FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

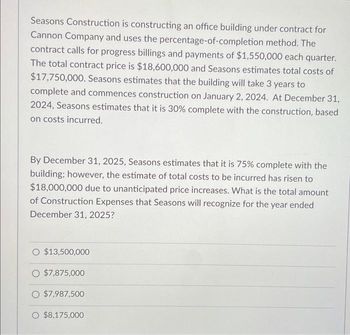

Transcribed Image Text:Seasons Construction is constructing an office building under contract for

Cannon Company and uses the percentage-of-completion method. The

contract calls for progress billings and payments of $1,550,000 each quarter.

The total contract price is $18,600,000 and Seasons estimates total costs of

$17,750,000. Seasons estimates that the building will take 3 years to

complete and commences construction on January 2, 2024. At December 31,

2024, Seasons estimates that it is 30% complete with the construction, based

on costs incurred.

By December 31, 2025, Seasons estimates that it is 75% complete with the

building; however, the estimate of total costs to be incurred has risen to

$18,000,000 due to unanticipated price increases. What is the total amount

of Construction Expenses that Seasons will recognize for the year ended

December 31, 2025?

$13,500,000

O $7,875,000

$7,987,500

O $8,175,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- YellowStone Construction is constructing an office building under contract for LimeStone Company and uses the percentage-of-completion method. The contract calls for progress billings and payments of $1300000 each quarter. The total contract price is $15600000 and YellowStone estimates total costs of $17500000. YellowStone estimates that the building will take 3 years to complete, and commences construction on January 2, 2021. At December 31, 2022, YellowStone Construction estimates that it is 75% complete with the building; however, the estimate of total costs to be incurred has risen to $17750000 due to unanticipated price increases.YellowStone Construction completes the remaining 25% of the building construction on December 31, 2023, as scheduled. At that time the total costs of construction are $18500000. What is the total amount of Revenue from Long-Term Contracts and Construction Expenses that YellowStone will recognize for the year ended December 31, 2023? Revenue Expenses…arrow_forwardCerise Ltd (Cerise) has a year end of 30 April 2021. The company begandeveloping a project on 1 May 2020, incurring total development costs up to the year end of £270,000 which were incurred evenly throughout the year. Cerise also incurred a one-off training expense for its employees to learn how to use the new product, costing £12,000 on 13 March 2021. This was incurred in addition to the £270,000 development costs.The relevant criteria for capitalisation according to IAS 38 Intangible Assetshave been met by project Magenta from 1 January 2021. How much would be eligible for capitalisation for this project for the year ended 30 April 2021?a) £270,000b) £78,000c) £90,000d) £102,000 Which option is correct and whyarrow_forwardThe Titanic Shipbuilding Company has a noncancelable contract to build a small cargo vessel. Construction involves a cash outlay of $270,000 at the end of each of the next two years. At the end of the third year, the company will receive payment of $620,000. The company can speed up construction by working an extra shift. In this case, there will be a cash outlay of $584,000 at the end of the first year followed by a cash payment of $620,000 at the end of the second year. Use the IRR rule to show the (approximate) range of opportunity costs of capital at which the company should work the extra shift. Note: Enter your answers as a percent rounded to 2 decimal places. Enter the smallest percent first. The company should work the extra shift if the cost of capital is between % and %.arrow_forward

- Jeff Heun, president of Wildhorse Always, agrees to construct a concrete cart path at Dakota Golf Club. Wildhorse Always enters into a contract with Dakota to construct the path for $233,000. In addition, as part of the contract, a performance bonus of $42,800 will be paid based on the timing of completion. The performance bonus will be paid fully if completed by the agreed-upon date. The performance bonus decreases by $10,700 per week for every week beyond the agreed-upon completion date. Jeff has been involved in a number of contracts that had performance bonuses as part of the agreement in the past. As a result, he is fairly confident that he will receive a good portion of the performance bonus. Jeff estimates, given the constraints of his schedule related to other jobs, that there is 55% probability that he will complete the project on time, a 30% probability that he will be 1 week late, and a 15% probability that he will be 2 weeks late. a.) Determine the transaction…arrow_forwardDuring 2023, Sunland Company started a construction job with a contract price of $1,792,000. The job was completed in 2025. The following information is available. The contract is non-cancellable. Costs incurred to date Estimated costs to complete Billings to date (non-refundable) Collections to date (a) 2023 2024 $448,000 $924,000 672,000 336,000 1,008,000 907,200 302.400 308,000 0000 2025 $1,198,400 0 1,792,000 1,596,000 Calculate the amount of gross profit to be recognized each year, assuming the percentage-of-completion method is used. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) nont ROOFarrow_forwardOn April 1st, Tesla entered into a contract of one-month duration to build a barn for Amazon. Tesla is guaranteed to receive a base fee of $5,300 for his services in addition to a bonus depending on when the project is completed. Amazon created incentives for Tesla to finish the barn as soon as he can without jeopardizing the structural integrity of the barn. Amazon offered to pay an additional 30% of the base fee if the project finished 2 weeks early and 10% if the project finished a week early. The probability of finishing 2 weeks early is 30% and the probability of finishing a week early is 60%. What is the expected transaction price with variable consideration estimated as the expected value? Multiple Choice O $5,300 O $7,095 O $5,035 $6,095 Garrow_forward

- XYZ Co. completed construction of a new silver mine in 2020. The cost of direct materials for the construction was $2,500,000 and direct labour was $2,300,000. In addition, the company allocated $280,000 of general overhead costs to the project. To finance the project, the company obtained a loan of $2,700,000 from its bank. The loan funds were drawn on February 24, 2020 and the mine was completed on November 24, 2020. The interest rate on the loan was 9% p.a. During construction, excess funds from the loan were invested and earned interest income of $24,000. The remainder of the funds needed for construction was drawn from internal cash reserves in the company. The company has also publicly made a commitment to clean up the site of the mine when the extraction operation is complete. It is estimated that the mining of this particular seam will be completed in 13 years, at which time restoration costs of $150,000 will be incurred. The appropriate discount rate for this type of…arrow_forwardOn January 02, 2021, ACME Incorporated constructed a sea-salt extraction platform and processing plant on the Caribbean Sea for $500,000 cash. The contract runs for 10 years at which time ACME must dismantle the site. The decommissioning and removal costs are estimated at $250,000 and management has publicly announced that it will commit an additional $50,000 to sea-life preservation and study at that time. The company has a December 31 year end and none of the restoration obligation applies to production. An appropriate discount rate for this transaction is 8%. Required: Show your work below each entry and round interim calculations to four decimal places and final answers to the nearest dollar. Assuming that ACME follows ASPE, 1. Prepare all entries related to the site restoration only for 2021 (ignore depletion entries). 2. On January 03, 2023, the restoration obligation was revised and increased by $54,027 (present value of the increase). Prepare the required entry assuming that…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education