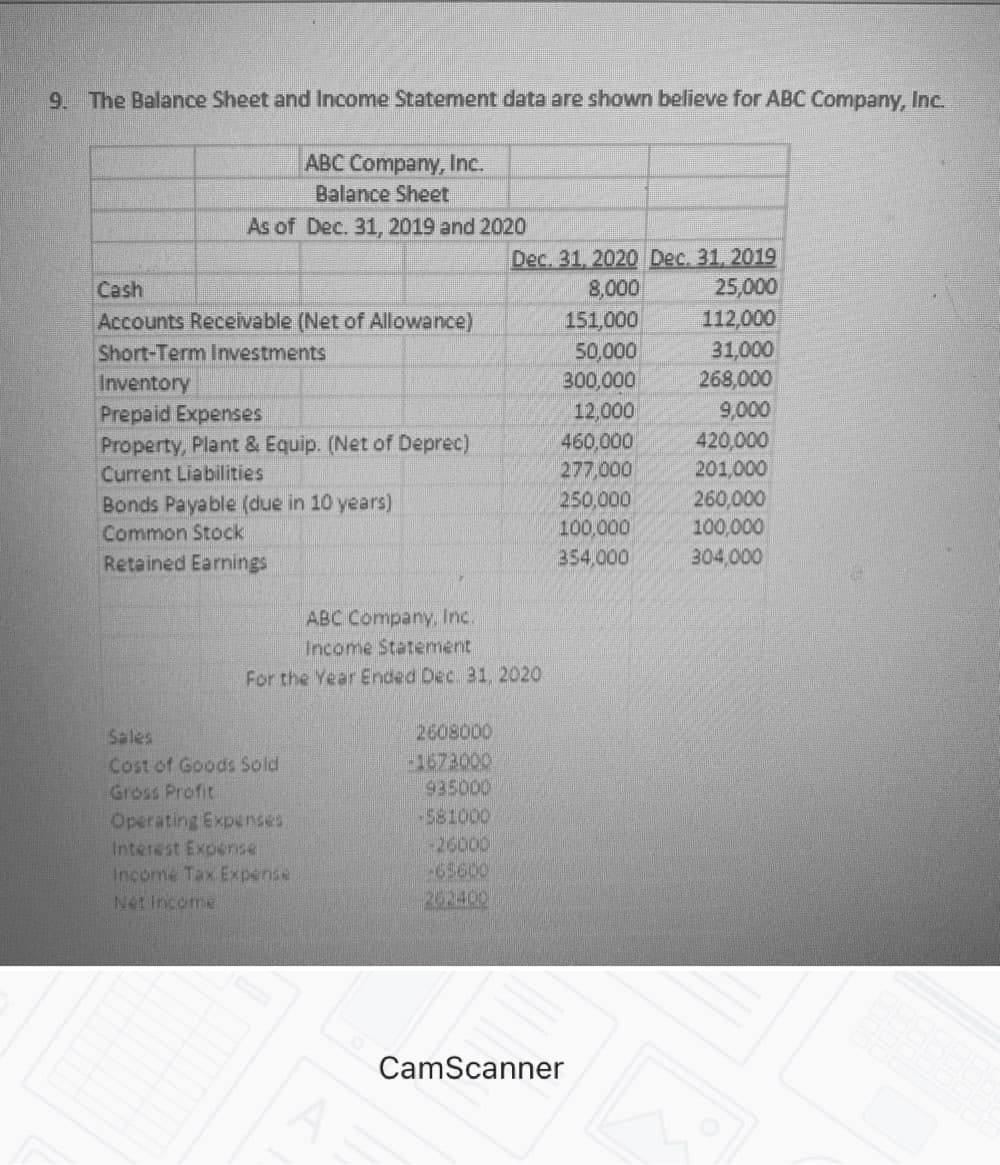

Use this data to compute the following ratios: 1.Current ratio (Dec 2020 )2.Acid-test Ratio (Dec 2020) 3.Accounts Receivable Turnover

Use this data to compute the following ratios:

1.

)2.Acid-test Ratio (Dec 2020)

3.Accounts Receivable Turnover

4.Inventory Turnover

5.Return on Assets

6.Profit Margin on Sales

7.Return on Equity

8.Times Interest Earned

b.Discuss the financial condition of ABC Company, Inc. based on what you learn from computing the ratios.

Ratio analysis means where different ratio of various years of years companies has been compared and results are interpreted to make effective decision regarding future course of action.

Due to our policy , we can answer only first three sub parts. For rest answer , please post the again with specific direction to solve the specific question.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps