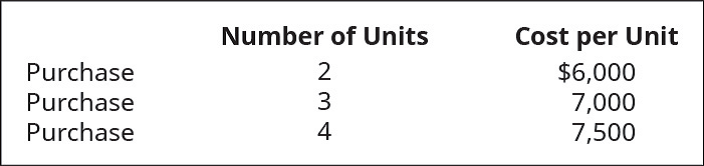

When prices are rising (inflation), which costing method would produce the highest value for gross margin? Choose between first-in, first-out (FIFO); last-in, first-out (LIFO); and weighted average (AVG). Evansville Company had the following transactions for the month.

Calculate the gross margin for each of the following cost allocation methods, assuming A62 sold just one unit of these goods for $10,000. Provide your calculations.

A. first-in, first-out (FIFO)

B. last-in, first-out (LIFO)

C. weighted average (AVG)

Trending nowThis is a popular solution!

Chapter 10 Solutions

Principles of Accounting Volume 1

Additional Business Textbook Solutions

Principles of Management

Horngren's Accounting (12th Edition)

Financial Accounting (12th Edition) (What's New in Accounting)

Horngren's Accounting (11th Edition)

Managerial Accounting (4th Edition)

Construction Accounting And Financial Management (4th Edition)

- When prices are falling (deflation), which costing method would produce the highest gross margin for the following? Choose first-in, first-out (FIFO); last-in, first-out (LIFO); or weighted average, assuming that B62 Company had the following transactions for the month. Calculate the gross margin for each of the following cost allocation methods, assuming B62 sold just one unit of these goods for $400. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forwardUsing the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardPietro expects to produce 50,000 units and sell 49,300 units. Beginning inventory of finished goods is 42,500, and ending inventory of finished goods is expected to be 34,000. Required: 1. Prepare a statement of cost of goods sold in good form. 2. What if the beginning inventory of finished goods decreased by 5,000? What would be the effect on the cost of goods sold?arrow_forward

- Click the Chart sheet tab. On the screen is a column chart showing ending inventory costs. During a deflationary period, which bar (A, B, or C) represents FIFO costing, which represents LIFO costing, and which represents weighted average? Explain your reasoning. On January 4 following year-end, Rio Enterprises received a shipment of 60 units of product costing 580 each. These units had been ordered by Del in December and had been shipped to him on December 27. They were shipped FOB shipping point. Revise the FIFOLIFO3 worksheet to include this shipment. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as FIFOLIFOT. Using the FIFOLIFO3 file, prepare a 3-D bar (stacked) chart showing the cost of goods sold and ending inventory under each of the four inventory cost flow assumptions. No Chart Data Table is needed. Use the values in the Calculations Section of the worksheet for your chart. Enter your name somewhere on the chart. Save the file again as FIFOLIFO3. Print the chart.arrow_forward7. Assume that Sweeten Company uses cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. If Job P includes 20 units and Job Q includes 30 units, what selling price would the company establish for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? 8. What is Sweeten Company’s cost of goods sold for the year? 9. What are the company’s predetermined overhead rates in the Molding Department and the Fabrication Department?arrow_forwardHuge Company’s traditional format income statement for the month of May was as follows: Using the space provided below, please prepare an income statement for the month in contribution margin format b. By how much would net income increase if sales increased by $30,000?arrow_forward

- a. Calculate the cost of goods manufactured for the year by Gopaul Electronics b.) Prepare an income statement for Gopaul Electronics for the year ended December 31, 2023, clearly showing the calculation of Cost of Goods Sold. List the non-production overheads in order of size starting with the largest. c) What is the selling price per switch if Gopaul Electronics manufactured 1,500 switches for the period under review and uses a mark-up of 33⅓% on cost?arrow_forward1. In presenting inventory on the balance sheet December 31, 2021, the unit cost under absorption costing is? 2. What is the net income for 2021 under variable costing?arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- Spectrum Corp. makes two products: C and D. The following data have been summarized: (Click the icon to view the data.) Spectrum Corp. desires a 25% target gross profit after covering all product costs. Considering the total product costs assigned to the Products C and D, what would Spectrum have to charge the customer to achieve that gross profit? Round to two decimal places. Begin by selecting the formula to compute the amount that the company should charge for each product. Required sales price per unit Data table Direct materials cost per unit Direct labor cost per unit Indirect manufacturing cost per unit Total costs assigned Print $ $ Product C 600.00 $ 300.00 270.00 1,170.00 S Done - X Product D 2,400.00 200.00 604.00 3,204.00arrow_forwardKALIBO CORP. prepared the following absorption-costing income statement for the year ended May 31, 2019 Sales (16,000 units) Cost of goods sold Gross margin Selling and administrative expenses Operating income Additional information follows: Selling and administrative expenses include P1.50 of variable cost per unit sold. There was no beginning inventory, and 17,500 units were produced. Variable manufacturing costs were P11 per unit. Actual fixed costs were equal to budgeted fixed costs. REQUIREMENT: Prepare a variable-costing income statement for the same period. P 320,000 216.000 P104,000 46.000 P 58,000 Absorption Costing Income Statement (Conversion from Variable Net Income) 4. LEGAZPI COMPANY manufactures and sells premium tomato juice by the gallon. LEGAZPI just finished its first year of operations. The following data relates to this first year:arrow_forwardThe contribution margin income statement of Unique Donuts for August 2024 follows: (Click the icon to view the contribution margin income statement.) Data table Unique Donuts Contribution Margin Income Statement Month Ended August 31, 2024 Net Sales Revenue Variable Costs: Cost of Goods Sold Selling Costs Administrative Costs Contribution Margin Fixed Costs: Selling Costs Administrative Costs Operating Income $ 32,300 17,200 1,300 42,210 14,070 $ $ - 127,000 50,800 76,200 56,280 19,920 Requirements Unique sells two dozen plain donuts for every dozen custard-filled donuts. A dozen plain donuts sells for $3.10, with total variable cost of $1.24 per dozen. A dozen custard-filled donuts sells for $7.20, with total variable cost of $2.88 per dozen. d-filled donuts 1. Calculate the weighted-average contribution margin. 2. Determine Unique's monthly breakeven point in dozens of plain donuts and custard-filled donuts. Prove your answer by preparing a summary contribution margin income…arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning