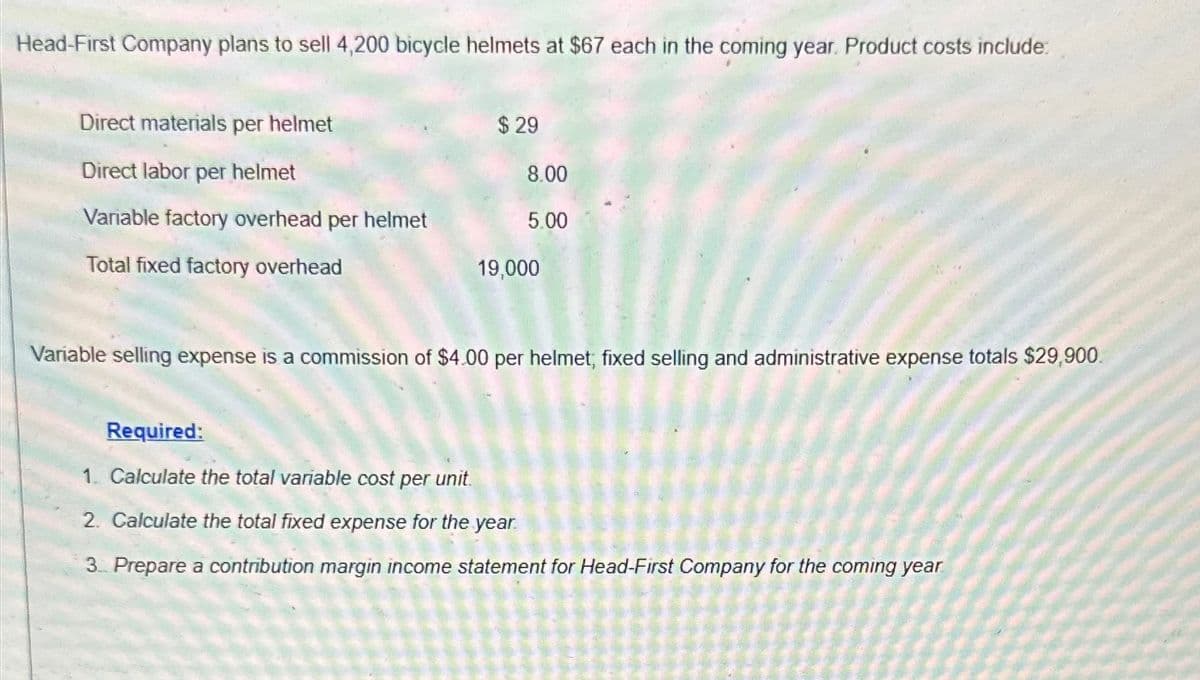

Head-First Company plans to sell 4,200 bicycle helmets at $67 each in the coming year. Product costs include: Direct materials per helmet $29 Direct labor per helmet 8.00 Variable factory overhead per helmet 5.00 Total fixed factory overhead 19,000 Variable selling expense is a commission of $4.00 per helmet, fixed selling and administrative expense totals $29,900. Required: 1. Calculate the total variable cost per unit 2. Calculate the total fixed expense for the year. 3. Prepare a contribution margin income statement for Head-First Company for the coming year

Head-First Company plans to sell 4,200 bicycle helmets at $67 each in the coming year. Product costs include: Direct materials per helmet $29 Direct labor per helmet 8.00 Variable factory overhead per helmet 5.00 Total fixed factory overhead 19,000 Variable selling expense is a commission of $4.00 per helmet, fixed selling and administrative expense totals $29,900. Required: 1. Calculate the total variable cost per unit 2. Calculate the total fixed expense for the year. 3. Prepare a contribution margin income statement for Head-First Company for the coming year

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 26BEB: Variable Cost Ratio, Contribution Margin Ratio Chillmax Company plans to sell 3,500 pairs of shoes...

Related questions

Question

Transcribed Image Text:Head-First Company plans to sell 4,200 bicycle helmets at $67 each in the coming year. Product costs include:

Direct materials per helmet

$29

Direct labor per helmet

8.00

Variable factory overhead per helmet

5.00

Total fixed factory overhead

19,000

Variable selling expense is a commission of $4.00 per helmet, fixed selling and administrative expense totals $29,900.

Required:

1. Calculate the total variable cost per unit

2. Calculate the total fixed expense for the year.

3. Prepare a contribution margin income statement for Head-First Company for the coming year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning