FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

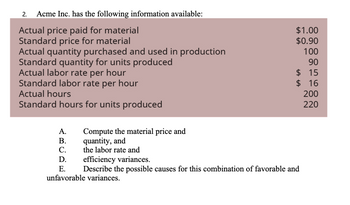

Transcribed Image Text:**Acme Inc. Variance Analysis**

Acme Inc. has provided the following information for variance analysis:

- **Actual price paid for material:** $1.00

- **Standard price for material:** $0.90

- **Actual quantity purchased and used in production:** 100 units

- **Standard quantity for units produced:** 90 units

- **Actual labor rate per hour:** $15

- **Standard labor rate per hour:** $16

- **Actual hours:** 200 hours

- **Standard hours for units produced:** 220 hours

**Tasks:**

A. Compute the material price and quantity variances.

B. Compute the labor rate and labor efficiency variances.

C. Describe the possible causes for this combination of favorable and unfavorable variances.

**Analysis Guidelines:**

- For material price variance, assess the difference between the actual and standard prices per unit and multiply by the actual quantity.

- For material quantity variance, analyze the difference between actual and standard quantities used, multiplied by the standard price.

- For labor rate variance, compare the actual and standard labor rates per hour, multiplied by actual hours worked.

- For labor efficiency variance, compare the actual and standard hours worked, multiplied by the standard labor rate.

- Consider possible factors affecting these variances, like changes in supplier prices or production efficiency.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An example of a performance measure with a long−timehorizon is ________. A. quality of room service B. direct materials efficiency variances C. number of new patents developed D. overhead spending variancesarrow_forwardPlease answer asap. HW due soonarrow_forwardDo not give image formatarrow_forward

- Antuan Company set the following standard costs per unit for its product. Direct materials (6 pounds @ $5 per pound) $ 30 Direct labor (2 hours @ $17 per hour) 34 Overhead (2 hours @ $18.50 per hour) 37 Standard cost per unit $ 101 The standard overhead rate ($18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. Overhead Budget (75% Capacity) Variable overhead costs $ 45,000 Indirect materials Indirect labor 180,000 Power 45,000 Maintenance 90,000 costs 360,000 Total var ble ove Fixed overhead costs. 24,000 80,000 Depreciation-Building Depreciation-Machinery Taxes and insurance Supervisory salaries. 12,000 79,000 Total fixed overhead costs 195,000 Total overhead costs $ 555,000 The company incurred the following actual costs when it operated at 75% of capacity in October. Direct materials (91,000 pounds @ $5.10 per pound) $…arrow_forwardRequired Indicate whether each of the following variances is favorable (F) or unfavorable (U). The first one has been done as an example. Note: Select "None" if there is no effect (1.e., zero variance). Item to Classify Sales volume Sales price Materials cost Materials usage Labor cost Labor usage Fixed cost spending Fixed cost per unit (volume) $ $ $ $ $ Standard 40,100 units 3.61 per unit 3.00 per pound 91,100 pounds 10.10 per hour 61,100 hours 401,000 3.21 per unit $ $ $ $ $ Actual 42,100 units 3.64 per unit 3.10 per pound 90,100 pounds 9.70 per hour 61,900 hours 391,000 3.17 per unit Type of Variance Farrow_forwardPlease do not give solution in image format thankuarrow_forward

- 1.3 REQUIRED Use the information provided below to calculate the following variances. Each answer must indicate whether the variance is favourable or unfavourable. 1.3.1 Material quantity variance 1.3.2 Labour rate variance 1.3.3 Variable manufacturing overheads efficiency variance INFORMATION The standard variable costs per unit (with a standard quantity of 25 000 units), set by Kidman Manufacturers, for Product M are as follows: Materials Labour Variable overhead 4 kg at R10 per kg 2 hours at R20 per hour 2 hours at R12 per hour The actual costs for October 2022 are as follows: Materials Materials Labour Variable overhead 100 000 kg were purchased for R980 000 78 000 kg were used to produce 20 000 units of Product M 41 000 labour hours at R19.60 per hour R500 200 incurredarrow_forwardPlease assist with requirements 1 and 2, providing explanations for each calculation in detail. Thanks! Requirements 1. Compute the variable overhead cost and efficiency variances and fixed overhead cost and volume variances. 2. Explain why the variances are favorable or unfavorable.arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education