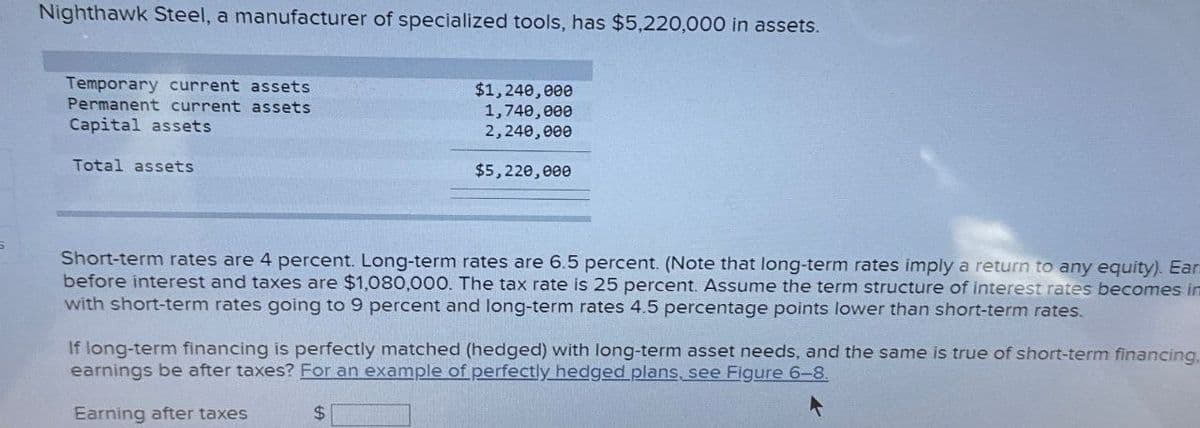

Nighthawk Steel, a manufacturer of specialized tools, has $5,220,000 in assets. Temporary current assets Permanent current assets Capital assets Total assets $1,240,000 1,740,000 2,240,000 $5,220,000

Q: Two years ago, you purchased 203 shares of IBM stock for $147 a share. Today, you sold your IBM…

A: Profit per share is the difference between the sale price per share and the purchase price per…

Q: What does the insurer agree to pay for in addition to covering losses in an insurance policy?…

A: Insurance is a contract between the insurer and insured. In this contract, the insurer agrees to…

Q: The market values and after-tax costs of various sources of capital used by Ridge Tool are shown in…

A: WACC or weighted average cost of capital is an important metric in finance. Essentially WACC is a…

Q: You and your spouse are in good health and have reasonably secure careers. Each of you makes about…

A: DINK refers to double income, no kids category of insured. In this time of insurance category, both…

Q: You are looking at a one-year loan of $13,500. The interest rate is quoted as 8.7 percent plus two…

A: Point on a loan:One point implies one percentage of the loan amount. As it is payable upfront, it…

Q: what is the aftertax salvage value of the asset? (MACRS schedule) (Do not round intermediate…

A: The after-tax salvage value is finding the amount you will receive for selling something after you…

Q: 52-WEEK VOLUME NET HI 75.43 LO 45.86 STOCK (DIV) RJW 175 YLD% PE 19 2.9 100s 10 CLOSE CHANGE ?? -.55…

A: Given Data: Stock Dividend 1.75Dividend Yield2.90%P/E Ratio19Net change-0.55

Q: [+] to determine the regular payment amount, rounded to the nearest dollar. Conside lowing pair of…

A: A loan to a borrower given by the bank/ financial institution which helpful to the borrower in…

Q: What is the current yield? (Hint: Refer to Footnote 6 for the definition of the current yield and to…

A: b.Current yield = 10.94%4. If the bond is called, the current yield will remain the same but the…

Q: Required information [The following information applies to the questions displayed below.] A pension…

A: The Sharpe ratio assesses an investment's risk-adjusted performance by comparing its return to its…

Q: Inputs Tagliaferro Incorporated 10 Year Bond Rigsby and Pelt Corporation 5 Yea Settlement Date…

A: Duration of bond shows the weighted period required to recover all cash flows from the bond and that…

Q: You estimate that a 1-year zero-coupon bond (face value = $1000) has a probability of default equal…

A: A zero ccoupon bond is a bond that does not pay any coupons. Rather there bonds are issued at…

Q: Mendez Company has identified an investment project with the following cash flows. Year…

A: The objective of the question is to calculate the present value of the cash flows for Mendez Company…

Q: 14-Suppose a bank enters a repurchase agreement in which it agrees to buy Treasury securities from a…

