Concept explainers

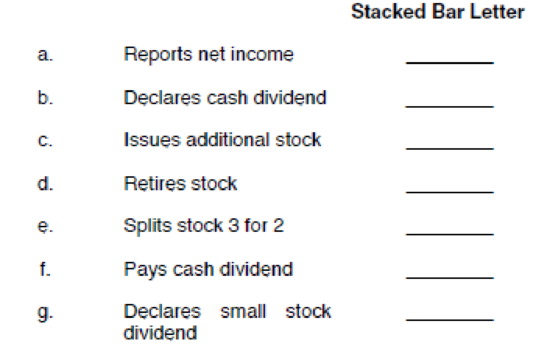

Click the Chart sheet tab. The stacked bar chart shows Chenʼs equity account balances at December 31, 2013. Match the stacked bars (A–G) that best describe what will happen to the equity accounts if the following transactions and events occur in 2014.

Letters may be repeated or not used. Consider each case independently.

When the assignment is complete, close the file without saving it again.

TICKLERS (optional)

Worksheet. Suppose that the $54,000 “Additional paid-in capital” balance at December 31, 2011, comes from two ledger accounts: $42,000 from Paid-in capital in excess of par and $12,000 from Paid-in capital from

Chart. Using the STOCKEQ4 file, prepare a column chart showing the dollar amount of each of the stockholdersʼ equity account balances at December 31, 2013. Treasury stock can be shown as a negative value. Enter your name somewhere on the chart. Save the file again as STOCKEQ4. Print the chart.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Excel Applications for Accounting Principles

- During its first year of operations, Bonita Corporation had the following transactions pertaining to its common stock. Jan. 10 Mar. 1 July Sept. 1 1 Issued 83,700 shares for cash at $6 per share. Issued 5,000 shares to attorneys in payment of a bill for $37,000 for services rendered in helping the company to incorporate. Issued 32,100 shares for cash at $8 per share. Issued 63,100 shares for cash at $10 per share.arrow_forwardAdjusted Trial Balance As of 12/31/20xx Accounts Account Balances Cash $20,521 28,000 4,000 Accounts Receivable Allowance for Uncollectible Accounts 35,000 Prepaid Rent Equipment Accumulated Depreciation Accounts Payable 40,114 10,000 10.521 |10,000 30,000 Deferred Revenue Common Stock Retained Carnings 10,000 Dividends 3,000 Service Revenue 65.114 1.000 4.000 4.000 4.000 Sales Discounts Rent Expense Interest Expense Income Tax Expense Question:Based on the Partial Trial Balance and Additionalarrow_forwardJason Hilton, M.D., reported the following unadjusted trial balance as of September 30, 2025: View the trial balance. Calculate the debt ratio for Jason Hilton, M.D. Select the debt ratio formula on the first line and then calculate the ratio. (Round the percentage to the nearest whole percent.) Average total assets Average total equity Average total liabilities Net income Total assets + Total equity Total liabilities = Debt ratio % Trial Balance Account Title Cash Jason Hilton, M.D. Unadjusted Trial Balance September 30, 2025 Accounts Receivable Supplies Land Building Office Equipment Accounts Payable Utilities Payable Unearned Revenue Notes Payable Common Stock Dividends Service Revenue Salaries Expense Utilities Expense Advertising Expense Total $ Debit Balance 39,000 7,300 2,900 28,000 100,000 25,000 56,000 23,400 800 300 282,700 $ Credit 2,400 1,100 8,666 95,000 130,000 45,534 282,700 I Xarrow_forward

- Castle Investments completed the following investment transactions during 2024: (Click the icon to view the investment transactions.) Read the requirements. Requirement 1. Journalize Castle's investment transactions. Explanations are not required. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. If no entry is required, select "No entry required" on the first line of the Accounts and Explanation column and leave the remaining cells blank.) Begin by journalizing Castle's investment on January 5, 2024. Date Accounts and Explanation 2024 Jan. 5 Requirements 1. Journalize Castle's investment transactions. Explanations are not required. 2. Prepare a partial balance sheet for Castle's Visser investment as of December 31, 2024. Debit 3. Prepare a comprehensive income statement for Castle Investments for year ended December 31, 2024. Assume net income was $220,000. Print Done - X C Credit More info 2024 Jan. 5 Jun. 30 Dec. 31 Dec. 31…arrow_forwardPrepare the journal entries for these transactions, assuming that the common stock is no-par with a stated value of $3 per share. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record entries in the order displayed in the problem statement.)arrow_forwardcomplete the table by using 2 Data Tables. Given that the balance sheet is at May31,2020. There are options provided for the "Accounts" column in the second attachment , choose the most suitable 4 options among the 9 and write down its debit and credit.arrow_forward

- (a) Prepare the journal entries for these transactions, assuming that the common stock has a par value of $2 per share. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit choose a transaction date Jan. 5Aug. 1Sept. 20Dec. 19 enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount choose a transaction date Jan. 5Aug. 1Sept. 20Dec. 19 enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount…arrow_forwardTeal Company is presently testing a number of new agricultural seed planters that it has recently developed. To stimulate interest, it has decided to grant to five of its largest customers the unconditional right of return to these products if not fully satisfied. The right of return extends for 4 months. Teal estimates returns of 20%. Teal sells these planters on account for $1,500,000 (cost $825,000) on January 2, 2020. Customers are required to pay the full amount due by March 15, 2020. (a) Your answer is correct. Prepare the journal entry for Teal at January 2, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 2, Accounts Receivable 1,500,000 2020 Sales Revenue 1,500,000 (To recognize revenue.) Cost of Goods Sold 825000 Inventory 825000 (To record cost of goods sold.) eTextbook and…arrow_forward! Required information [The following information applies to the questions displayed below.] Mark's Consulting experienced the following transactions for 2018, its first year of operations, and 2019. Assume that all transactions involve the receipt or payment of cash. Transactions for 2018 1. Acquired $85,000 by issuing common stock. 2. Received $135,000 cash for providing services to customers. 3. Borrowed $22,000 cash from creditors. 4. Paid expenses amounting to $53,000. 5. Purchased land for $35,000 cash. Transactions for 2019 Beginning account balances for 2019 are: $154,000 35,000 22,000 85,000 82,000 Cash Land Notes payable Common stock Retained earnings 1. Acquired an additional $27,000 from the issue of common stock. 2. Received $137,000 for providing services. 3. Paid $17,000 to creditors to reduce loan. 4. Paid expenses amounting to $68,000. 5. Paid a $11,500 dividend to the stockholders. 6. Determined that the market value of the land is $45,000.arrow_forward

- During its first year of operations, Bridgeport Corporation had the following transactions pertaining to its common stock. Jan. July 10 1 Issued 66,000 shares for cash at $6 per share. Issued 44,500 shares for cash at $10 per share.arrow_forwardBelow are individual unrelated transactions from X-call Inc. Record each transaction in the General Journal directly below it Enter an appropriate description when antering the transacions in the journal Dates must be entered in the format ddimmam (ie January 15 would be 15/Jan). For each journal entry, indicate how each account affects the balance sheet (Assets, Liabilities, Equity) Use for increase and for decrease For example, if an account decreases equity, choose Equity a) On November 1, 2014, X-cel Inc purchased $1.440 of equipment on credit General Journal Date Papú GJ FD Creat 1,440 Effect Of Balance Sheet +Assets Equipment Accounts Payable 1,440 +Liabilities to record the purchase of equipment on mad b) On November 2, 2014, X-cell Inc. agreed to provide teaching services to a client for a fixed too of $900 per month On that same day this dient paid the first two months' tes in advance Effect On General Journal Page GJ F Des Creat Date Account Explanation Balaton Shant LA c)A…arrow_forwardYou can find below a list of accounts and their amounts for DigitalCom Co. The accounts are presented in alphabetical order. Prepare a trial balance for December 31, 2019 and keep the numbers on a side paper (you might need them for answering other questions also). Then answer the question below, based on your results. Question: What is the amount of Retained Earnings? Accounts Payable Accounts Receivable Advertising expense Building Capital stock Cash Dividends Land Notes Payable 5,000 3,000 400 18,000 14,100 6,500 1,600 26,000 15,000 31,000 Revenue Retained Earnings Supplies Utilities expense Wage expense Wages Payable ? 700 900 13,250 3,050arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning