. Based on the above…arrow_forward

- Mary Jones and Jack Smart have joined forces to start M&J Food Products, a processor of packaged shredded lettuce for institutional use. Jack has years of food processing experience, and Mary has extensive commercial food preparation experience. The process will consist of opening crates of lettuce and then sorting, washing, slicing, preserving, and finally packaging the prepared lettuce. Together, with help from vendors, they think they can adequately estimate demand, fixed costs, revenues, and variable cost per 5-pound bag of lettuce. They think a largely manual process will have monthly fixed cost of $50,000 and a variable cost of $2.50 per bag. They expect to sell 75,000 bags of lettuce per month. They expect to sell the shredded lettuce for $3.25 per 5-pound bag. Jack and Mary has been contacted by a vendor to consider a more mechanized process. This new process will have monthly fixed cost of $125,000 per month with a variable cost of $1.75 per bag. Based on the above…arrow_forwardSpeed Racer in Victoria makes bicycles for people of all ages. The frames division makes and paints the frames and supplies them to the assembly division where the bicycles are assembled. Speed Racer is a successful and profitable corporation that attributes much of its success to its decentralized operating style. Each division manager is compensated on the basis of division operating income. The assembly division currently acquires all its frames from the frames division. The assembly division manager could purchase similar frames in the market for $480. The frames division is currently operating at 80% of its capacity of 4,000 frames (units) and has the following details: Voltage Regulator Direct materials ($150 per unit x 320 units) $480,000 Direct manufacturing labour ($60 per unit x 3,200 units) 192,000 Variable manufacturing overhead costs ($30 per unit × 3,200 units) 96,000 Fixed manufacturing overhead costs $624,000 All the frames…arrow_forwardSpeed Racer in Victoria makes bicycles for people of all ages. The frames division makes and paints the frames and supplies them to the assembly division where the bicycles are assembled. Speed Racer is a successful and profitable corporation that attributes much of its success to its decentralized operating style. Each division manager is compensated on the basis of division operating income. The assembly division currently acquires all its frames from the frames division. The assembly division manager could purchase similar frames in the market for $480. The frames division is currently operating at 80% of its capacity of 4,000 frames (units) and has the following details: Voltage Regulator Direct materials ($150 per unit x 320 units) $480,000 Direct manufacturing labour ($60 per unit x 3,200 units) 192,000 Variable manufacturing overhead costs ($30 per unit × 3,200 units) 96,000 Fixed manufacturing overhead costs $624,000 All the frames division’s…arrow_forward

- Speed Racer in Victoria makes bicycles for people of all ages. The frames division makes and paints the frames and supplies them to the assembly division where the bicycles are assembled. Speed Racer is a successful and profitable corporation that attributes much of its success to its decentralized operating style. Each division manager is compensated on the basis of division operating income. The assembly division currently acquires all its frames from the frames division. The assembly division manager could purchase similar frames in the market for $480. The frames division is currently operating at 80% of its capacity of 4,000 frames (units) and has the following details: Voltage Regulator Direct materials ($150 per unit x 320 units) $480,000 Direct manufacturing labour ($60 per unit x 3,200 units) 192,000 Variable manufacturing overhead costs ($30 per unit × 3,200 units) 96,000 Fixed manufacturing overhead costs $624,000 All the frames division’s…arrow_forwardSpeed Racer in Victoria makes bicycles for people of all ages. The frames division makes and paints the frames and supplies them to the assembly division where the bicycles are assembled. Speed Racer is a successful and profitable corporation that attributes much of its success to its decentralized operating style. Each division manager is compensated on the basis of division operating income. The assembly division currently acquires all its frames from the frames division. The assembly division manager could purchase similar frames in the market for $480. The frames division is currently operating at 80% of its capacity of 4,000 frames (units) and has the following details: Voltage Regulator Direct materials ($150 per unit x 320 units) $480,000 Direct manufacturing labour ($60 per unit x 3,200 units) 192,000 Variable manufacturing overhead costs ($30 per unit × 3,200 units) 96,000 Fixed manufacturing overhead costs $624,000 All the frames division’s…arrow_forwardSpeed Racer in Victoria makes bicycles for people of all ages. The frames division makes and paints the frames and supplies them to the assembly division where the bicycles are assembled. Speed Racer is a successful and profitable corporation that attributes much of its success to its decentralized operating style. Each division manager is compensated on the basis of division operating income. The assembly division currently acquires all its frames from the frames division. The assembly division manager could purchase similar frames in the market for $480. The frames division is currently operating at 80% of its capacity of 4,000 frames (units) and has the following details: Voltage Regulator Direct materials ($150 per unit x 320 units) $480,000 Direct manufacturing labour ($60 per unit x 3,200 units) 192,000 Variable manufacturing overhead costs ($30 per unit × 3,200 units) 96,000 Fixed manufacturing overhead costs $624,000 All the frames…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning