Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Statement of cash flows-indirect m

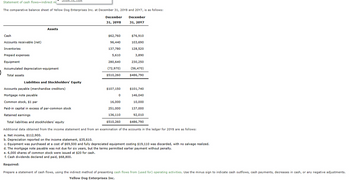

The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 2018 and 2017, is as follows:

Assets

December

31, 2018

December

31, 2017

Cash

$62,760

$76,910

Accounts receivable (net)

Inventories

Prepaid expenses

96,440

103,690

137,780

128,520

5,610

3,890

Equipment

280,640

230,250

Accumulated depreciation-equipment

(72,970)

(56,470)

Total assets

$510,260

$486,790

Liabilities and Stockholders' Equity

Accounts payable (merchandise creditors)

$107,150

$101,740

Mortgage note payable

0

146,040

Common stock, $1 par

16,000

10,000

Paid-in capital in excess of par-common stock

251,000

137,000

Retained earnings

136,110

92,010

Total liabilities and stockholders' equity

$510,260

$486,790

Additional data obtained from the income statement and from an examination of the accounts in the ledger for 2018 are as follows:

a. Net income, $112,900.

b. Depreciation reported on the income statement, $35,610.

c. Equipment was purchased at a cost of $69,500 and fully depreciated equipment costing $19,110 was discarded, with no salvage realized.

d. The mortgage note payable was not due for six years, but the terms permitted earlier payment without penalty.

e. 6,000 shares of common stock were issued at $20 for cash.

f. Cash dividends declared and paid, $68,800.

Required:

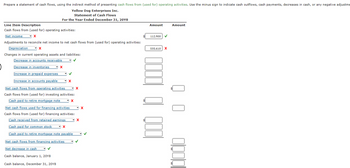

Prepare a statement of cash flows, using the indirect method of presenting cash flows from (used for) operating activities. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.

Yellow Dog Enterprises Inc.

Transcribed Image Text:Prepare a statement of cash flows, using the indirect method of presenting cash flows from (used for) operating activities. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustme

Yellow Dog Enterprises Inc.

Statement of Cash Flows

For the Year Ended December 31, 20Y8

Amount

Amount

Line Item Description

Cash flows from (used for) operating activities:

Net income

Adjustments to reconcile net income to net cash flows from (used for) operating activities:

Depreciation

Changes in current operating assets and liabilities:

Decrease in accounts receivable

Decrease in inventories

Increase in prepaid expenses

Increase in accounts payable

Net cash flows from operating activities

Cash flows from (used for) investing activities:

Cash paid to retire mortgage note

Net cash flows used for financing activities

Cash flows from (used for) financing activities:

Cash received from retained earnings

Cash paid for common stock

Cash paid to retire mortgage note payable

Net cash flows from financing activities

Net decrease in cash

Cash balance, January 1, 20Y8

Cash balance, December 31, 20Y8

112,900

535,610 X

Q |

Q

000

0000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Use the following information from Birch Companys balance sheets to determine net cash flows from operating activities (indirect method), assuming net income for 2018 of $122,000.arrow_forwardPreparing a Statement of Cash Flows Volusia Company reported the following comparative balance sheets for 2019: Required: Prepare a statement of cash flows for Volusia using the indirect method to compute net cash flow from operating activities.arrow_forwardUse the following information from Juniper Companys financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018.arrow_forward

- Use the following excerpts from Unigen Companys financial information to prepare the operating section of the statement of cash flows (indirect method) for the year 2018.arrow_forwardUse the following information from Eiffel Companys financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018.arrow_forwardUse the following excerpts from Tungsten Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forward

- Use the following information from Honolulu Companys financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018.arrow_forwardUse the following excerpts from Stern Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forwardUse the following excerpts from Fromera Companys financial information to prepare the operating section of the statement of cash flows (direct method) for the year 2018.arrow_forward

- Statement of Cash Flows The comparative balance sheet of Kit Kat Company for December 31, 2019 and 2018, is as follows: Kit Kat Company Comparative Balance Sheet December 31, 2019 and 2018 Assets 2019 2018 Cash $140,350 95,900 Accounts receivable (net) 95,300 102,300 Inventories 165,200 157,900 Prepaid expenses 6,240 5,860 Investment (long-term) 35,700 84,700 Land 75,000 90,000 Buildings 375,000 260,000 Accumulated depreciation – buildings (71,300) (58,300) Machinery and equipment 428,300 428,300 Accumulated depreciation – machinery and equipment (148,500) (138,000) Patents 58,000 65,000 Total Assets $1,159,290 $1,093,660 Liabilities and Stockholders’ Equity Accounts Payable (Merchandise Creditors) 43,500 46,700 Accrued expenses payable (operating expenses)…arrow_forwardHow do you calculate a statement of Cash Flows using the below details: Maple Group Ltd Comparative Balance Sheet December 31, 2020 and 2019 2020 2019 Increase/Decrease Assets Cash and cash Equivalent $ 51,500.00 $ 45,400.00 $ 6,100.00 Accounts Receivable $ 51,100.00 $ 61,400.00 $ 10,000.00 Inventories $ 61,400.00 $ 51,900.00 $ 9,500.00 Fixed Assets, net $ 160,000.00 $ 110,000.00 $ 50,000.00 Total Assets $ 324,000.00 $ 268,700.00 $ 55,600.00 Liabilities Accounts Payable $ 35,450.00 $ 27,800.00 $ 7,650.00 Accrued liabilities $ 31,000.00 $ 37,550.00 -$ 6,550.00 Long-term notes payable $ 60,000.00 $ 78,540.00 -$ 18,540.00 Stockholders Equity: Common Stock $ 143,050.00 $ 105,110.00 $ 37,940.00 Retained Earnings $ 54,800.00 $…arrow_forwardSTATEMENT OF CASH FLOWS An entity presented the following comparative financial information: 2018 2017 Property, plant and equipment 2,190,000 1,440,000 Accumulated depreciation 450,000 270,000 Long-term investments 225,000 - Prepaid expenses 351,000 315,000 Merchandise inventory 1,950,000 1,260,000 Accounts receivable, net of allowance 1,560,000 1,080,000 Cash 690,000 640,000 Share capital-ordinary 3,000,000 2,400,000 Retained earnings 906,000 688,000 Long-term note payable 1,275,000 1,095,000 Accounts payable 309,000 282,000 Dividend payable 201,000 - Accrued expenses 825,000 - 2018 2017 Net credit sales 7,020,000 3,753,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning