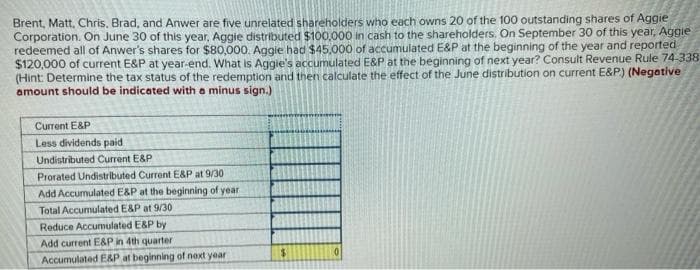

Brent, Matt, Chris, Brad, and Anwer are five unrelated shareholders who each owns 20 of the 100 outstanding shares of Aggie Corporation. On June 30 of this year, Aggie distributed $100,000 in cash to the shareholders. On September 30 of this year, Aggie redeemed all of Anwer's shares for $80,000. Aggie had $45,000 of accumulated E&P at the beginning of the year and reported $120,000 of current E&P at year-end. What is Aggie's accumulated E&P at the beginning of next year? Consult Revenue Rule 74-338 (Hint: Determine the tax status of the redemption and then calculate the effect of the June distribution on current E&P) (Negative amount should be indicated with a minus sign.) Current E&P Less dividends paid Undistributed Current E&P Prorated Undistributed Current E&P at 9/30 Add Accumulated E&P at the beginning of year Total Accumulated E&P at 9/30 Reduce Accumulated E&P by Add current E&P in 4th quarter Accumulated E&P at beginning of next year $

Brent, Matt, Chris, Brad, and Anwer are five unrelated shareholders who each owns 20 of the 100 outstanding shares of Aggie Corporation. On June 30 of this year, Aggie distributed $100,000 in cash to the shareholders. On September 30 of this year, Aggie redeemed all of Anwer's shares for $80,000. Aggie had $45,000 of accumulated E&P at the beginning of the year and reported $120,000 of current E&P at year-end. What is Aggie's accumulated E&P at the beginning of next year? Consult Revenue Rule 74-338 (Hint: Determine the tax status of the redemption and then calculate the effect of the June distribution on current E&P) (Negative amount should be indicated with a minus sign.) Current E&P Less dividends paid Undistributed Current E&P Prorated Undistributed Current E&P at 9/30 Add Accumulated E&P at the beginning of year Total Accumulated E&P at 9/30 Reduce Accumulated E&P by Add current E&P in 4th quarter Accumulated E&P at beginning of next year $

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter13: Corporations: Earning & Profits And Distributions

Section: Chapter Questions

Problem 40P

Related questions

Question

Transcribed Image Text:Brent, Matt, Chris, Brad, and Anwer are five unrelated shareholders who each owns 20 of the 100 outstanding shares of Aggie

Corporation. On June 30 of this year, Aggie distributed $100,000 in cash to the shareholders. On September 30 of this year, Aggie

redeemed all of Anwer's shares for $80,000. Aggie had $45,000 of accumulated E&P at the beginning of the year and reported

$120,000 of current E&P at year-end. What is Aggie's accumulated E&P at the beginning of next year? Consult Revenue Rule 74-338

(Hint: Determine the tax status of the redemption and then calculate the effect of the June distribution on current E&P) (Negative

amount should be indicated with a minus sign.)

Current E&P

Less dividends paid

Undistributed Current E&P

Prorated Undistributed Current E&P at 9/30

Add Accumulated E&P at the beginning of year

Total Accumulated E&P at 9/30

Reduce Accumulated E&P by

Add current E&P in 4th quarter

Accumulated E&P at beginning of next year

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you