Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

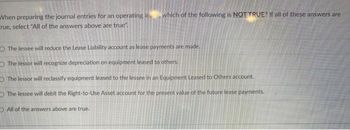

Transcribed Image Text:When preparing the journal entries for an operating lewhich of the following is NOT TRUE? If all of these answers are

rue, select "All of the answers above are true".

The lessee will reduce the Lease Liability account as lease payments are made.

The lessor will recognize depreciation on equipment leased to others.

The lessor will reclassify equipment leased to the lessee in an Equipment Leased to others account.

The lessee will debit the Right-to-Use Asset account for the present value of the future lease payments.

All of the answers above are true.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In relation to a short-term operating lease, which of the following statements is NOT correct? a. The lessee will be responsible for repairs and maintenance of the leased asset b. The lease period will not cover the leased asset’s useful economic life c. The asset and lease obligation will not be recorded in the statement of financial position d. An operating lease is a rental agreement Clear my choicearrow_forwardPlease help me. Thankyou.arrow_forward* Your answer is incorrect. When a company sells property and then leases it back, any gain on the sale should usually be deferred and recognized as income over the term of the lease. O recognized at the end of the lease. Orecognized in the current year. O recognized as a prior period adjustment.arrow_forward

- Prior to 2019, lessees did not include the right-of-use asset and the lease liability for operating leases on their balance sheets. Both FASB and IASB wrote new standards to require that lessees nearly always report an asset and liability on their balance sheets when they engage in a lease transaction. This accounting results in which of the following? Group of answer choices a more reliable estimation of the lease's value a better determination on whether the lessor held the risks and rewards of the leased asset's ownership a more faithful representation of the rights and obligations arising from leases All of the abovearrow_forwardWhich of the following is not correct statement for accounting by the lessee? The lessee records depreciation expense on the right-of-use asset. O b. The lessee recognizes interest expense on the lease liability over the lease term O c. The lease liability is computed as the present value of the lease payments. O d. The operating lease method is used to account for the lease.arrow_forwardFor a(n) ________ lease, a lessor recognizes revenue on the sale and records the asset, ________ lease. It also removes the leased asset from its accounts and records the ________. Group of answer choices sales-type; net investment in lease–sales-type; cost of goods sold finance; gross investment in lease–sales-type; cost of goods sold operating; net investment in lease–sales-type; cost of goods sold sales-type; finance; revenuearrow_forward

- The lessee compares the present value of owningthe equipment with the present value of leasingit. Now put yourself in the lessor’s shoes. In a fewsentences, how should you analyze the decision towrite or not to write the lease?arrow_forwardhelp me to solve it pleasearrow_forwardIn calculating the amortization of a leased asset, the lessee should subtract a Select one: a. guaranteed residual value and amortize over the term of the lease. b. unguaranteed residual value and amortize over the term of the lease. c. guaranteed residual value and amortize over the life of the asset. d. unguaranteed residual value and amortize over the life of the asset. e. None of the above.arrow_forward

- 9. Baa Co. enters into a lease of commercial space. The contract specifies a non-cancellable term of five years and a two-year, market-priced commencement, Baa Co. makes significant leasehold improvements with a useful life of ten years. Baa Co. determines that the economic benefits of the leasehold renewal option. Before the lease improvements can only be realized through continued of the leased property. At lease commencement, Occupancy b. 5 years c. 7 years d. 10 years a. 2 years Which of the following statements is incorrect regarding the accounting for lease liabilities? Lease liabilities are subsequently measured at amortized cost, adjusted for lease modifications and reassessments. b. Subsequent lease payments are apportioned to both the interest and the principal balance of the lease liability. c Periodic interests reflect a varying rate of interest on the remaining balance of the lease liability. d. Periodic interests reflect a constant rate of interest on the remaining…arrow_forwardThe following are some of the characteristics of an asset available for lease. (Click the icon to view the lease characteristics.) Required a. Determine the amount of lease payment that the lessor would require to lease the asset. b. Compute the lessor's net investment in the lease at initial recognition. c. Compute the value of the lessee's ROU asset at initial recognition. d. Compute the lessee's lease liability at initial recognition. Requirement a. Determine the amount of lease payment that the lessor would require to lease the asset. Begin by calculating the present value of the residual value and the value to be recovered by the lessor from the annual lease payments. (Use a financial calculator for all present value computations. Enter your final answers as positive amounts rounded to the nearest whole dollar.) Present value of guaranteed residual value Value to be recovered by annual lease payments Determine the amount of lease payment that the lessor would require to lease the…arrow_forwardThe lessee compares the present value of owning the equipment with the present value of leasing it. Now put yourself in the lessor’s shoes. In a few sentences, how should you analyze the decision to write or not to write the lease?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning