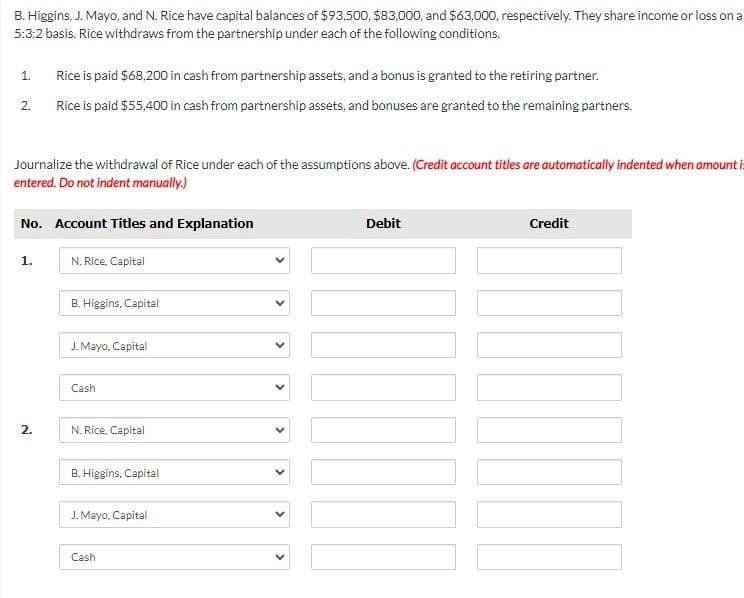

B. Higgins, J. Mayo, and N. Rice have capital balances of $93,500, $83,000, and $63,000, respectively. They share income or loss o 5:3:2 basis. Rice withdraws from the partnership under each of the following conditions. 1. Rice is paid $68,200 in cash from partnership assets, and a bonus is granted to the retiring partner. 2. Rice is paid $55,400 in cash from partnership assets, and bonuses are granted to the remaining partners. Journalize the withdrawal of Rice under each of the assumptions above. (Credit account titles are automatically indented when amou entered. Do not indent manually.)

B. Higgins, J. Mayo, and N. Rice have capital balances of $93,500, $83,000, and $63,000, respectively. They share income or loss o 5:3:2 basis. Rice withdraws from the partnership under each of the following conditions. 1. Rice is paid $68,200 in cash from partnership assets, and a bonus is granted to the retiring partner. 2. Rice is paid $55,400 in cash from partnership assets, and bonuses are granted to the remaining partners. Journalize the withdrawal of Rice under each of the assumptions above. (Credit account titles are automatically indented when amou entered. Do not indent manually.)

Chapter21: Partnerships

Section: Chapter Questions

Problem 11BCRQ

Related questions

Question

Transcribed Image Text:B. Higgins, J. Mayo, and N. Rice have capital balances of $93,500, $83,000, and $63,000, respectively. They share income or loss on a

5:3:2 basis. Rice withdraws from the partnership under each of the following conditions.

1.

Rice is paid $68,200 in cash from partnership assets, and a bonus is granted to the retiring partner.

2.

Rice is paid $55,400 in cash from partnership assets, and bonuses are granted to the remaining partners.

Journalize the withdrawal of Rice under each of the assumptions above. (Credit account titles are automatically indented when amount is

entered. Do not indent manually.)

No. Account Titles and Explanation

Debit

Credit

1.

N. Rice, Capital

2.

B. Higgins, Capital

J.Mayo, Capital

Cash

N. Rice, Capital

B. Higgins, Capital

J.Mayo, Capital

Cash

<

>

<

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT