Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

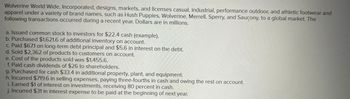

Transcribed Image Text:Wolverine World Wide, Incorporated, designs, markets, and licenses casual, industrial, performance outdoor, and athletic footwear and

apparel under a variety of brand names, such as Hush Puppies, Wolverine, Merrell, Sperry, and Saucony, to a global market. The

following transactions occurred during a recent year. Dollars are in millions.

a. Issued common stock to investors for $22.4 cash (example).

b. Purchased $1,621.6 of additional inventory on account.

c. Paid $67.1 on long-term debt principal and $5.6 in interest on the debt.

d. Sold $2,362 of products to customers on account.

e. Cost of the products sold was $1,455.6.

f. Paid cash dividends of $26 to shareholders.

g. Purchased for cash $33.4 in additional property, plant, and equipment.

h. Incurred $719.6 in selling expenses, paying three-fourths in cash and owing the rest on account.

i. Earned $1 of interest on investments, receiving 80 percent in cash.

j. Incurred $31 in interest expense to be paid at the beginning of next year.

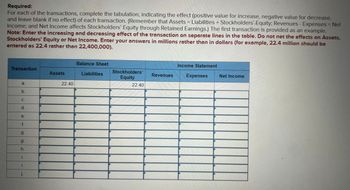

Transcribed Image Text:Required:

For each of the transactions, complete the tabulation, indicating the effect (positive value for increase, negative value for decrease,

and leave blank if no effect) of each transaction. (Remember that Assets = Liabilities + Stockholders' Equity; Revenues - Expenses = Net

Income; and Net Income affects Stockholders' Equity through Retained Earnings.) The first transaction is provided as an example.

Note: Enter the increasing and decreasing effect of the transaction on separate lines in the table. Do not net the effects on Assets,

Stockholders' Equity or Net Income. Enter your answers in millions rather than in dollars (for example, 22.4 million should be

entered as 22.4 rather than 22,400,000).

Balance Sheet

Income Statement

Transaction

Assets

Liabilities

Stockholders'

Equity

Revenues

Expenses

Net Income

22.40

22.40

a.

b.

C.

d.

e.

f.

g.

g.

h

j.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Wolverine World Wide, Incorporated, designs, markets, and licenses casual, industrial, performance outdoor, and athletic footw apparel under a variety of brand names, such as Hush Puppies, Wolverine, Merrell, Sperry, and Saucony, to a global market. Th following transactions occurred during a recent year. Dollars are in millions. a. Issued common stock to investors for $14.4 cash (example). b. Purchased $1,685.6 of additional inventory on account. c. Paid $57.1 on long-term debt principal and $4.6 in interest on the debt. d. Sold $2,350 of products to customers on account. e. Cost of the products sold was $1,448.6. f. Paid cash dividends of $23 to shareholders. g. Purchased for cash $34.4 in additional property, plant, and equipment. h. Incurred $706.6 in selling expenses, paying three-fourths in cash and owing the rest on account. i. Earned $1 of interest on investments, receiving 80 percent in cash. j. Incurred $32 in interest expense to be paid at the beginning of next year.…arrow_forwardWolverine World Wide, Incorporated, designs, markets, and licenses casual, industrial, performance outdoor, and athletic footwear and apparel under a variety of brand names, such as Hush Puppies, Wolverine, Merrell, Sperry, and Saucony, to a global market. The following transactions occurred during a recent year. Dollars are in millions. a. Issued common stock to investors for $21.4 cash (example). b. Purchased $1,647.6 of additional inventory on account. c. Paid $49.1 on long-term debt principal and $4.6 in interest on the debt. d. Sold $2,371 of products to customers on account. e. Cost of the products sold was $1,402.6. f. Paid cash dividends of $29 to shareholders. g. Purchased for cash $29.4 in additional property, plant, and equipment. h. Incurred $707.6 in selling expenses, paying three-fourths in cash and owing the rest on account. i. Earned $1 of interest on investments, receiving 80 percent in cash. j. Incurred $32 in interest expense to be paid at the beginning of next year.…arrow_forwardHelp me with C and F. Please tell me how too because I have difficulties with these problemsarrow_forward

