FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Ch03 PPT - Korumalı Görünüm - bu bilgisayar konumuna kaydedildi

ZEYNEP ALTUNKAYNAK

ZA

terisi Gözden Geçir

Görünüm Vardım

Payla

Sample Exercise

opensta

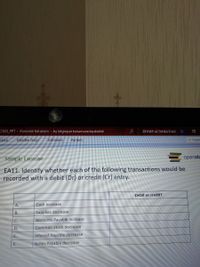

EA11. Identify whether each of the following transactions would be

recorded with a debit (Dr) or credit (Cr) entry.

Debit or credit?

A.

Cash increase

B.

Supplies decrease

Accounts Payable increase

D.

Common Stock decrease

E.

Interest Payable decrease

F.

Notes Payable decrease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- topic: double-entry accounting indicate how to increase each of the accounts below (credit or debit) cash- accounts payable- supplies- accounts receivable-arrow_forwardThe earnings of service revenue that are not yet received in cash are recorded as follows: Group of answer choices Debit to cash and credit to revenue Debit to accounts payable and credit to revenue Debit to accounts receivable and credit to revenue Debit to revenue and credit to accounts receivablearrow_forwardUnder the allowance method for uncollectible receivables, the entry to record uncollectible-account expense has what effect on the financial statements?a. Decreases assets and has no effect on net incomeb. Increases expenses and increases stockholders’ equityc. Decreases net income and decreases assetsd. Decreases stockholders’ equity and increases liabilitiesarrow_forward

- If the balance in Cash Short and Over at the end of a period is a credit, it should be reported as "Other Income" on the income statement. Please explain with full explanation. a. True b. Falsearrow_forwardWhich of the following is a permanent account? A. dividends distributed B. allowance for doubtful accounts C. internet expense d. salesarrow_forwardThe accounting treatment of Discount on bill discounted is: a. A current liability b. A current asset c. An income for a bank d. An expenses for a bankarrow_forward

- The primary purpose of the balance sheet is to: O measure the net income of a busniess up to a particular point in time. O report the difference between cash inflows and cash outflows for the period. O report the financial position of athe reporting entity at a particular point in time. O report revenues and expenses for a period of time. DEREN 11arrow_forwardWhich of the following would indicate a cash payment? a. An increase in prepaid expenses b. Selling equipment at a loss c. A decrease in inventory d. A decrease in accounts receivablearrow_forwardWhich of the following entries records receiving the cash payment from a customer for previous services performed on account. (AP = Accounts Payable, AR = Accounts Receivable)arrow_forward

- Which one of the following statements about revenue is not correct?A. Revenue can result in increases in accounts receivableB. Revenue can result in increases in liabilitiesC. Revenue is earned whenever cash is received from a customerD. Revenue is earned when a service is provided to a customerarrow_forwardWhich of the following entries properly closes a temporary account? Select one: a. Income Summary XX Cash b. C. Debit Credit Expense Accumulated Depreciation XX Income Summary Income Summary d. e. XX Retained Earnings XX Dividends Debit Credit Debit Credit XX Debit Credit Income Summary XX Revenue XX XX Debit Credit XX XXarrow_forwardUnder the direct charge-off method, when a specific account receivable is written off, what account is debited and what is the effect of the write-off on net income and on assets? debit Accounts Receivable; the write off decreases net income and total assets debit Allowance for Uncollectible Accounts; the write off increases net income and total assets debit Uncollectible Accounts Expense the write off decreases net income and total assets debit Uncollectible Accounts Expense; the write off increases net income and total assets Aarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education