FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

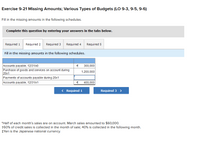

Transcribed Image Text:Exercise 9-21 Missing Amounts; Various Types of Budgets (LO 9-3, 9-5, 9-6)

Fill in the missing amounts in the following schedules.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

Required 5

Fill in the missing amounts in the following schedules.

Accounts payable, 12/31/x0

Purchase of goods and services on account during

20x1

Payments of accounts payable during 20x1

Accounts payable, 12/31/x1

€

300,000

1,200,000

€ 400,000

< Required 1

Required 3 >

*Half of each month's sales are on account. March sales amounted to $60,000.

160% of credit sales is collected in the month of sale; 40% is collected in the following month.

+Yen is the Japanese national currency.

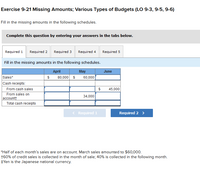

Transcribed Image Text:Exercise 9-21 Missing Amounts; Various Types of Budgets (LO 9-3, 9-5, 9-6)

Fill in the missing amounts in the following schedules.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

Required 5

Fill in the missing amounts in the following schedules.

April

May

June

Sales*

80,000 s

60,000

Cash receipts:

From cash sales

45,000

From sales on

accountt

34,000

Total cash receipts

< Required 1

Required 2 >

*Half of each month's sales are on account. March sales amounted to $60,000.

160% of credit sales is collected in the month of sale; 40% is collected in the following month.

+Yen is the Japanese national currency.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Only typed solutionarrow_forwardQuestion Content Area After the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $702,763 and Allowance for Doubtful Accounts has a balance of $22,123. What is the net realizable value of the accounts receivable? a. $702,763 b. $680,640 c. $724,886 d. $22,123arrow_forwardeNOWv2 | Online teachin X + Wilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress... A Accounts Receivable Analysis Xavier Stores Company and Lestrade Stores Inc. are large retail department stores. Both companies offer credit to their customers through their own credit card operations. Information from the financial statements for both companies for two recent years is as f (in millions): Xavier Lestrade Sales $255,500 $357,700 Credit card receivables-beginning 24,416 47,840 Credit card receivables-ending 20,384 36,832 a. Determine the (1) accounts receivable turnover and (2) the number of days' sales in receivables for both companies. Round answers to one decimal place. Assume 365 days a year. Xavier Lestrade 1. Accounts receivable turnover days days 2. Number of days' sales in receivables than Lestrade's. The number of days' sales in receivables is b. Xavier's accounts receivable turnover is for Xavier than for Lestrade. These differences…arrow_forward

- Do not give answer in imagearrow_forwardion) eBook 4 Debit Debit v2.cengagenow.com Drawing Print Item Credit Credit Debit Debit Revenue + Credit Debit Credit Debit 2. Under each T account for the accounts under the classifications, select either a plus or minus sign on the left side to indicate whether a Debit increases or decreases the classification and select either a plus or minus sign on the right side to indicate whether a Credit increases or decreases the classification.. 3. Record the amounts in the proper positions in the T accounts. Record the amounts in the order given (letters 'a' through 'h'). 4. Foot and balance the accounts. < Bal. Bal Debit 33,000 +4 Cash Accounts Payable X + Debit Credit 130 X 9,640 Exercise Equipment Bal. G. Elden, Capital x Debit Credit Debit 9,640 ✔ Store Equipment Bal.. x Credit 270 X + Credit 2,390 X Income from Services x Debit Credit Debit 770 V Bal. Office Equipment Debit Credit 450 V Bal. x Credit Bal. Advertising Expense F Debit Credit 130 V Bal. Check My Work 1. Debit is the left…arrow_forwardHarwell Company manufactures automobile tires. On July 15, 2021, the company sold 1,600 tires to the Nixon Car Company for $30 each. The terms of the sale were 2/10, n/30. Harwell uses the gross method of accounting for cash discounts. Required: 1. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and collection on July 23, 2021. 2. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and collection on August 15, 2021. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and collection on July 23, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Debit Credit July 15, 2021 Accounts receivable 1 Sales revenue 2 July 23, 2021 Cash Sales discounts Accounts receivablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education