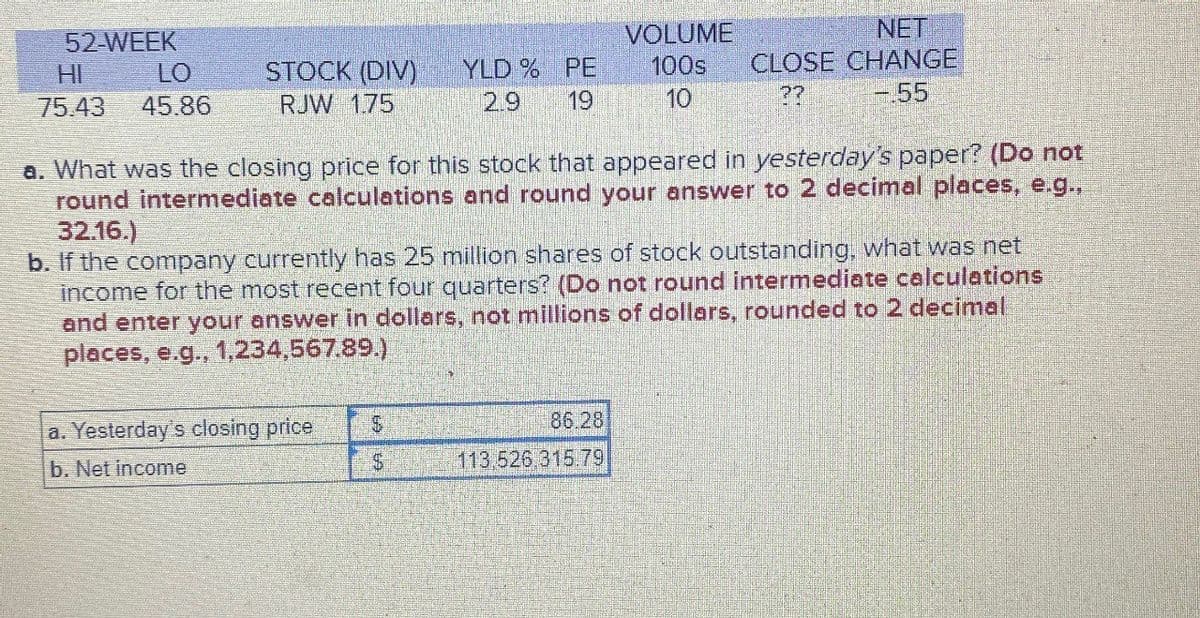

52-WEEK VOLUME NET HI 75.43 LO 45.86 STOCK (DIV) RJW 175 YLD% PE 19 2.9 100s 10 CLOSE CHANGE ?? -.55 a. What was the closing price for this stock that appeared in yesterday's paper? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the company currently has 25 million shares of stock outstanding, what was net income for the most recent four quarters? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) a. Yesterday's closing price $ 86.28 b. Net income $ 113.526.315.79

52-WEEK VOLUME NET HI 75.43 LO 45.86 STOCK (DIV) RJW 175 YLD% PE 19 2.9 100s 10 CLOSE CHANGE ?? -.55 a. What was the closing price for this stock that appeared in yesterday's paper? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the company currently has 25 million shares of stock outstanding, what was net income for the most recent four quarters? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) a. Yesterday's closing price $ 86.28 b. Net income $ 113.526.315.79

Chapter11: The Cost Of Capital

Section: Chapter Questions

Problem 11PROB

Related questions

Question

Transcribed Image Text:52-WEEK

VOLUME

NET

HI

75.43

LO

45.86

STOCK (DIV)

RJW 175

YLD% PE

19

2.9

100s

10

CLOSE CHANGE

??

-.55

a. What was the closing price for this stock that appeared in yesterday's paper? (Do not

round intermediate calculations and round your answer to 2 decimal places, e.g.,

32.16.)

b. If the company currently has 25 million shares of stock outstanding, what was net

income for the most recent four quarters? (Do not round intermediate calculations

and enter your answer in dollars, not millions of dollars, rounded to 2 decimal

places, e.g., 1,234,567.89.)

a. Yesterday's closing price

$

86.28

b. Net income

$

113.526.315.79

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning