Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

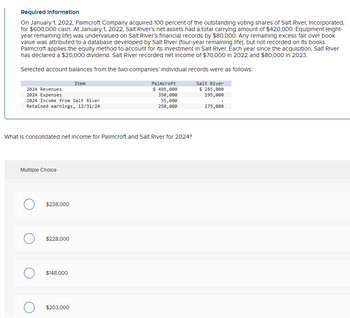

Transcribed Image Text:Required Information

On January 1, 2022, Palmcroft Company acquired 100 percent of the outstanding voting shares of Salt River, Incorporated,

for $600,000 cash. At January 1, 2022, Salt River's net assets had a total carrying amount of $420,000. Equipment (eight-

year remaining life) was undervalued on Salt River's financial records by $80,000. Any remaining excess fair over book

value was attributed to a database developed by Salt River (four-year remaining life), but not recorded on its books.

Palmcroft applies the equity method to account for its Investment in Salt River. Each year since the acquisition, Salt River

has declared a $20,000 dividend. Salt River recorded net income of $70,000 in 2022 and $80,000 in 2023.

Selected account balances from the two companies' individual records were as follows:

2024 Revenues

2024 Expenses

Item

2024 Income from Salt River

Retained earnings, 12/31/24

Palmcroft

$ 498,000

350,000

55,000

250,000

What is consolidated net income for Palmcroft and Salt River for 2024?

Multiple Choice

○ $238,000

○ $228,000

$148,000

$203,000

Salt River

$ 285,000

195,000

175,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Required Information On January 1, 2022, Palmcroft Company acquired 100 percent of the outstanding voting shares of Salt River, Incorporated, for $600,000 cash. At January 1, 2022, Salt River's net assets had a total carrying amount of $420,000. Equipment (eight- year remaining life) was undervalued on Salt River's financial records by $80,000. Any remaining excess fair over book value was attributed to a database developed by Salt River (four-year remaining life), but not recorded on its books. Palmcroft applies the equity method to account for its Investment in Salt River. Each year since the acquisition, Salt River has declared a $20,000 dividend. Salt River recorded net income of $70,000 in 2022 and $80,000 in 2023. Selected account balances from the two companies' individual records were as follows: 2024 Revenues 2024 Expenses Item 2024 Income from Salt River Retained earnings, 12/31/24 Palmcroft $ 498,000 350,000 55,000 250,000 Salt River $ 285,000 195,000 175,000 What is…arrow_forwardhow much is the non-controlling interest in net assets as of December 31, 2022?arrow_forwardOn July 1, 2022 the ABC Company acquired the net assets of XYZ Company for P8,000,000. The recorded assets and liabilities of XYZ Corporation on July 1, 2022, immediately before the acquisition are as follows: Cash P 800,000 Inventory 2,400,000 Property and equipment, net 4,800,000 Liabilities 1,800,000 On July 1, 2022 it was determined that the inventory of XYZ had a fair value of P1,900,000, and the property and equipment, net had a fair value of P5,600,000. What is the amount of goodwill (gain on bargain purchase) that will be reported in the books of ABC?arrow_forward

- Please do not provide answer in image formate thank you. The DeBlois Family Co. acquired 40% of Orange Beach Co. with a $500,000 payment on January 1, 2023. The equivalent net book value (40% share) of Orange Beach on the date of acquisition was $425,000. $50,000 of the excess payment was attributable to equipment with a 10-year remaining life. The remainder of the excess payment was not attributable to any identifiable item. Orange Beach Co. Reported net income of $40,000 in 2023 No dividends were paid out. On January 1, 2024, DeBlois Family Co.Acquired an additional 50% ownership share in Orange Beach Co. With a cash payment of $700,000. The fair value of the noncontrolling interest was determined to be $140,000 on the date of acquisition. The total fair value of Orange Beach's identifiable assets and liabilities on January 1, 2024, was $1,000,000. The trading value of stock shares remained the same as acquisition date prices for several months after January 1, 2024. Orange Beach Co.…arrow_forwardVisuarrow_forwardOn March 31, 2018, Elf Hotels purchased Reindeers and Riders Company for $6,000,000. Reindeers reported the following balance sheet on the date of the acquisition:arrow_forward

- AAA Inc. acquired on January 1, 2016 all the issued and outstanding common shares of BBB Inc. for P320,000 and BBB Inc. is dissolved. On this day, the assets and liabilities of BBB Inc. show: Cash P 30,000 Merchandise inventory 90,000 Plant and equipment 160,000 Goodwill 50,000 Liabilities ( 60,000) Per appraisal, plant and equipment and merchandise inventory were valued at P190,000 and P75,000, respectively. The journal entry in the books of the acquirer would include a debit to Plant and equipment amounting to The amount of goodwill from this transaction is:arrow_forwardAccounting On January 1, 2022, Pronto Company acquired all of Speedy Inc.'s voting stock for $28,800,000. Speedy's net assets were reported at amounts approximating book value, but Pronto determined that Speedy had the following previously unreported intangible assets: Developed technology, fair value $2,400,000, 5-year life • Favorable leases, fair value $1,200,000, 4-year life ● Speedy's shareholders' equity on January 1, 2022, was $12,000,000. It is now December 31, 2023 (two years later). Speedy reported net income of $960,000 in 2022. There are no impairments of identifiable intangibles or goodwill in 2022 or 2023. Pronto uses the complete equity method to report its investment in Speedy on its own books. Speedy's December 31, 2023, trial balance appears below. Dr (Cr) $24,000,000 Current assets Property and equipment, net 60,000,000 Liabilities (69,600,000) Capital stock (2,400,000) Retained earnings, January 1 (10,560,000) Sales revenue (84,000,000) Cost of goods sold 72,000,000…arrow_forwardparrow_forward

- Please solve this question general accountingarrow_forwardPritano Company acquired all the net assets of Succo Company on December 31, 2013, for $2,145,600 cash. The balance sheet of Succo Company immediately prior to the acquisition showed: Book value Fair value Current assets $ 995,110 $995,110 Plant and equipment 979,390 1,375,740 Total $1,974,500 $2,370,850 Liabilities $187,040 $235,560 Common stock 524,720 Other contributed capital 588,400 Retained earnings 674,340 Total $1,974,500 As part of the negotiations, Pritano Company agreed to issue 9,230 additional shares of its $10 par value common stock to the stockholders of Succo if the average postcombination earnings over the next three years equaled or exceeded $2,481,300. The fair value of the contingent consideration on the date of acquisition was estimated to be $219,700. The contingent consideration (earnout) was classified as equity rather than as a liability.…arrow_forwardCheck my we Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2022. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired. Demers earns income and pays dividends as follows: 2022 2023 2024 Net income $ 100,000 Dividends 40,000 $ 120,000 50,000 $ 130,000 60,000 Assume the equity method is applied. Compute Pell's investment account balance in Demers at December 31, 2024. Multiple Choice $639,000 $643.200 $763,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub