Coupon payments are fixed, but the percentage return that investors receive varies based on market conditions. This percentage return is referred to as the bond's yield. Yield to maturity (YTM) is the rate of return expected from a bond held until its maturity date. However, the YTM equals the expected rate of return under certain assumptions. Which of the following is one of those assumptions? The bond will not be called. The bond has an early redemption feature. Consider the case of Blanche Inc.: Blanche Inc. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $1,130.35. However, Blanche Inc. may call the bonds in eight years at a call price of $1,060. What are the YTM and the yield to call (YTC) on Blanche Inc.'s bonds? Value

Coupon payments are fixed, but the percentage return that investors receive varies based on market conditions. This percentage return is referred to as the bond's yield. Yield to maturity (YTM) is the rate of return expected from a bond held until its maturity date. However, the YTM equals the expected rate of return under certain assumptions. Which of the following is one of those assumptions? The bond will not be called. The bond has an early redemption feature. Consider the case of Blanche Inc.: Blanche Inc. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $1,130.35. However, Blanche Inc. may call the bonds in eight years at a call price of $1,060. What are the YTM and the yield to call (YTC) on Blanche Inc.'s bonds? Value

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 9Q: In Chapter 7, we saw that if the market interest rate, rd, for a given bond increased, the price of...

Related questions

Question

Transcribed Image Text:5. Бопа уyielas

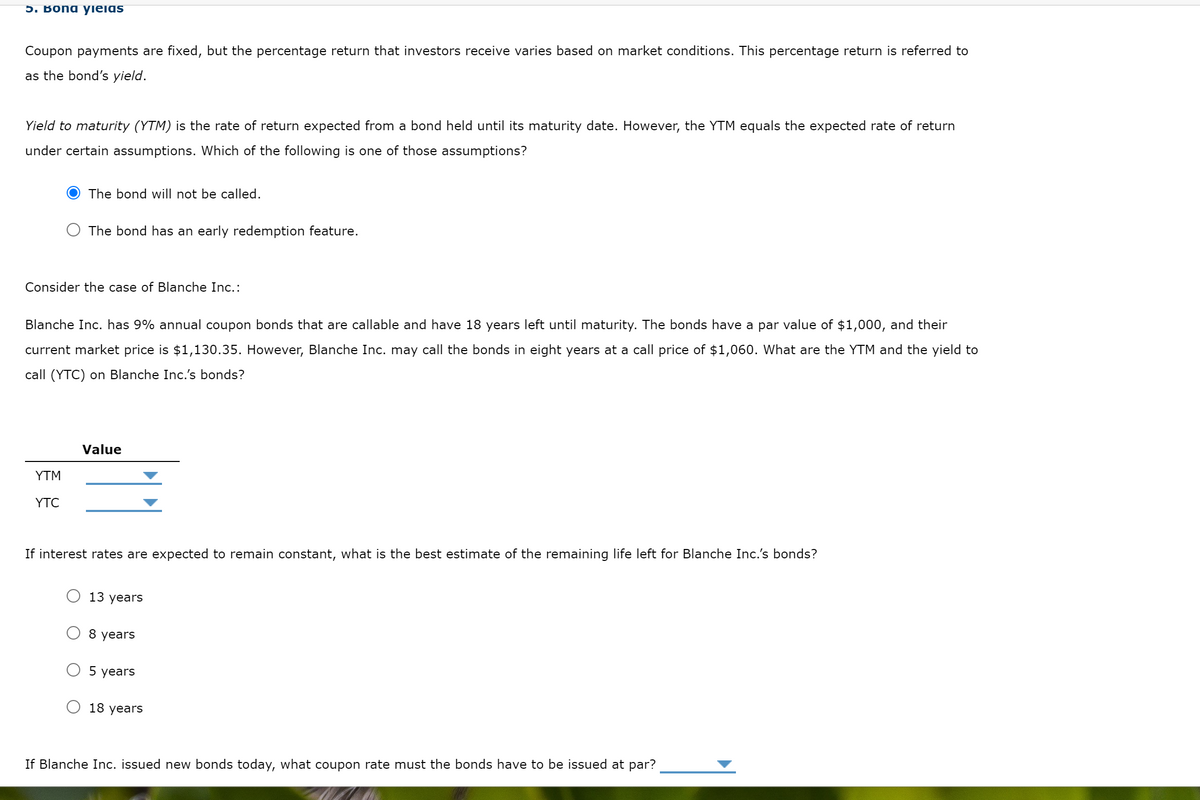

Coupon payments are fixed, but the percentage return that investors receive varies based on market conditions. This percentage return is referred to

as the bond's yield.

Yield to maturity (YTM) is the rate of return expected from a bond held until its maturity date. However, the YTM equals the expected rate of return

under certain assumptions. Which of the following is one of those assumptions?

The bond will not be called.

The bond has an early redemption feature.

Consider the case of Blanche Inc.:

Blanche Inc. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their

current market price is $1,130.35. However, Blanche Inc. may call the bonds in eight years at a call price of $1,060. What are the YTM and the yield to

call (YTC) on Blanche Inc.'s bonds?

YTM

YTC

Value

If interest rates are expected to remain constant, what is the best estimate of the remaining life left for Blanche Inc.'s bonds?

13 years

8 years

5 years

18 years

If Blanche Inc. issued new bonds today, what coupon rate must the bonds have to be issued at par?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning