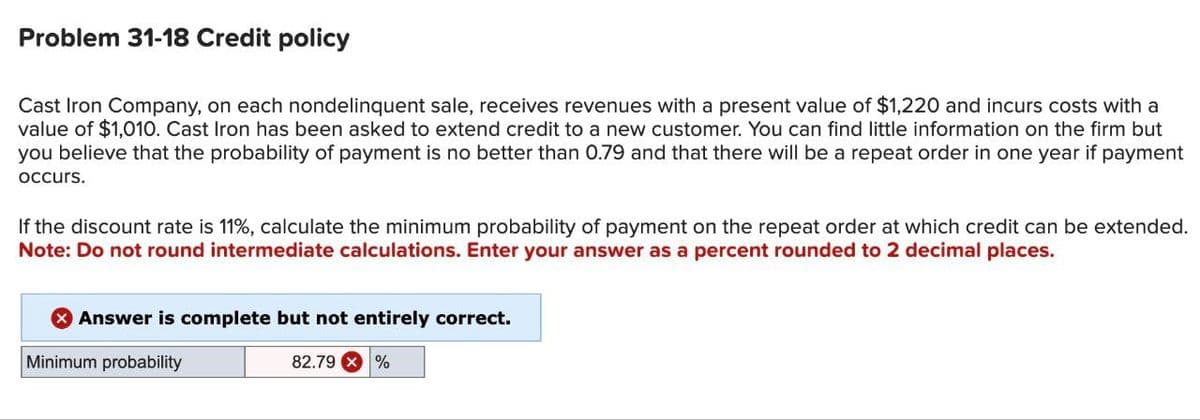

Problem 31-18 Credit policy Cast Iron Company, on each nondelinquent sale, receives revenues with a present value of $1,220 and incurs costs with a value of $1,010. Cast Iron has been asked to extend credit to a new customer. You can find little information on the firm but you believe that the probability of payment is no better than 0.79 and that there will be a repeat order in one year if payment occurs. If the discount rate is 11%, calculate the minimum probability of payment on the repeat order at which credit can be extended. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Answer is complete but not entirely correct. Minimum probability 82.79%

Problem 31-18 Credit policy Cast Iron Company, on each nondelinquent sale, receives revenues with a present value of $1,220 and incurs costs with a value of $1,010. Cast Iron has been asked to extend credit to a new customer. You can find little information on the firm but you believe that the probability of payment is no better than 0.79 and that there will be a repeat order in one year if payment occurs. If the discount rate is 11%, calculate the minimum probability of payment on the repeat order at which credit can be extended. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Answer is complete but not entirely correct. Minimum probability 82.79%

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter6: Using Credit

Section: Chapter Questions

Problem 7FPE

Related questions

Question

Transcribed Image Text:Problem 31-18 Credit policy

Cast Iron Company, on each nondelinquent sale, receives revenues with a present value of $1,220 and incurs costs with a

value of $1,010. Cast Iron has been asked to extend credit to a new customer. You can find little information on the firm but

you believe that the probability of payment is no better than 0.79 and that there will be a repeat order in one year if payment

occurs.

If the discount rate is 11%, calculate the minimum probability of payment on the repeat order at which credit can be extended.

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

Answer is complete but not entirely correct.

Minimum probability

82.79%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT