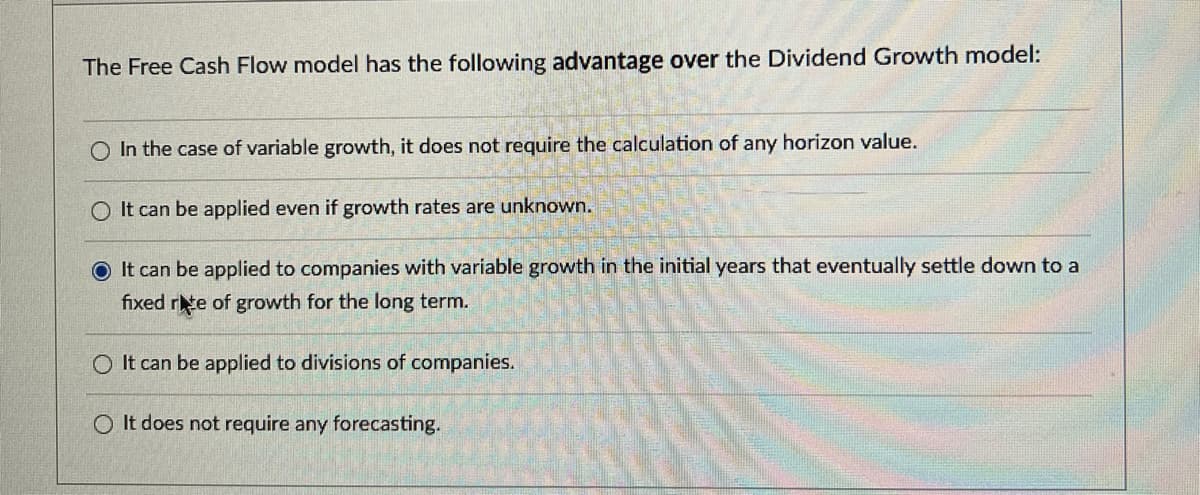

The Free Cash Flow model has the following advantage over the Dividend Growth model: In the case of variable growth, it does not require the calculation of any horizon value. O It can be applied even if growth rates are unknown. It can be applied to companies with variable growth in the initial years that eventually settle down to a fixed rate of growth for the long term. O It can be applied to divisions of companies. O It does not require any forecasting.

Q: How can companies use market research to validate and refine their value propositions?

A: Market research serves as a vital tool for companies seeking to validate and refine their value…

Q: UCLp 0.0332 (enter your response as a number between 0 and 1, rounded to four decimal places). LCLp…

A: where: is the average proportion defective which is 2% or 0.02z is the z-value for the desired…

Q: A seafood distribution company specializes in delivering fresh lobsters from their harvesting sites…

A: Find the given details below:

Q: After the physical inventory is completed, theo unit costs are determined by dividing the quantities…

A: Financial management is the aspect of management that is concerned with or manages all the…

Q: How does international operations management contribute to overall business strategy and…

A: International Operations Management (IOM) is the discipline that manages international corporate…

Q: Hi! I need a little help with D. I can't figure out how to calculate the efficiency. Can you explain…

A: The efficiency of the balanced line is approximately 63.89%.Explanation:1. Total Task Times: This is…

Q: Activity Predecessors 1 Description Duration Start job 1 2 1 Relocate electric 6 3 1 4 3 5 4 6 4 7…

A: To calculate the Latest Finish (LF) time for each activity, we'll start by drawing the Activity on…

Q: d iscuss the role of supervisors or managers in conducting traditional performance reviews.

A: Performance evaluations are essential to an employee's professional development in an organisation…

Q: Customers enter the camera department of a store at an average rate of six per hour. The department…

A: The given problem corresponds to the M/M/1 queuing model which is a single-server queuing system…

Q: Asap True or False: In a perfectly competitive market, firms have significant market power..

A: FalseExplanation:Companies do not have a considerable amount of market power in a market market that…

Q: The following are monthly actual and forecast demand levels for May through December for units of a…

A: A tracking signal is a tool utilized in statistics and management science to observe forecasts and…

Q: Fix-Em-Up Industries restores classic cars. Their chairman wants to create a project netwo diagram…

A: Project management is the branch of management that deals with organizing and overseeing the…

Q: If the forecast and the actual demand in the year 2021 was 600 and 700 respectively, what is the…

A: The objective of the question is to calculate the forecast for the year 2022 using the naive…

Q: d CE Additional Algo 5-11 Attrition Losses and Yields A process has three resources and two types of…

A: Answers are in attachment. Explanation:

Q: Develop a 1 year periodized program for a Major League Baseball population. Use the traditional…

A: Major League Baseball (MLB) - is a professional baseball league in North America, consisting of 30…

Q: How does outsourcing affect a company's design capacity calculations?

A: In the context of capacity planning, an organization's design capacity is its maximum ability to…

Q: Peter’s Paper Clips uses a three-stage production process: cutting wire to prescribed lengths, inner…

A: Cutting capacity = 220 pieces per minuteInner bending capacity = 230 pieces per minuteOuter bending…

Q: NYC Real Estate is purchasing an old office building in order to renovate it. The renovation project…

A:

Q: Please help with correct answers in details: step by step as last submission were given incorrect…

A: B) ANSWER FOR QUESTION BTo develop the equation with dummy variables for seasonal effects, you can…

Q: 13. The Bi-Product Company produces two products (A and B) that are similar in terms of labor con-…

A: Aggregate plans show output rates, workforce levels, and inventory in accordance with demand and…

Q: Macy's has decided to hire 1,000 additional sale people from October 1st - January 31st to help with…

A: The answer is: a. controllable variableExplanation:The answer is: a. controllable variableHere's…

Q: 2.15 The opening backlog is 900 units. Forecast demand is shown in the following. Calculate the…

A: The opening backlog = 900 units Projected ending backlog = 200 units

Q: Strategic management is the process of formulating, implementing, and evaluating long-term…

A: Strategic management, in other words, refers to a total of all ways including planning,…

Q: (b) Solve the linear program formulated in part (a). How many service facilities are required? Where…

A: Prepare an excel sheet as shown below:Note that in excel the colored values represents the cities…

Q: A department store needs to hire holiday season sales staff for their store. To cover all the…

A: Linear programming helps us find the optimal solution/best outcome, given the constraints. Integer…

Q: RBMC Industry manufactures a special printing according to customer specifications with respect to…

A: (a) Cost Model Formulation:Cost of production: This is the cost incurred by the owner for producing…

Q: The owner of Artisanal Chips etc. produces three flavors of artisanal corn chips marketed at new…

A: The information regarding production of 3 products: pumpkin (P), chipotle adobo (C) and basement (B)…

Q: The following time series represents the number of automobiles sold by a car dealership each of the…

A: a.) The correct time series plot for the given data is the third plot.The time series plot shows a…

Q: A company manufactures plastic bottles, buckets, and cups. The profit units are $10 for a plastic…

A: The Simplex Method or Simplex Algorithm is used for calculating the optimal solution to the linear…

Q: Given the following information set up the problem in a transportation table and solve for the…

A: Find the given details below:

Q: Examine the impact of occupational diseases, stress and communicable diseases to the health and…

A: Maintaining workers' health and safety in today's changing work conditions is critical to the…

Q: Hale's TV Production is considering producing a pilot for a comedy series in the hope of selling it…

A: The detailed solution is provided below.Explanation: 2) WHAT IS THE RECOMMENDED DECISION IF AGENCY…

Q: Explain, How do organizations manage scheduling conflicts between different departments or…

A: Operations planning entails scheduling of resources, tasks, and work to be completed within the…

Q: Your international business is an Oil Company located and operating in Saudi Arabia 1a. Outline…

A: The objective of the question is to outline the organizational structure for an international oil…

Q: How do organizations measure and track the effectiveness of their Quality Assurance programs?

A: The goal of quality assurance as a business idea is to provide value for customers by removing…

Q: How do organizations manage excess and obsolete inventory effectively?

A: Inventory management is an essential part of supply chain management. It involves keeping track of…

Q: Using the information below answer the following questions a) What is the bottleneck in the process…

A: There are 4 products produced by a factory as shown below:Factory runs one 8-hour shift per day per…

Q: Use the relative-aggregate-scores approach to compare the two motherboard assembly technology…

A: The relative-aggregate-score method is a decision-making approach used to compare alternatives based…

Q: Identify and discuss by completing a thorough analysis of Tech Products Inc. one (1) internal tool…

A: Business environment is the aspect that deals with the study of the factors or components that…

Q: The multifaceted challenges an organization faces when contemplating international ventures are not…

A: The objective of the question is to analyze the various challenges an organization might face when…

Q: Discuss the advantages of using work sampling as a method of work measurement.

A: A Work Measurement Study uses an approaches to systematically determine the work content and…

Q: Activity Predecessors 1 Description Duration Start job 1 2 1 Relocate electric 6 3 1 4 3 5 4 6 4 7…

A: To determine the earliest finish time (EF) for each activity, we need to compute the forward pass in…

Q: a.What additional annual cost is the shop incurring by staying with this order size? (Round your…

A:

Q: Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care…

A: The objective of the question is to understand the various pressures that decision makers in public…

Q: Question 1. Narrow the focus of each of the following broad topics so that they each signal the use…

A: The objective of the question is to narrow down the broad topics using the Analysis by Division…

Q: There is a love triangle between two females and one male in your plant and as the HR manager you…

A: Ensuring the well-being and peace of our workplace is my responsibility as our organization's HR…

Q: Please help with correct answers in details: Step by step Suppose these data show the number of…

A: Compute four-week and five-week moving averages for the time series.WeekSales (1000s of…

Q: Help me calculate the fixed production cost for option 1

A: The objective of the question is to calculate the fixed production cost for option 1, which involves…

Q: In the context of operation management How can organizations address resistance to change during…

A: Enterprise Resource Planning (ERP) improves operations throughout a company by coordinating data…

Q: How does agile management support the concept of continuous delivery and frequent releases?

A: Agile project management is a flexible and collaborative methodology that is mostly used in software…

Step by step

Solved in 3 steps

- You are considering a 10-year investment project. At present, the expected cash flow each year is 10,000. Suppose, however, that each years cash flow is normally distributed with mean equal to last years actual cash flow and standard deviation 1000. For example, suppose that the actual cash flow in year 1 is 12,000. Then year 2 cash flow is normal with mean 12,000 and standard deviation 1000. Also, at the end of year 1, your best guess is that each later years expected cash flow will be 12,000. a. Estimate the mean and standard deviation of the NPV of this project. Assume that cash flows are discounted at a rate of 10% per year. b. Now assume that the project has an abandonment option. At the end of each year you can abandon the project for the value given in the file P11_60.xlsx. For example, suppose that year 1 cash flow is 4000. Then at the end of year 1, you expect cash flow for each remaining year to be 4000. This has an NPV of less than 62,000, so you should abandon the project and collect 62,000 at the end of year 1. Estimate the mean and standard deviation of the project with the abandonment option. How much would you pay for the abandonment option? (Hint: You can abandon a project at most once. So in year 5, for example, you abandon only if the sum of future expected NPVs is less than the year 5 abandonment value and the project has not yet been abandoned. Also, once you abandon the project, the actual cash flows for future years are zero. So in this case the future cash flows after abandonment should be zero in your model.)In the cash balance model from Example 11.5, the timing is such that some receipts are delayed by one or two months, and the payments for materials and labor must be made a month in advance. Change the model so that all receipts are received immediately, and payments made this month for materials and labor are 80% of sales this month (not next month). The period of interest is again January through June. Rerun the simulation, and comment on any differences between your outputs and those from the example.A company manufacturers a product in the United States and sells it in England. The unit cost of manufacturing is 50. The current exchange rate (dollars per pound) is 1.221. The demand function, which indicates how many units the company can sell in England as a function of price (in pounds) is of the power type, with constant 27556759 and exponent 2.4. a. Develop a model for the companys profit (in dollars) as a function of the price it charges (in pounds). Then use a data table to find the profit-maximizing price to the nearest pound. b. If the exchange rate varies from its current value, does the profit-maximizing price increase or decrease? Does the maximum profit increase or decrease?

- Suppose you currently have a portfolio of three stocks, A, B, and C. You own 500 shares of A, 300 of B, and 1000 of C. The current share prices are 42.76, 81.33, and, 58.22, respectively. You plan to hold this portfolio for at least a year. During the coming year, economists have predicted that the national economy will be awful, stable, or great with probabilities 0.2, 0.5, and 0.3. Given the state of the economy, the returns (one-year percentage changes) of the three stocks are independent and normally distributed. However, the means and standard deviations of these returns depend on the state of the economy, as indicated in the file P11_23.xlsx. a. Use @RISK to simulate the value of the portfolio and the portfolio return in the next year. How likely is it that you will have a negative return? How likely is it that you will have a return of at least 25%? b. Suppose you had a crystal ball where you could predict the state of the economy with certainty. The stock returns would still be uncertain, but you would know whether your means and standard deviations come from row 6, 7, or 8 of the P11_23.xlsx file. If you learn, with certainty, that the economy is going to be great in the next year, run the appropriate simulation to answer the same questions as in part a. Repeat this if you learn that the economy is going to be awful. How do these results compare with those in part a?The IRR is the discount rate r that makes a project have an NPV of 0. You can find IRR in Excel with the built-in IRR function, using the syntax =IRR(range of cash flows). However, it can be tricky. In fact, if the IRR is not near 10%, this function might not find an answer, and you would get an error message. Then you must try the syntax =IRR(range of cash flows, guess), where guess" is your best guess for the IRR. It is best to try a range of guesses (say, 90% to 100%). Find the IRR of the project described in Problem 34. 34. Consider a project with the following cash flows: year 1, 400; year 2, 200; year 3, 600; year 4, 900; year 5, 1000; year 6, 250; year 7, 230. Assume a discount rate of 15% per year. a. Find the projects NPV if cash flows occur at the ends of the respective years. b. Find the projects NPV if cash flows occur at the beginnings of the respective years. c. Find the projects NPV if cash flows occur at the middles of the respective years.In the financial world, there are many types of complex instruments called derivatives that derive their value from the value of an underlying asset. Consider the following simple derivative. A stocks current price is 80 per share. You purchase a derivative whose value to you becomes known a month from now. Specifically, let P be the price of the stock in a month. If P is between 75 and 85, the derivative is worth nothing to you. If P is less than 75, the derivative results in a loss of 100(75-P) dollars to you. (The factor of 100 is because many derivatives involve 100 shares.) If P is greater than 85, the derivative results in a gain of 100(P-85) dollars to you. Assume that the distribution of the change in the stock price from now to a month from now is normally distributed with mean 1 and standard deviation 8. Let EMV be the expected gain/loss from this derivative. It is a weighted average of all the possible losses and gains, weighted by their likelihoods. (Of course, any loss should be expressed as a negative number. For example, a loss of 1500 should be expressed as -1500.) Unfortunately, this is a difficult probability calculation, but EMV can be estimated by an @RISK simulation. Perform this simulation with at least 1000 iterations. What is your best estimate of EMV?

- Seas Beginning sells clothing by mail order. An important question is when to strike a customer from the companys mailing list. At present, the company strikes a customer from its mailing list if a customer fails to order from six consecutive catalogs. The company wants to know whether striking a customer from its list after a customer fails to order from four consecutive catalogs results in a higher profit per customer. The following data are available: If a customer placed an order the last time she received a catalog, then there is a 20% chance she will order from the next catalog. If a customer last placed an order one catalog ago, there is a 16% chance she will order from the next catalog she receives. If a customer last placed an order two catalogs ago, there is a 12% chance she will order from the next catalog she receives. If a customer last placed an order three catalogs ago, there is an 8% chance she will order from the next catalog she receives. If a customer last placed an order four catalogs ago, there is a 4% chance she will order from the next catalog she receives. If a customer last placed an order five catalogs ago, there is a 2% chance she will order from the next catalog she receives. It costs 2 to send a catalog, and the average profit per order is 30. Assume a customer has just placed an order. To maximize expected profit per customer, would Seas Beginning make more money canceling such a customer after six nonorders or four nonorders?Assume the demand for a companys drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. If the company builds a plant that can produce x units of Wozac per year, it will cost 16x. Each unit of Wozac is sold for 3. Each unit of Wozac produced incurs a variable production cost of 0.20. It costs 0.40 per year to operate a unit of capacity. Determine how large a Wozac plant the company should build to maximize its expected profit over the next 10 years.Referring to the retirement example in Example 11.6, rerun the model for a planning horizon of 10 years; 15 years; 25 years. For each, which set of investment weights maximizes the VAR 5% (the 5th percentile) of final cash in todays dollars? Does it appear that a portfolio heavy in stocks is better for long horizons but not for shorter horizons?