FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

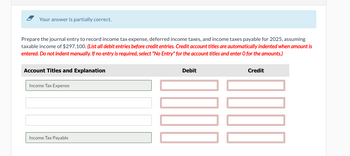

Transcribed Image Text:Your answer is partially correct.

Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2025, assuming

taxable income of $297,100. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

Income Tax Expense

Income Tax Payable

Debit

Credit

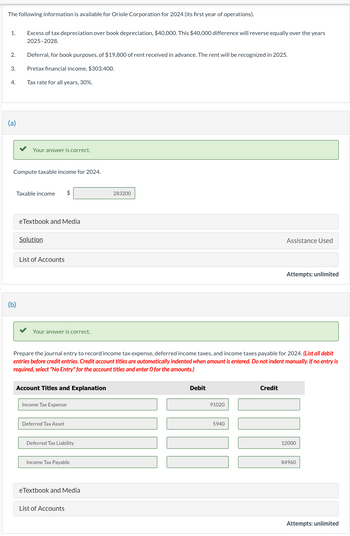

Transcribed Image Text:The following information is available for Oriole Corporation for 2024 (its first year of operations).

1.

Excess of tax depreciation over book depreciation, $40,000. This $40,000 difference will reverse equally over the years

2025-2028.

2.

Deferral, for book purposes, of $19,800 of rent received in advance. The rent will be recognized in 2025.

3.

Pretax financial income, $303,400.

4.

Tax rate for all years, 30%.

(a)

Your answer is correct.

Compute taxable income for 2024.

(b)

Taxable income $

eTextbook and Media

Solution

List of Accounts

Your answer is correct.

283200

Assistance Used

Attempts: unlimited

Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2024. (List all debit

entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is

required, select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

Income Tax Expense

Deferred Tax Asset

Deferred Tax Liability

Income Tax Payable

eTextbook and Media

List of Accounts

Debit

91020

5940

Credit

12000

84960

Attempts: unlimited

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- please answer part b.arrow_forwardI need help with part Barrow_forward(b) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2024. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation cash Debit Credit WITarrow_forward

- In 2023, Windsor Ltd., which follows IFRS, reported accounting income of $1,130,000 and the 2023 tax rate was 20%. Windsor had two timing differences for tax purposes: CCA on the company's tax return was $512,000. Depreciation expense on the financial statements was $308,000. These amounts relate to assets that were acquired on January 1, 2023, for $2,048,000. Accrued warranty expense for financial statement purposes was $140,600 (accrued expenses are not deductible for tax purposes). This is the first year Windsor offers warranties. Both of these timing differences are expected to fully reverse over the next four years, as follows: Year 2024 2025 2026 2027 Depreciation Difference $70,500 57,500 40,500 35,500 Warranty Expense Rate $20,500 20% 29,900 20% 39,600 18% 50,600 18% $204,000 $140,600arrow_forwardSandhill Company has the following two temporary differences between its income tax expense and income taxes payable. Pretax financial income Excess depreciation expense on tax return Excess warranty expense in financial income Taxable income The income tax rate for all years is 20%. (a) 2025 $864,000 (30,400) 19,400 $853,000 2026 $917,000 (38,500) 10,100 $888,600 2027 $909,000 (9,800) 8,300 $907,500 Assuming there were no temporary differences prior to 2025, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2025, 2026, and 2027. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.)arrow_forwardPlease answer question correctly Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select, “No entry” for the accounts titles and enter 0 for the amounts. Record journal entries in the order displayed in the problemarrow_forward

- On December 31, 2024, Blossom Inc. borrowed $4,380,000 at 12% payable annually to finance the construction of a new building. In 2025, the company made the following expenditures related to this building: March 1, $525,600; June 1, $876,000; July 1, $2,190,000; December 1, $2,190,000. The building was completed in February 2026. Additional information is provided as follows. 1. 2. Other debt outstanding: 10-year, 13% bond, December 31, 2018, interest payable annually 6-year, 10% note, dated December 31, 2022, interest payable annually March 1, 2025, expenditure included land costs of $219,000. 3. Interest revenue of $71,540 earned in 2025. $5,840,000 2,336,000 Determine the amount of interest to be capitalized in 2025 in relation to the construction of the building. The amount of interest $arrow_forwardSkysong Corp. sold an investment on an installment basis. The total gain of $74,400 was reported for financial reporting purposes in the period of sale. The company qualifies to use the installment-sales method for tax purposes. The installment period is 3 years; one-third of the sale price is collected in the period of sale. The tax rate was 40% in 2020, and 20% in 2021 and 2022. The 20% tax rate was not enacted in law until 2021. The accounting and tax data for the 3 years is shown below. Financial Accounting Tax Return 2020 (40% tax rate). Income before temporary difference $86,800 $86,800 Temporary difference 74,400 24,800 Income $161,200 $111,600 2021 (20% tax rate) Income before temporary difference $86,800 $86,800 Temporary difference 24,800 Income $86,800 $111,600 2022 (20% tax rate). Income before temporary difference $86,800 $86,800 Temporary difference 24,800 Income $86,800 $111,600 Calculate cumulative temporary differences for years 2020-2022. (Negative amounts using…arrow_forwardH1.arrow_forward

- Prepare the journal entries for Oriole for this revenue arrangement on June 1, 2025 and September 30, 2025, assuming Oriole receives payment when the equiptment is delivered. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem. Round answers to 0 decimal places, e.g. 5,275.)arrow_forwardMake the entry as of December 31, 2025, recording any necessary amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Creditarrow_forwardplease and thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education