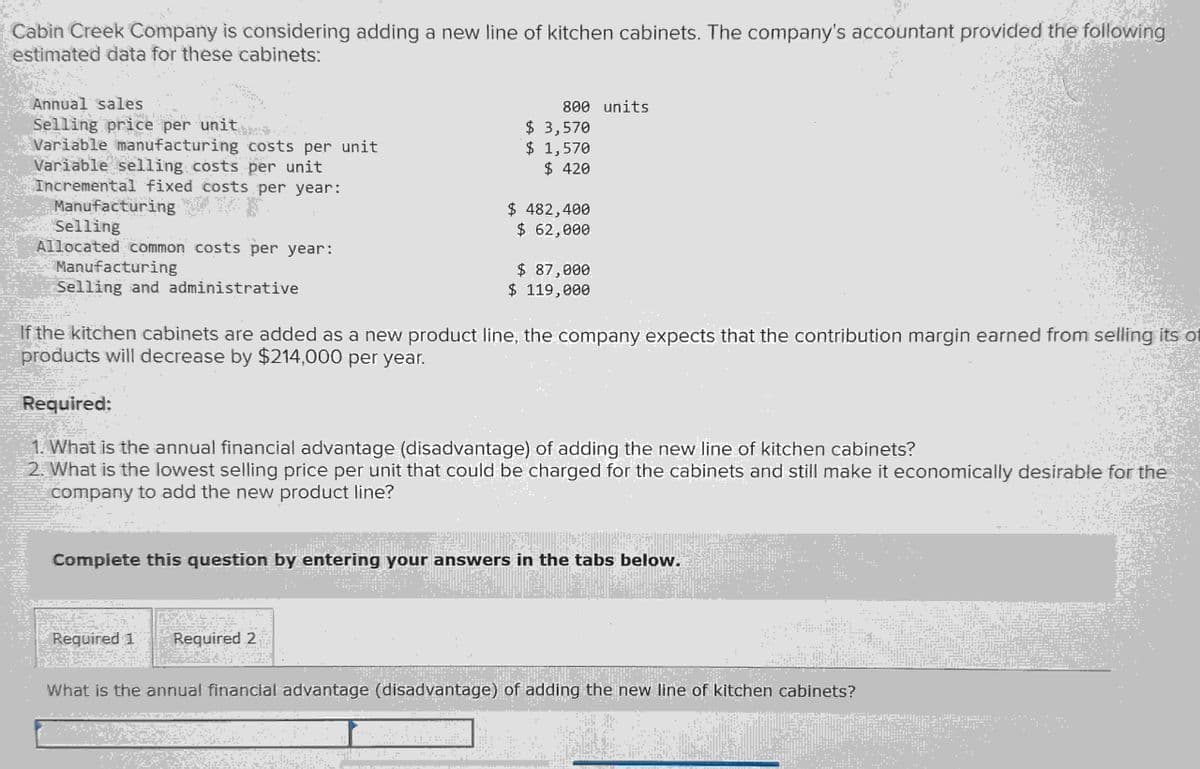

Cabin Creek Company is considering adding a new line of kitchen cabinets. The company's accountant provided the following estimated data for these cabinets: Annual sales Selling price per unit Variable selling costs per unit 800 units $ 3,570 Variable manufacturing costs per unit $ 1,570 $ 420 $ 482,400 $ 62,000 Incremental fixed costs per year: Manufacturing Selling Allocated common costs per year: Manufacturing Selling and administrative $ 87,000 $ 119,000 If the kitchen cabinets are added as a new product line, the company expects that the contribution margin earned from selling its products will decrease by $214,000 per year. Required: 1. What is the annual financial advantage (disadvantage) of adding the new line of kitchen cabinets? 2. What is the lowest selling price per unit that could be charged for the cabinets and still make it economically desirable for the company to add the new product line? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the annual financial advantage (disadvantage) of adding the new line of kitchen cabinets?

Cabin Creek Company is considering adding a new line of kitchen cabinets. The company's accountant provided the following estimated data for these cabinets: Annual sales Selling price per unit Variable selling costs per unit 800 units $ 3,570 Variable manufacturing costs per unit $ 1,570 $ 420 $ 482,400 $ 62,000 Incremental fixed costs per year: Manufacturing Selling Allocated common costs per year: Manufacturing Selling and administrative $ 87,000 $ 119,000 If the kitchen cabinets are added as a new product line, the company expects that the contribution margin earned from selling its products will decrease by $214,000 per year. Required: 1. What is the annual financial advantage (disadvantage) of adding the new line of kitchen cabinets? 2. What is the lowest selling price per unit that could be charged for the cabinets and still make it economically desirable for the company to add the new product line? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the annual financial advantage (disadvantage) of adding the new line of kitchen cabinets?

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter20: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 3CMA: Bolger and Co. manufactures large gaskets for the turbine industry. Bolgers per-unit sales price and...

Related questions

Question

Transcribed Image Text:Cabin Creek Company is considering adding a new line of kitchen cabinets. The company's accountant provided the following

estimated data for these cabinets:

Annual sales

Selling price per unit

Variable manufacturing costs per unit

Variable selling costs per unit

Incremental fixed costs per year:

Manufacturing

Selling

r

Allocated common costs per year:

Manufacturing

Selling and administrative

800 units

$ 3,570

$ 1,570

$ 420

$ 482,400

$ 62,000

$ 87,000

$ 119,000

If the kitchen cabinets are added as a new product line, the company expects that the contribution margin earned from selling its of

products will decrease by $214,000 per year.

Required:

1. What is the annual financial advantage (disadvantage) of adding the new line of kitchen cabinets?

2. What is the lowest selling price per unit that could be charged for the cabinets and still make it economically desirable for the

company to add the new product line?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

What is the annual financial advantage (disadvantage) of adding the new line of kitchen cabinets?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning