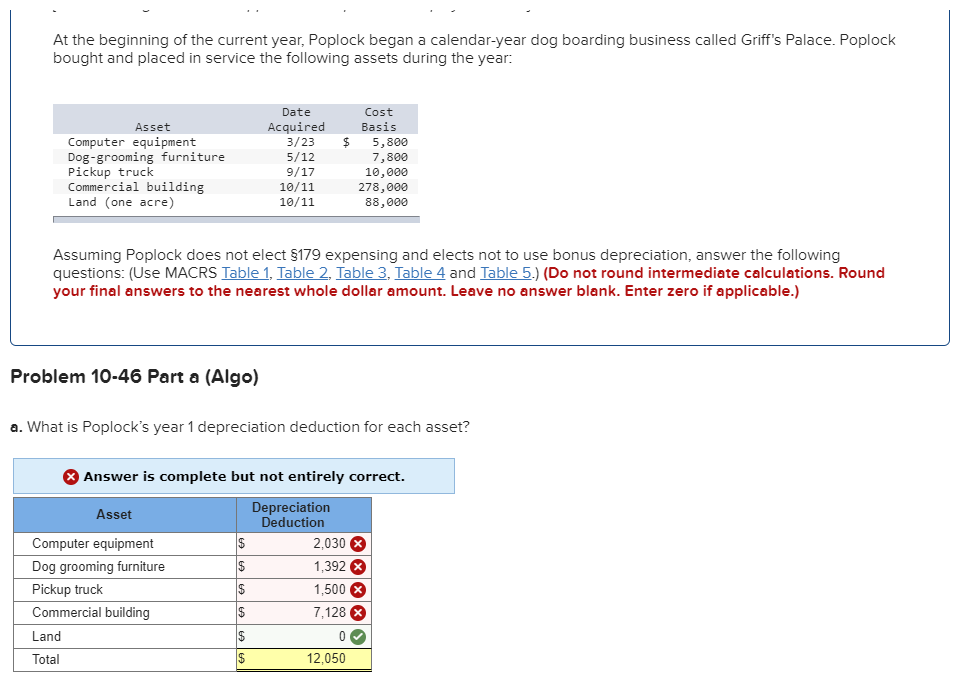

At the beginning of the current year, Poplock began a calendar-year dog boarding business called Griff's Palace. Poplock bought and placed in service the following assets during the year: Asset Date Acquired Cost Basis Computer equipment 3/23 $ 5,800 Dog-grooming furniture 5/12 7,800 Pickup truck 9/17 10,000 Commercial building Land (one acre) 10/11 10/11 278,000 88,000 Assuming Poplock does not elect §179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) Problem 10-46 Part a (Algo) a. What is Poplock's year 1 depreciation deduction for each asset? Answer is complete but not entirely correct. Depreciation Asset Deduction Computer equipment $ 2,030 Dog grooming furniture $ 1,392 Pickup truck $ 1,500 × Commercial building $ 7,128 × Land $ 0 Total $ 12,050

At the beginning of the current year, Poplock began a calendar-year dog boarding business called Griff's Palace. Poplock bought and placed in service the following assets during the year: Asset Date Acquired Cost Basis Computer equipment 3/23 $ 5,800 Dog-grooming furniture 5/12 7,800 Pickup truck 9/17 10,000 Commercial building Land (one acre) 10/11 10/11 278,000 88,000 Assuming Poplock does not elect §179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) Problem 10-46 Part a (Algo) a. What is Poplock's year 1 depreciation deduction for each asset? Answer is complete but not entirely correct. Depreciation Asset Deduction Computer equipment $ 2,030 Dog grooming furniture $ 1,392 Pickup truck $ 1,500 × Commercial building $ 7,128 × Land $ 0 Total $ 12,050

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:At the beginning of the current year, Poplock began a calendar-year dog boarding business called Griff's Palace. Poplock

bought and placed in service the following assets during the year:

Asset

Date

Acquired

Cost

Basis

Computer equipment

3/23

$

5,800

Dog-grooming furniture

5/12

7,800

Pickup truck

9/17

10,000

Commercial building

Land (one acre)

10/11

10/11

278,000

88,000

Assuming Poplock does not elect §179 expensing and elects not to use bonus depreciation, answer the following

questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round

your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.)

Problem 10-46 Part a (Algo)

a. What is Poplock's year 1 depreciation deduction for each asset?

Answer is complete but not entirely correct.

Asset

Depreciation

Deduction

Computer equipment

69

$

2,030 ×

Dog grooming furniture

$

1,392 ×

Pickup truck

$

1,500

Commercial building

$

7,128

Land

$

0

Total

$

12,050

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College