- Cintas designs, manufactures, and implements corporate identity uniform programs that it rents or sells to customers throughout the United States and Canada. The company’s stock is traded on the NASDAQ and has provided investors with significant returns over the past few years. Selected information from the company’s balance sheet follows. For 2012, the company reported sales revenue of $3,707,900 and cost of goods sold of $1,517,415.arrow_forwardNeiman Marcus Group (NMG) is one of the largest luxury fashion retailers in the world. Kohls Corporation (KSS) sells moderately priced private and national branded products through more than 1,100 department stores located throughout the United States. The current assets and current liabilities at the end of a recent year for both companies are as follows (in millions): a. Would an analysis of working capital between the two companies be meaningful? Explain. b. Compute the quick ratio for both companies. Round to one decimal place. c. Interpret your results.arrow_forwardUpton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Uptons balance sheet as of December 31, 2019, is shown here (millions of dollars): Sales for 2019 were 350 million, and net income for the year was 10.5 million, so the firms profit margin was 3.0%. Upton paid dividends of 4.2 million to common stockholders, so its payout ratio was 40%. Its tax rate was 25%, and it operated at full capacity. Assume that all assets/sales ratios, (spontaneous liabilities)/sales ratios, the profit margin, and the payout ratio remain constant in 2020. a. If sales are projected to increase by 70 million, or 20%, during 2020, use the AFN equation to determine Uptons projected external capital requirements. b. Using the AFN equation, determine Uptons self-supporting growth rate. That is, what is the maximum growth rate the firm can achieve without having to employ nonspontaneous external funds? c. Use the forecasted financial statement method to forecast Uptons balance sheet for December 31, 2020. Assume that all additional external capital is raised as a line of credit at the end of the year. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Assume Uptons profit margin and dividend payout ratio will be the same in 2020 as they were in 2019. What is the amount of the line of credit reported on the 2020 forecasted balance sheets? (Hint: You dont need to forecast the income statements because the line of credit is taken out on the last day of the year and you are given the projected sales, profit margin, and dividend payout ratio; these figures allow you to calculate the 2020 addition to retained earnings for the balance sheet without actually constructing a full income statement.)arrow_forward

- 1. Au-Yeung is a research analyst at BAMBOO, a registered broker/dealer and investment adviser. While employed with BAMBOO, Au-Yeung established Priority Trade Investments Limited and acts as that firm's investment adviser. Au-Yeung is responsible for formulating Priority's investment strategy and directs all trades on behalf of Priority. Over the course of several days, Au-Yeung purchases 50,000 shares of China- Pin stock and 1,978 China-Pin call options for his personal account at BAMBOO. Shortly thereafter, Au- Yeung uses $29.8 million of Priority's funds to purchase more than 3 million shares of China-Pin stock. A) Please discussion the following: • Which CFA Standard(s) of Professional Conduct do(es) the case relate to? B) Explain whether each of I, II, III & IV below is correct or incorrect separately with respect to the relevant Standard. State the key points of the case that relate to the relevant Standard in your own words. Au-Yeung's actions are: acceptable because Au-Yeung's…arrow_forwardNeed help with this questionarrow_forwardAmerico's Earnings and the Fall of the Dollar. Americo is a U.S.-based multinational manufacturing firm with wholly-owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Americo is traded on the NASDAQ. Americo currently has 650,000 shares outstanding. The basic operating characteristics of the various business units is as follows: (Click on the icon to import the table into a spreadsheet.) Business Performance (000s) Earnings before taxes (EBT) Corporate income tax rate Average exchange rate for the period U.S. Parent (US$) $4,500 35% Brazilian Subsidiary (R$) R$6,250 25% R$1.8/$ Americo must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? The dollar has experienced significant swings in value against most of the world's currencies in recent years. b. What would be the…arrow_forward

- Teasdale Inc. manufactures and sells commercial and residential security equipment. The comparative unclassified balance sheets for December 31, Year 2 and Year 1 are provided below. Selected missing balances are shown by letters.Please see the attachment for details: Note 2. The Investment in Wright Co. stock is an equity method investment representing 30% of the outstanding shares of Wright Co. The following selected investment transactions occurred during Year 2:Mar. 18. Purchased 800 shares of Richter Inc. at $40, including brokerage commission. Richter is classified as an available-for-sale security.July 12. Dividends of $12,000 are received on the Wright Co. investment.Oct. 1. Purchased $24,000 of Toon Co. 4%, 10-year bonds at 100. The bonds are classified as available for sale. The bonds pay interest on October 1 and April 1.Dec. 31. Wright Co. reported a total net income of $80,000 for Year 2. Teasdale recorded equity earnings for its share of Wright Co. net income.31. Accrued…arrow_forwardNeed all threearrow_forwardBabel Co. a publicly listed company, reported earnings for the year amounting to Php 25 million with outstanding shares of 1 million. The market value per share of Babel Co. is Php 122. What is the P/E Ratio of Babel Co. (round your answer to the nearest ones)? Suppose that Babel Co. sets as the industry leader, Vincenzo Co., another player in the same industry are being eyed by an investor. The reported EPS of Vincenzo Co. is Php 10. If the investor is aware of the Babel Co.’s performance, how much should the investor value Vincenzo Co.?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT