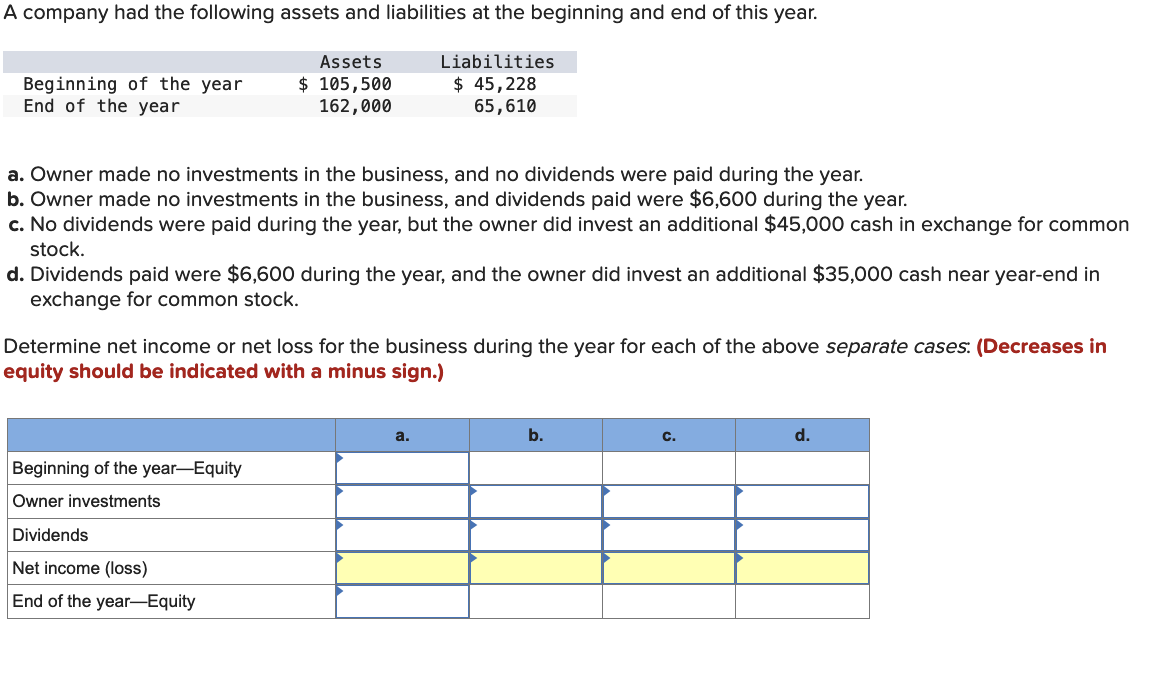

A company had the following assets and liabilities at the beginning and end of this year. Beginning of the year End of the year Assets $ 105,500 162,000 Liabilities $ 45,228 65,610 a. Owner made no investments in the business, and no dividends were paid during the year. b. Owner made no investments in the business, and dividends paid were $6,600 during the year. c. No dividends were paid during the year, but the owner did invest an additional $45,000 cash in exchange for common stock. d. Dividends paid were $6,600 during the year, and the owner did invest an additional $35,000 cash near year-end in exchange for common stock. Determine net income or net loss for the business during the year for each of the above separate cases: (Decreases in equity should be indicated with a minus sign.) Beginning of the year-Equity Owner investments Dividends Net income (loss) End of the year-Equity a. b. C. d.

A company had the following assets and liabilities at the beginning and end of this year. Beginning of the year End of the year Assets $ 105,500 162,000 Liabilities $ 45,228 65,610 a. Owner made no investments in the business, and no dividends were paid during the year. b. Owner made no investments in the business, and dividends paid were $6,600 during the year. c. No dividends were paid during the year, but the owner did invest an additional $45,000 cash in exchange for common stock. d. Dividends paid were $6,600 during the year, and the owner did invest an additional $35,000 cash near year-end in exchange for common stock. Determine net income or net loss for the business during the year for each of the above separate cases: (Decreases in equity should be indicated with a minus sign.) Beginning of the year-Equity Owner investments Dividends Net income (loss) End of the year-Equity a. b. C. d.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter1: Accounting As A Form Of Communication

Section: Chapter Questions

Problem 1.5E: The Accounting Equation Using the accounting equation, answer each of the following independent...

Related questions

Topic Video

Question

vi.3

Transcribed Image Text:A company had the following assets and liabilities at the beginning and end of this year.

Beginning of the year

End of the year

Assets

$ 105,500

162,000

Liabilities

$ 45,228

65,610

a. Owner made no investments in the business, and no dividends were paid during the year.

b. Owner made no investments in the business, and dividends paid were $6,600 during the year.

c. No dividends were paid during the year, but the owner did invest an additional $45,000 cash in exchange for common

stock.

d. Dividends paid were $6,600 during the year, and the owner did invest an additional $35,000 cash near year-end in

exchange for common stock.

Determine net income or net loss for the business during the year for each of the above separate cases: (Decreases in

equity should be indicated with a minus sign.)

Beginning of the year-Equity

Owner investments

Dividends

Net income (loss)

End of the year-Equity

a.

b.

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning