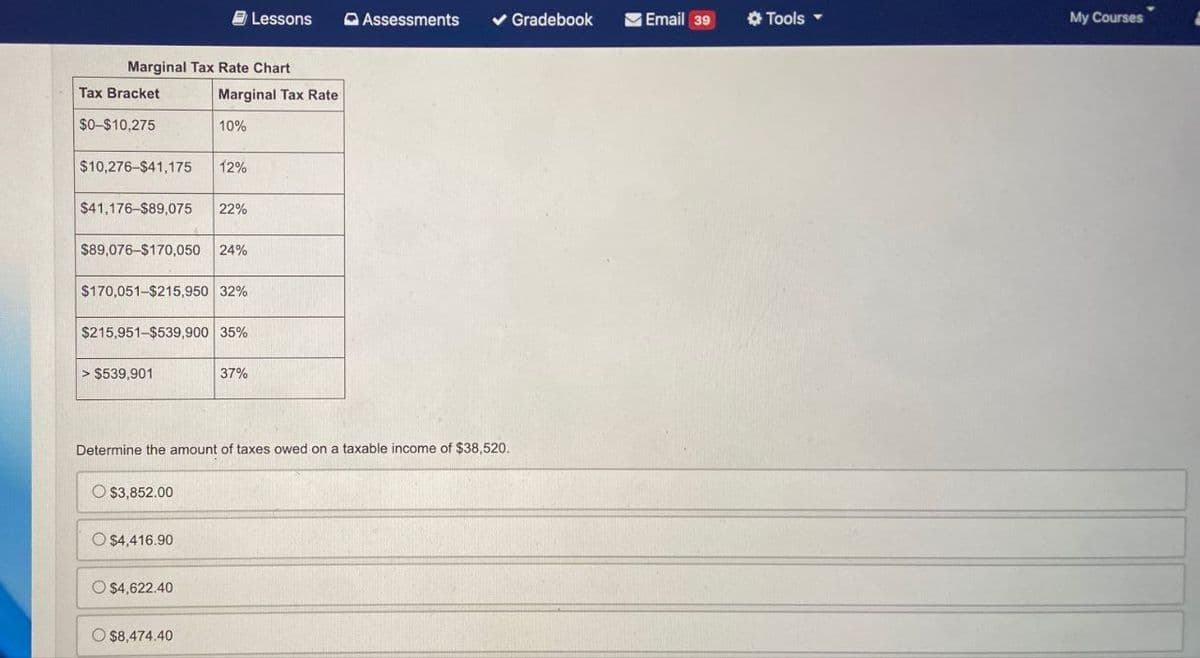

Marginal Tax Rate Chart Marginal Tax Rate Tax Bracket $0-$10,275 10% $10,276-$41,175 12% $41,176-$89,075 22% $89,076-$170,050 24% $170,051-$215,950 32% $215,951-$539,900 35% > $539,901 37% Determine the amount of taxes owed on a taxable income of $38,520. O $3,852.00 $4,416.90 $4,622.40 $8,474.40

Q: A 3.70 percent coupon municipal bond has 15 years left to maturity and has a price quote of 95.65.…

A: Given Data: Par value5000Coupon Rate3.70%Frequency2

Q: You need a $140,000 loan. Option 1: a 30-year loan at an APR of 7.5%. Option 2: a 15-year loan at an…

A: APR(Annual percentage rate) refers to annual cost paid by the borrower for the loan taken which…

Q: Maddox, a division of Stanley Enterprises, currently performs computer services for various…

A: Irrelevant costs are expenses that do not have any impact on the decision-making process. They do…

Q: Suppose your firm is considering investing in a project with the cash flows shown below, that the…

A: Internal Rate of Return (IRR) is the discount rate at which the present value of cash inflows is…

Q: A stock priced at $50 has two possible outcomes, either increases to $60 or decreases to $42. If the…

A: The objective of the question is to calculate the Hedge Ratio (also known as the Delta) of a call…

Q: Required information Skip to question [The following information applies to the questions displayed…

A: Expected returnStandard deviationBond fund9%Bond fund27%Stock fund15%Stock fund36%Risk free…

Q: vvk.3 A bond has a $1,000 par value bond with a 4% annual coupon rate and it matures in 8 years.…

A: The objective of the question is to find the price of the bond given its par value, annual coupon…

Q: Rare Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The…

A: Capita budgeting is the process where investors evaluate long-term investment proposals. In this…

Q: Use the Pl decision rule to decide if the project should be accepted or rejected? -38.88 percent,…

A: PI is the profitability index. It is used in capital budgeting to make project accept/reject…

Q: What does the insurer agree to pay for in addition to covering losses in an insurance policy?…

A: Insurance is a contract between the insurer and insured. In this contract, the insurer agrees to…

Q: The practical benefit of ownership in the firm for shareholders is that... The practical benefit of…

A: In this question, we are required to determine the practical benefit of ownership in the firm for…

Q: Both Bond Bill and Bond Ted have 11 percent coupons, make semiannual payments, and are priced at par…

A: The relationship between bond price and yield is inverse. As the yield on a bond increases, the…

Q: Diversification will reduce risk is securities returns are negatively correlated. TRUE FALSE

A: Diversification can reduce risk if securities have negative correlations because when one security's…

Q: You find the following Treasury bond quotes. To calculate the number of years until maturity, assume…

A: A bond is a fixed-income capital market security that offers the lenders a fixed set of periodic…

Q: You own an oil pipeline that will generate a $2million cash return over the coming year.…

A: The objective of this question is to calculate the present value of the cash flows from an oil…

Q: For firms that have debt on their balance sheets, interest expense is commonly seen as an expense on…

A: The objective of the question is to understand why interest expense, which is commonly seen as an…

Q: Revenues = $15,369. Cost of Goods Sold $5,114. Depreciation Expense = $2,496, Interest = $537 and…

A: Operating cash flow (OCF) is a financial metric that represents the amount of cash a company…

Q: Problem 22-12 Delta What are the deltas of a call option and a put option with the following…

A: Stock price = $50Exercise price = $50Risk-free rate = 4.4%Maturity = 9 monthsStandard deviation =…

Q: Coupon payments are fixed, but the percentage return that investors receive varies based on market…

A: Yield to maturity (YTM) is the overall rate of return that a bond will have earned once all interest…

Q: Astromet is financed entirely by common stock and has a beta of 1.50. The firm pays no taxes. The…

A: ParticularsValuesBeta of stock1.5PE multiple14expected return10.60%Refinancing (50 % shares…

Q: You run a construction firm. You have just won a contract to build a government office complex.…

A: The value of NPV is given in million The NPV of the opportunity cost is $3.63 million

Q: To what amount will the following investment accumulate? $9,328, invested today for 31 years at 3…

A: To calculate the accumulated amount we will use the below formulaAccumulated amount = P*(1+r)nWhereP…

Q: e.com/courses/31939/quizzes/265081 The same scenario will be used for questions 1-10. Keith Shoe…

A: none of the aboveExplanation:Output:Total Cost calculation when unit price is $32.00:1. Purchase…

Q: Use Excel for this question: A company announced that it will pay a $2.00 dividend, a $2.50…

A: A corporation's payout of profits to its shareholders is known as a dividend. A company that…

Q: Gary wants to save $555,000 in 5 years, he currently has $225,000 in an investment. Due to financial…

A: To find out the interest rate Gary needs to earn to achieve his goal, we can use the formula for…

Q: 24. 8-24 A souvenir retailer has an opportunity to establish a new location inside a large airport.…

A: The objective of the question is to determine the best decision for the souvenir retailer based on…

Q: If the interest rate is 5%, then the capitalized value of an investment that would be $ pays $8 per…

A: The capitalized value of an investment is the present value of the stream of income that the…

Q: Problem 9-11 Calculating Project Cash Flow from Assets [LO 2] Esfandairi Enterprises is considering…

A: NPV net present value refers to the capital budgeting technique helps to evaluate the feasibility…

Q: What is the payback period for the following set of cash flows? (Do not round intermediate…

A: Payback Period is the duration of time in which the initial investment is fully recovered by the…

Q: Langford ��. issued 14 -year bonds a year ago at a coupon fate of 7.2%. The bonds make semiannual…

A: The objective of this question is to calculate the current price of a bond issued by Langford Co.…

Q: At the end of each of the next 8 years, you planto put $25,000 of your annual salary in thebank. If…

A: The objective of this question is to calculate the present value of the planned savings stream and…

Q: Intro IBM is planning to produce an expert system based on artificial intelligence and expects the…

A: Profitability index1.106Explanation:Step 1:We have to calculate the profitability index of the…

Q: Jessie owns one share of stock of Lucky Hare and one share of stock of Glacial Tortoise. The total…

A: Total Combined Value of both shares = $595.77Lucky Hare StockExpected return (rL) = 10.60% or…

Q: An investment advisor offers you a product that will deliver cash-flows at the end of each of the…

A: Present Value (PV) is today`s value of money you expect from future cash flows.

Q: Unlevering the Equity Cost of Capital-Low Leverage & High Leverage Companies: Below, we show the…

A: Imagine two companies with similar operations but different capital structures. One might be heavily…

Q: Your company would like to determine the growth rate in sales that will allo expand as much as…

A: For maintaining growth in sales company need to invest in assets and liabilities and keep growing…

Q: a. Complete the below tables to calculate NPV. b. Should it operate the new business directly or…

A: The net present value is a useful tool for determining the value of an investment. It looks at the…

Q: Required information [The following information applies to the questions displayed below] A pension…

A: Standard deviation quantifies risk, while expected return represents the average return. Both…

Q: What is the current yield? (Hint: Refer to Footnote 6 for the definition of the current yield and to…

A: b.Current yield = 10.94%4. If the bond is called, the current yield will remain the same but the…

Q: Chris Lavigne invested a total of $10,200 in the AIC Diversified Canada Mutual Fund. The management…

A: Management fees is the fees charged by mutual fund manager for managing the portfolio of securities…

Q: QUESTION 2 The following table contains data on the returns of stock A and stock B from 2021 to…

A: YearsStock AStock B202161320228102023101420241211

Q: A process control manager is considering two robots to improve materials-handling capacity in the…

A: Incremental rate of return refers to the return that is earned on the higher of the cash flow of…

Q: Blooper Industries must replace its magnoosium purification system. Quick & Dirty Systems sells a…

A: Equivalent Annual Cost (EAC) is widely used by businesses to assess the economic feasibility of…

Q: 1. (10 Percent) Ryan Enterprises forecasts the free cash flows (in millions) shown below. Assume the…

A: The objective of the question is to calculate the total corporate value of Ryan Enterprises given…

Q: The financial statements of Eagle Sport Supply are shown in the table below. For simplicity, "Costs"…

A: Internal growth rate refers to the growth increase up to maximum level from the available resources…

Q: (oll option information and correct and incorrect option explain) Which of the following statements…

A: the correct statements are 2, 3, and 4. Statement 1 is incorrect.Explanation: 1. Owners of…

Q: Rare Agri-Products Ltd. is considering a new project with a projectedlife of seven (7) years. The…

A: To solve this problem, we need to calculate various financial metrics for the project. Let's break…

Q: Required information [The following information applies to the questions displayed below.] A pension…

A: The Sharpe ratio assesses an investment's risk-adjusted performance by comparing its return to its…

Q: 4a. Coupon bond price = (Par x PVIF) + (Coupon x PVIFA) 4b. What is the price of a coupon bond that…

A: Here,Par Value of Bond is $1,000Time to Maturity is 5 yearsCoupon Rate is 7%YTM is 6 %

Q: Quad Enterprises is considering a new 4-year expansion project that requires an initial fixed asset…

A: Operating Cash Flow is the cash flow earned in the normal course of business, without taking into…

Step by step

Solved in 3 steps

- 1-What will be the net income? a. 72000 b. 56000 c. 16000 d. 338000 Clear my choice Question 43 Not yet answered Marked out of 1.00 Flag question Question text What will be the Gross Profit at the end of the year December 2019 a. OMR 56000 b. OMR 16000 c. OMR 338,000 d. OMR 336,000 2-What is the Gross Margin in terms of Percentage? a. 16.66 b. 16.56 c. Cannot be determined d. 20.66 3-What will be the total operating expense? a. 21500 b. 53200 c. 41200 d. 19700 4-What will be the total Selling and distribution expense? a. 41200 b. 19700 c. 14800 d. 1720010. Nu Company reported the following pretax data for its first year of operations. Net sales 2,800 Cost of goods available for sale 2,500 Operating expenses 880 Effective tax rate 25 % Ending inventories: If LIFO is elected 820 If FIFO is elected 1,060 What is Nu's net income if it elects FIFO? a. 480 b. 360 c. 1360 d. 180For income tax purposes, what is the amount of gross income given the following amounts? Gross sales 4,000,000.00 Sales discounts, returns and allowances 100,000.00 Cost of sales 1,500,000.00 Itemized deductions 800,000.00 Group of answer choices P3,900,000.00 P1,600,000.00 P2,400,000.00 P1,700,000.00

- Description FY10 FY11 FY12 FY13 FY14 Financial Statements GBP m GBP m GBP m GBP m GBP m Income Statements Revenue 4,390 3,624 3,717 8,167 11,366 Profit before interest & taxes (EBIT) 844 700 704 933 1,579 Net Interest Payable (80) (54) (98) (163) (188) Taxation (186) (195) (208) (349) (579) Miniorities (94) (99) (105) (125) (167) Profit for the year 484 352 293 296 645 Balance Sheet Fixed Assets 3,510 3,667 4,758 10,431 11,483…Net Sales 36000 Commission received 6430 Interest received 3570 Cost of goods sold 7400 Dividends received 2220 From the above information the total income will be: a.OMR 41280 b.OMR 42820 c.OMR 48220 d.OMR 40820 Fast plz***********Calculate a base-weighted and current- weighted index. Years 1 is base and year 2 is current. Number of units bought Price paid per unit ($) Item 7. Year 1Year 2Year 1Year 2 A 121 141 $9 $10 B 149 163 $21 $23 C 173 182 $26 $27 D 194 103 $31 $33

- APPLE Mark-up 25 Percent Sales N$ 50 000 Inventory 01.03.2019 N$ 13 800 Inventory 29.02.2020 N$ 7 450 Total Expenses N$ 9 500 Calculate: Gross Profit, Purchases, Cost of Sale and Net Profit?tudent question Time to preview question: 00:09:07 Company is subject to an income tax rate of 30%. It has the provided the following data on December 31, 2021: Income Statement Items for 2021: Net sales P3,600,000Cost of goods sold 1,100,000Operating expenses including depreciation 840,000Depreciation expense 60,000Interest expense 100,000Income tax expense ? Other information for 2021: Payment of bank loan 300,000 Dividends paid to stockholders P250,000 Balance Sheet Items December 31, 2021 December 31, 2020Cash and cash equivalents 2,000,000 P1,750,000Accounts receivable 670,000 410,000Inventory 430,000 220,000Supplies 18,000 12,000Accounts payable 520,000 380,000Accrued liabilities 72,000 53,000Property and equipment, net 1,700,000 2,100,000Loans payable 1,000,000 1,500,000Share capital 1,000,000 1,000,000Retained earnings ? ? Based on the above, answer the following questions for 2021: (Round answers to whole numbers for monetary amounts while for percentages,…INCOME STATEMENT Year ended June 30 2022 2021 $'000 $'000Revenue 22450 18675Cost of sales 8475 8055Gross Profit 13975 10620Distribution costs 4245 3120Administrative expenses 1276 2134Selling expenses…

- Fixed vs variable ratio- 70:30Ctc - 18LBasic- 50%Hra- 20%Da - 12%Travel allowance- 2000Insurance - 2500Incentive- 75% target completionPf 12%Earned leaves - 2LOP - 4Year 1 Year 2 YR 1 YR2Sales (S) $ 614,405.00 $ 600,343.00 Cost of Good Sold (COGS) $ 385,101.00 $ 473,396.00 Gross Profit (GP) $ 229,304.00 $ 226,947.00 Calculate the following: (round to nearest percent) Answer Answer(a) Mark-up percent for year 1 (b) Mark-up percent for year 2 (c) Gross Profit for year 1 (d) Gross Profit for year 2Problem 13-2A (Static) Ratios, common-size statements, and trend percents LO P1, P2, P3 Skip to question [The following information applies to the questions displayed below.]Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 2019 Sales $ 555,000 $ 340,000 $ 278,000 Cost of goods sold 283,500 212,500 153,900 Gross profit 271,500 127,500 124,100 Selling expenses 102,900 46,920 50,800 Administrative expenses 50,668 29,920 22,800 Total expenses 153,568 76,840 73,600 Income before taxes 117,932 50,660 50,500 Income tax expense 40,800 10,370 15,670 Net income $ 77,132 $ 40,290 $ 34,830 KORBIN COMPANY Comparative Balance Sheets December 31 2021 2020 2019 Assets Current assets $ 52,390 $ 37,924 $ 51,748 Long-term investments 0 500 3,950 Plant assets, net 100,000 96,000 60,000 Total assets $ 152,390 $ 134,424 $ 115,698 Liabilities…