A: Buyback price = $25,000,000Purchase price = $24,995,000

Q: Find the present value of an annuity with monthly payments of $8,333.33, at an interest rate of 5.5%…

A: Present value of annuity cash flow = whereA = Periodical cash flow = monthly payment = $8,333.33i =…

Q: vvk.2

A: The objective of the question is to find the price of the bond given its par value, annual coupon…

Q: RAK Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company…

A: If the current price and par value of the bond are equal, then the bond is trading at par because…

Q: Metallica Bearings, Incorporated, is a young start-up company. No dividends will be paid on the…

A: Expected Dividend 10 years from today (D10) = $12Constant growth rate after 10 years (g) = 6% or…

Q: A GM and a Ford bond both have 4 years to maturity, a $1,000 par value, a BB rating and pay interest…

A: BOND:A bond is a long-term fixed-income financial instrument issued by the companies to raise…

Q: are u sure about that in the nominal rate calculations we ignored inflation? it must be real rate ?

A: Interest rate there are two rate one' is nominal rate inflation included and without inflation is…

Q: The financial statements of Eagle Sport Supply are shown in the table below. For simplicity, "Costs"…

A: Internal growth rate refers to the growth increase up to maximum level from the available resources…

Q: Bart Software has 8 percent coupon bonds on the market with 23 years to maturity. The bonds make…

A: Current yield of the bond can be referred to as the yield that can be found by dividing the annual…

Q: Abbreviated financial statements for Archimedes Levers are shown in the table below. Assume sales…

A: The maximum possible growth rate, also known as the sustainable growth rate, can be calculated using…

Q: Consider the following information: Rate of Return if State Occurs State of Economy Probability of…

A: Here, State of EconomyProbabilityReturn-Stock AReturn- Stock BReturn-Stock…

Q: Weston Corporation just paid a dividend of $2.5 a share (i.e., Do = $2.5). The dividend is expected…

A: The first three years show supernormal growth in dividends. This growth rate is higher than the cost…

Q: (Related to Checkpoint 5.6) (Solving for i) You are considering investing in a security that will…

A: An investment is a method through which individuals and corporations park their funds and a sum of…

Q: Using the following returns, calculate the arithmetic average returns, the variances, and the…

A: YearReturn XReturn Y19%23%227%44%316%-6%4-17%-20%518%52%

Q: POD has a project with the following cash flows: Year 0 1 Cash Flows -$ 281,000 145,500 163,000 2 3…

A: Profitability Index (PI) is a financial ratio that measures the attractiveness of a project.It is…

Q: Xenia has had access to credit since she was 17 because her parents made her an authorized user on…

A: A credit card score, or credit score as it is more widely called, is a number that indicates a…

Q: Founders of a firm put up 140 million at time 1 to be withdrawn completely at time 2 by selling the…

A: To calculate the market values of the firm at each period, we need to discount the future cash…

Q: and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of…

A: Mutual funds are financial institutions that invest money on behalf of investors in different asset…

Q: Vrooom is a car dealership that determined the present value of its free cash flow to common equity…

A: Terminal Value refers to the end value of the capital investment at the end of the tenure or useful…

Q: 15) All else held constant, the present value of a bond increases when the: A) yield to maturity…

A: The present value of a bond is the current worth of all future cash flows generated by the bond,…

Q: You need a $140,000 loan. Option 1: a 30-year loan at an APR of 7.5%. Option 2: a 15-year loan at an…

A: APR(Annual percentage rate) refers to annual cost paid by the borrower for the loan taken which…

Q: Required information [The following information applies to the questions displayed below.] A pension…

A: Expected return of Stock fund (S)17%Expected return of bond fund (B)11%Risk-free rate…

Q: Bayou Okra Farms just paid a dividend of $3.60 on its stock. The growth rate individends is expected…

A: The objective of the question is to calculate the current share price of Bayou Okra Farms given the…

Q: Mary's portfolio consists of two stocks. She invested $5,000 in BCD stock and $5,000 in EFG stock.…

A:

Q: What is the payback period for the following set of cash flows? (Do not round intermediate…

A: Payback Period is the duration of time in which the initial investment is fully recovered by the…

Q: suppose you held à diversified portfolio consisting of a $7,500 investment in each of 20 different…

A: Beta quantifies a security's price volatility relative to the broader market, with a beta of 1…

Q: Consider a three-year project with the following information: Initial fixed asset Investment =…

A: The sensitivity of Operating Cash Flow (OCF) refers to the degree to which OCF changes in response…

Q: A Treasury bond that settles on August 10, 2022, matures on November 5, 2029. The coupon rate is 6.8…

A: Settlement date: 10-08-2022Maturity rate: 05-11-2029Coupon rate: 6.8%Price:

Q: Long lines of patients wait for CAT scanning service in a hospital. Patients arrive for scans at a…

A: The corrected answers are:1. Probability that the system is empty: 0.5382. Probability that a…

Q: ted. First cost, $ Equipment replaceme year 2, $ Annual operating cos Salvage value, $ Life, years…

A: Equivalent annual cost is that cost which includes the all cost including the cost of operating and…

Q: ABC's preferred stock has a par value of $100, a dividends rate of 5%, and a market price of $155;…

A: The preferred stock has a fixed dividend rate.It is payable as a % of par value.So the amount of…

Q: The NASDAQ stock market bubble peaked at 4,865 in 2000. Two and a half years later it had fallen to…

A: The Nasdaq is an electronic stock exchange based in New York City. It's the second-largest stock…

Q: ased on Exhibit 9-9, or using a financial calculator, what would be the monthly mortgage payments…

A: Amortization refers to the process of gradually paying off a debt, typically a loan, through regular…

Q: Please help solve this and please show all the steps to solve this step by step in Excel. Two years…

A: The mortgage is the debt obligation that the borrower owes to the lender, it is a structure in which…

Q: To help them estimate the company's cost of capital, Smithco has hired you as a consultant. You have…

A: Expected Dividend = d1 = $1.45Current Price of Stock = p0 = $25Growth Rate = g = 6.50%Flotation Cost…

Q: 6. Assume an elderly couple owns a $140,000 home that is free and clear of mortgage debt. A reverse…

A: a. The monthly payment on this Reverse Annuity Mortgage (RAM) is $1,152.16. b. The following is the…

Q: Rare Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The…

A: Let's break down each step of the analysis: 1. **Compute the appropriate rate for discounting the…

Step by step

Solved in 3 steps with 1 images

- The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?Talbot Enterprises recently reported an EBITDA of $8 million and net income of $2.4 million. It had $2.0 million of interest expense, and its corporate tax rate was 40%. What was its charge for depreciation and amortization?Chasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital expenditures of $112,900, cash dividends of $35,800, and average maturities of long-term debt over the next 5 years of $122,300. What is Chasses free cash flow and cash flow adequacy ratio? a. $94,300 and 0.77, respectively c. $130,100 and 1.06, respectively b. $94,300 and 0.82, respectively d. $165,900 and 1.36, respectively

- Long-Term Financing Needed At year-end 2018, Wallace Landscapings total assets were 2.17 million, and its accounts payable were 560,000. Sales, which in 2018 were 3.5 million, are expected to increase by 35% in 2019. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Wallace typically uses no current liabilities other than accounts payable. Common stock amounted to 625,000 in 2018, and retained earnings were 395,000. Wallace has arranged to sell 195,000 of new common stock in 2019 to meet some of its financing needs. The remainder of its financing needs will be met by issuing new long-term debt at the end of 2019. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales is 5%, and 45% of earnings will be paid out as dividends. a. What were Wallaces total long-term debt and total liabilities in 2018? b. How much new long-term debt financing will be needed in 2019? [Hint: AFN New stock = New long-term debt.)Payne Products had $1.6 million in sales revenues in the most recent year and expects sales growth to be 25% this year. Payne would like to determine the effect of various current assets policies on its financial performance. Payne has $1 million of fixed assets and intends to keep its debt ratio at its historical level of 60%. Payne’s debt interest rate is currently 8%. You are to evaluate three different current asset policies: (1) a restricted policy in which current assets are 45% of projected sales, (2) a moderate policy with 50% of sales tied up in current assets, and (3) a relaxed policy requiring current assets of 60% of sales. Earnings before interest and taxes are expected to be 12% of sales. Payne’s tax rate is 40%. What is the expected return on equity under each current asset level? In this problem, we have assumed that the level of expected sales is independent of current asset policy. Is this a valid assumption? Why or why not? How would the overall risk of the firm vary under each policy?Income, Cash Flow, and Future Losses On January L 2017, Cermack National Bank loaned 55,000,000 under a 2-year, zero coupon note to a real estate developer. The bank recognized interest revenue on this note of approximately $400,000 per year. Due to an economic downturn, the developer was unable to pay the $5,800,000 maturity amount on December 31, 2018. The bank convinced the developer to pay $800,000 on December 31, 2018, and agreed to extend $5,000,000 credit to the developer despite the gloomy economic outlook for the next several years. Thus, on December 31, 2018, the bank issued a new 2-year, zero coupon note to the developer to mature on December 31, 2020, for $6,000,000. The bank recognized interest revenue on this note of approximately $500,000 per year. The banks external auditor insisted that the riskiness of the new loan be recognized by increasing the allowance for uncollectible notes by $1,500,000 on December 31, 2018, and $2,000,000 on December 31, 2019. On December 31, 20201 the bank received $1,200,000 from the developer and learned that the developer was in bankruptcy and that no additional amounts would be recovered. Required: Prepare a schedule showing the effect of the notes on net income in each of the 4 years.

- Income, Cash Flow, and Future Losses On January L 2017, Cermack National Bank loaned 55,000,000 under a 2-year, zero coupon note to a real estate developer. The bank recognized interest revenue on this note of approximately $400,000 per year. Due to an economic downturn, the developer was unable to pay the $5,800,000 maturity amount on December 31, 2018. The bank convinced the developer to pay $800,000 on December 31, 2018, and agreed to extend $5,000,000 credit to the developer despite the gloomy economic outlook for the next several years. Thus, on December 31, 2018, the bank issued a new 2-year, zero coupon note to the developer to mature on December 31, 2020, for $6,000,000. The bank recognized interest revenue on this note of approximately $500,000 per year. The banks external auditor insisted that the riskiness of the new loan be recognized by increasing the allowance for uncollectible notes by $1,500,000 on December 31, 2018, and $2,000,000 on December 31, 2019. On December 31, 20201 the bank received $1,200,000 from the developer and learned that the developer was in bankruptcy and that no additional amounts would be recovered. Required: 1. Prepare a schedule showing annual cash flows fur the two notes in each of the 4 years.Income, Cash Flow, and Future Losses On January L 2017, Cermack National Bank loaned 55,000,000 under a 2-year, zero coupon note to a real estate developer. The bank recognized interest revenue on this note of approximately $400,000 per year. Due to an economic downturn, the developer was unable to pay the $5,800,000 maturity amount on December 31, 2018. The bank convinced the developer to pay $800,000 on December 31, 2018, and agreed to extend $5,000,000 credit to the developer despite the gloomy economic outlook for the next several years. Thus, on December 31, 2018, the bank issued a new 2-year, zero coupon note to the developer to mature on December 31, 2020, for $6,000,000. The bank recognized interest revenue on this note of approximately $500,000 per year. The banks external auditor insisted that the riskiness of the new loan be recognized by increasing the allowance for uncollectible notes by $1,500,000 on December 31, 2018, and $2,000,000 on December 31, 2019. On December 31, 20201 the bank received $1,200,000 from the developer and learned that the developer was in bankruptcy and that no additional amounts would be recovered. Required: Which figure, net income or net cash flow, does the better job of telling the banks stock-holders about the effect of these notes on the bank? Explain by reference to the schedules prepared in Requirements 1 and 2.Macon Mills is a division of Bolin Products. Inc. During the most recent year, Macon had a net income of $40 million. Included in the income was interest expense of $2,800,000. The companys tax rate was 40%. Total assets were $470 million, current liabilities were $104,000,000, and $72,000,000 of the current liabilities are noninterest bearing. What are the invested capital and ROI for Macon?

- Colter Steel has $4,550,000 in assets. Temporary current assets $ 1,100,000 Permanent current assets 1,505,000 Fixed assets 1,945,000 Total assets $ 4,550,000 Assume the term structure of interest rates becomes inverted, with short-term rates going to 13 percent and long-term rates 2 percentage points lower than short-term rates. Earnings before interest and taxes are $970,000. The tax rate is 20 percent. If long-term financing is perfectly matched (synchronized) with long-term asset needs, and the same is true of short-term financing, what will earnings after taxes be?GQ recently reported (in millions) $8,250 of sales, $5,750 of operating costs other than depreciation, and $850 of depreciation. The company had $3,200 of outstanding bonds that carry a 5% interest rate, and its federal-plus-state income tax rate was 25%. In order to sustain its operations and thus generate future sales and cash flows, the firm was required to make $1,250 of capital expenditures on new fixed assets and to invest $300 in net operating working capital. By how much did the firm's net income exceed its free cash flow? Do not round the intermediate calculations.Brown Office Supplies recently reported $15,500 of sales, $8,250 of operating costs other than depreciation, and $1,750 of depreciation. It had $9,000 of bonds outstanding that carry a 7.0% interest rate, and its federal-plus-state income tax rate was 25%. How much was the firm's earnings before taxes (EBT)?