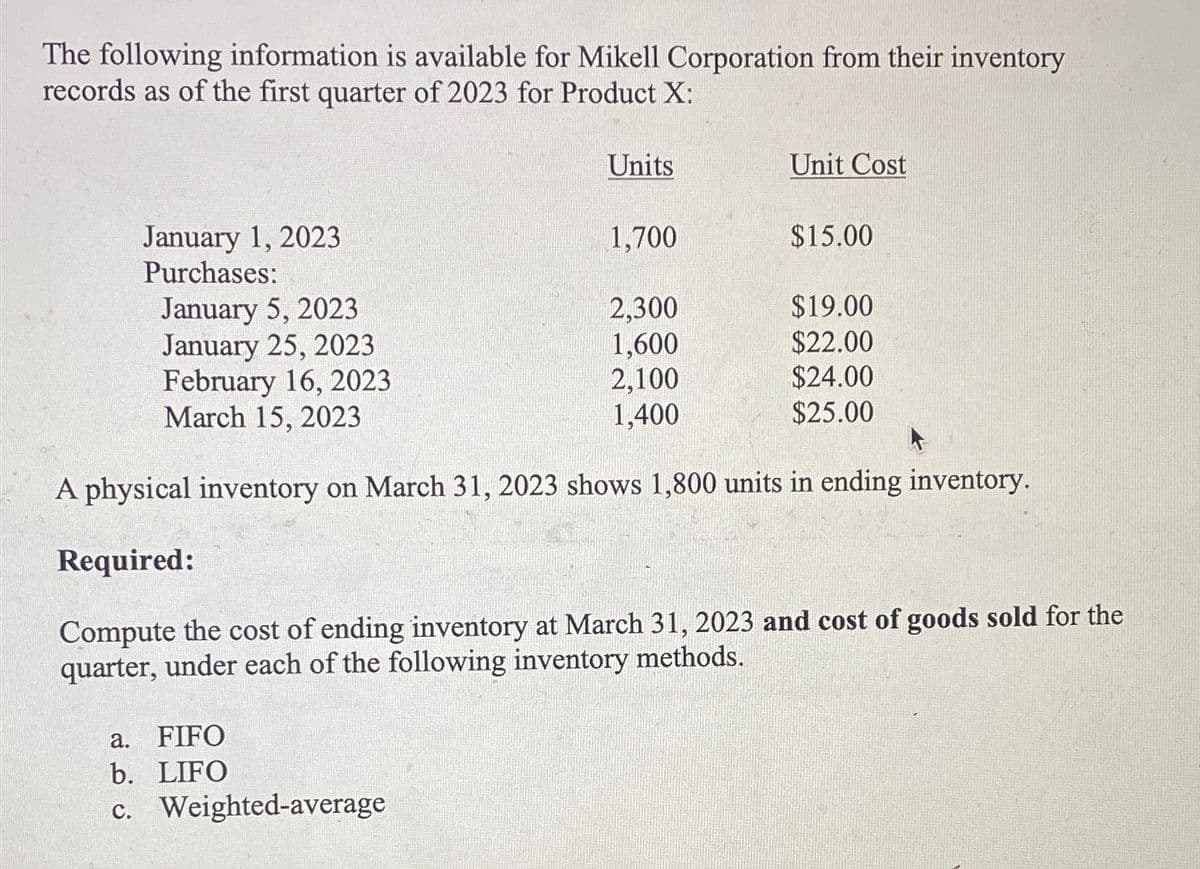

The following information is available for Mikell Corporation from their inventory records as of the first quarter of 2023 for Product X: January 1, 2023 Purchases: January 5, 2023 January 25, 2023 February 16, 2023 March 15, 2023 Units Unit Cost 1,700 $15.00 2,300 $19.00 1,600 $22.00 2,100 $24.00 1,400 $25.00 A physical inventory on March 31, 2023 shows 1,800 units in ending inventory. Required: Compute the cost of ending inventory at March 31, 2023 and cost of goods sold for the quarter, under each of the following inventory methods. a. FIFO b. LIFO c. Weighted-average

The following information is available for Mikell Corporation from their inventory records as of the first quarter of 2023 for Product X: January 1, 2023 Purchases: January 5, 2023 January 25, 2023 February 16, 2023 March 15, 2023 Units Unit Cost 1,700 $15.00 2,300 $19.00 1,600 $22.00 2,100 $24.00 1,400 $25.00 A physical inventory on March 31, 2023 shows 1,800 units in ending inventory. Required: Compute the cost of ending inventory at March 31, 2023 and cost of goods sold for the quarter, under each of the following inventory methods. a. FIFO b. LIFO c. Weighted-average

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 4MC

Related questions

Question

The following information is available for Mikell Corporation from their inventory records as of the first quarter of 2023 for Product X: \table[[,(,(

Transcribed Image Text:The following information is available for Mikell Corporation from their inventory

records as of the first quarter of 2023 for Product X:

January 1, 2023

Purchases:

January 5, 2023

January 25, 2023

February 16, 2023

March 15, 2023

Units

Unit Cost

1,700

$15.00

2,300

$19.00

1,600

$22.00

2,100

$24.00

1,400

$25.00

A physical inventory on March 31, 2023 shows 1,800 units in ending inventory.

Required:

Compute the cost of ending inventory at March 31, 2023 and cost of goods sold for the

quarter, under each of the following inventory methods.

a. FIFO

b. LIFO

c. Weighted-average

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 1 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning