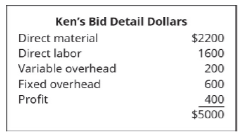

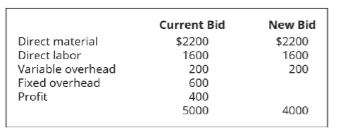

Ken Owens Construction specializes in small additions and repairs. His normal charge is $400/day plus materials. Due to his physical condition, David, an elderly gentleman, needs a downstairs room converted to a bathroom. Ken has produced a bid for $5000 to complete the bathroom. He did not provide David with the details of the bid. However, they are shown here.

- The town’s social services has asked Ken if he could reduce his bid to $4000. Should Ken accept the counter offer?

B. How much would his income be reduced?

C. If the town’s social services guaranteed him another job next month at his normal price, could he accept this job at $4000?

Trending nowThis is a popular solution!

Chapter 10 Solutions

Principles of Accounting Volume 2

Additional Business Textbook Solutions

Horngren's Accounting (11th Edition)

Principles of Accounting Volume 1

Cost Accounting (15th Edition)

Financial Accounting, Student Value Edition (4th Edition)

Horngren's Accounting (12th Edition)

Managerial Accounting (5th Edition)

- Taylor owns a 150-unit motel that was constructed in the late 1960s. It is located on 10 acres on the main highway leading into the city. Taylor renovated the motel three years ago. Taylors motel is condemned by the city, which is going to use 2 of the 10 acres for a small park. Taylor will sell the other 8 acres to a time-share developer who intends to build 400 units on the property. The developer already has secured approval from the city planning commission. Taylors attorney advises him not to contest the condemnation of the 2 acres for the park. Under the eminent domain provision, the city does have the right to take private property for public use. However, the attorney advises Taylor to contest the condemnation of the remaining property. According to the attorney, the city does not have the right to take private property for private use. The citys position is that the condemnation will result in a substantial number of new jobs and additional tax revenue for the city. Will Taylor be successful if he follows his attorneys advice? Summarize your findings in a two- to three-paragraph e-mail to your instructor.arrow_forwardPhil Dunphy, a real estate agent, is considering whether he should list an unusual $393,668 house for sale. If he lists it, he will need to spend $4,295 in advertising, staging, and fresh cookies. The current owner has given Phil 6 months to sell the house. If he sells it, he will receive a commission of $16,068. If he is unable to sell the house, he will lose the listing and his expenses. Phil estimates the probability of selling this house in 6 months to be 25%. What is the expected profit on this listing? Your Answer:arrow_forwardPhil Dunphy, a real estate agent, is considering whether he should list an unusual $902,958 house for sale. If he lists it, he will need to spend $3,668 in advertising, staging, and fresh cookies. The current owner has given Phil 6 months to sell the house. If he sells it, he will receive a commission of $21,270. If he is unable to sell the house, he will lose the listing and his expenses. Phil estimates the probability of selling this house in 6 months to be 44%. What is the expected profit on this listing?arrow_forward

- Edward Foster is a building contractor. He and his customer have agreed that he will submit a bill to them when he is 25 percent complete, 50 percent complete, 75 percent complete, and 100 percent complete. For example, he has a $300,000 room addition. When he has completed 25 percent, he will bill his customer $25,000. The problem occurs when he is 40 percent complete and has incurred expenses but cannot bill his customer.arrow_forwardJoe sends a check for $218 to the University by July 1 of every year to cover the cost of two tickets for each of the 7 home games plus $50 for a parking permit. Joe has difficulty finding friends to accompany him to the games. However, he is adamant that he must go to the games because he has paid for the tickets. Friends insist that the cost of the tickets is a sunk cost and that the decision should be based on future costs that would be different between alternatives – going to the game and not going to the game. Friends have calculated the fuel for the 6-hour round trip costs $15 and two meals while away from home for the game can easily cost $30 or more. Required Write a list to Joe outlining the relevant costs associated with a trip to the game.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENTBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENTBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage