Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

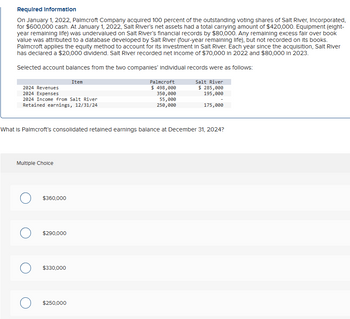

Transcribed Image Text:Required Information

On January 1, 2022, Palmcroft Company acquired 100 percent of the outstanding voting shares of Salt River, Incorporated,

for $600,000 cash. At January 1, 2022, Salt River's net assets had a total carrying amount of $420,000. Equipment (eight-

year remaining life) was undervalued on Salt River's financial records by $80,000. Any remaining excess fair over book

value was attributed to a database developed by Salt River (four-year remaining life), but not recorded on its books.

Palmcroft applies the equity method to account for its Investment in Salt River. Each year since the acquisition, Salt River

has declared a $20,000 dividend. Salt River recorded net income of $70,000 in 2022 and $80,000 in 2023.

Selected account balances from the two companies' individual records were as follows:

2024 Revenues

2024 Expenses

Item

2024 Income from Salt River

Retained earnings, 12/31/24

Palmcroft

$ 498,000

350,000

55,000

250,000

Salt River

$ 285,000

195,000

175,000

What is Palmcroft's consolidated retained earnings balance at December 31, 2024?

Multiple Choice

○ $360,000

○ $290,000

$330,000

○ $250,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Required Information On January 1, 2022, Palmcroft Company acquired 100 percent of the outstanding voting shares of Salt River, Incorporated, for $600,000 cash. At January 1, 2022, Salt River's net assets had a total carrying amount of $420,000. Equipment (eight- year remaining life) was undervalued on Salt River's financial records by $80,000. Any remaining excess fair over book value was attributed to a database developed by Salt River (four-year remaining life), but not recorded on its books. Palmcroft applies the equity method to account for its Investment in Salt River. Each year since the acquisition, Salt River has declared a $20,000 dividend. Salt River recorded net income of $70,000 in 2022 and $80,000 in 2023. Selected account balances from the two companies' individual records were as follows: 2024 Revenues 2024 Expenses Item 2024 Income from Salt River Retained earnings, 12/31/24 Palmcroft $ 498,000 350,000 55,000 250,000 What is consolidated net income for Palmcroft and…arrow_forwardOn January 1, 2022, Palmcroft Company acquired 100 percent of the outstanding voting shares of Salt River, Incorporated, for $776,000 cash. At January 1, 2022, Salt River’s net assets had a total carrying amount of $543,200. Equipment (eight-year remaining life) was undervalued on Salt River’s financial records by $126,000. Any remaining excess fair over book value was attributed to a database developed by Salt River (four-year remaining life), but not recorded on its books. Palmcroft applies the equity method to account for its investment in Salt River. Each year since the acquisition, Salt River has declared a $46,000 dividend. Salt River recorded net income of $111,000 in 2022 and $125,600 in 2023. Selected account balances from the two companies’ individual records were as follows: Items Palmcroft Salt River 2024 Revenues $ 554,000 $ 349,400 2024 Expenses 362,000 251,000 2024 Income from Salt River 55,950 - Retained earnings, 12/31/24 298,150 231,300 On its…arrow_forwarddevubenarrow_forward

- On March 31, 2021, JISOO Company purchased 32,000 shares of the 40,000 outstanding shares of ROSECompany at a price of P1,200,000 with an excess of P30,000 over the book value of ROSE Company’snet assets. P13,000 of the excess is attributed to an undervalued equipment with a remaining usefullife of 10 years from the date of acquisition and the rest of the amount is attributed to goodwill. Forthe year 2021, JISOO Company reported a net income of P750,000 and paid dividends of P180,000.While ROSE Company reported a net income of P240,000 which was evenly earned during the yearand paid dividends to JISOO Company amounting to P39,000. Goodwill was not impaired in 2021.The retained earnings of JISOO Company at the end of 2021 per books is P1,025,000. JISOO Companyuses the cost method to account for its investment in ROSE Company. Non-controlling interest ismeasured at fair market value. Requirement:Compute for the non-controlling interest in net assets on December 31, 2021.arrow_forwardFollowing are selected account balances from Penske Company and Stanza Corporation as of December 31, 2018:On January 1, 2018, Penske acquired all of Stanza’s outstanding stock for $680,000 fair value in cash and common stock. Penske also paid $10,000 in stock issuance costs. At the date of acquisition, copyrights (with a six-year remaining life) have a $440,000 book value but a fair value of $560,000.a. As of December 31, 2018, what is the consolidated copyrights balance?b. For the year ending December 31, 2018, what is consolidated net income?c. As of December 31, 2018, what is the consolidated retained earnings balance?d. As of December 31, 2018, what is the consolidated balance to be reported for goodwill?arrow_forwardOn January 2, 2019, Peace Co. acquired 80% of the outstanding common stock of Shade Co. for ₱1,344,000 with no goodwill resulting from the acquisition. The following selected account balances were taken from the accounting records of Shade Co. BV FV Building 12,000,000 12,400,000 Machinery 620,000 500,000 The building has an estimated useful life of 10 years and the equipment is expected to last for 5 years. For the year 2019, Peace Co. reported net income from own operations of ₱2,240,000 and Shade Co. reported ₱600,000 net income from own operations. Peace Co. accounts its investment in Shade Co. using the cost method. What is the consolidated income statement for the year 2019.arrow_forward

- On January 3, 2020, Novak Limited purchased 3,500 (35%) of the common shares of Sonja Corp. for $468,900. The following information is provided about the identifiable assets and liabilities of Sonja at the date of acquisition: Carrying Amount Fair Value Assets not subject to depreciation $516,000 $516,000 Assets subject to depreciation (10 years remaining) 806,000 866,000 Total identifiable assets 1,322,000 1,382,000 Liabilities 108,000 108,000 During 2020, Sonja reported the following information on its statement of comprehensive income: Income before discontinued operations $208,000 Discontinued operations (net of tax) (71,900) Net income and comprehensive income 136,100 Dividends declared and paid by Sonja November 15, 2020 124,000 Assume that the 35% interest is enough to make Sonja an associate of Novak, and that Novak is required to apply IFRS for its financial reporting. The fair…arrow_forwardOn January 1, 2022, Lucas Company acquired 85% of outstanding shares of Luna Corp. The consideration transferred includes cash payment of P2,000,000 and issuance of 50,000 shares with a market price of P45 per share. The book value of Luna Corp.’s identifiable net assets approximate its fair value, except for the following: • Merchandise inventory’s fair value is lower than the book balance by 150,000. • Equipment-A, with 2 years remaining useful life, costing P300,000 is understated by P50,000. • Land with a fair value of P500,000 is recognized in the books amounting to P350,000. The following events happened to Luna Corp. • Equipment-A was sold in June 30, 2023 for P320,000. • 60% of merchandise inventory were sold in 2022. • There is no movement as to the ordinary shares of Luna Corp during the year. The unadjusted trial balance as of December 31, 2022 were as follows: Lucas Company Luna Corp Cash 2,240,000 1,800,000 Trade Receivables 1,000,000 960,000 Merchandise Inventory…arrow_forwardAdams Corporation acquired 90 percent of the outstanding voting shares of Barstow, Inc., on December 31, 2019. Adams paid a total of $603,000 in cash for these shares. The 10 percent noncontrolling interest shares traded on a daily basis at fair value of $67,000 both before and after Adams's acquisition. On December 31, 2019, Barstow had the following account balances: Current assets Land Buildings (10-year remaining life) Equipment (5-year remaining life) Patents (10-year remaining life) Notes payable (due in years) Common stock Retained earnings, 12/31/19 Debits Current assets Land Buildings. Equipment Investment in Barstow, Inc. Cost of goods sold Depreciation expense December 31, 2021, adjusted trial balances for the two companies follow: Adams Corporation Interest expense Dividends declared Total debits Credits Notes payable Common stock Retained earnings, 1/1/21 Revenues Investment income Total credits Book Value $ 160,000 120,000 220,000 160,000 $ 0 (200,000) (180,000) (280,000)…arrow_forward

- On January 2, 2019, ABC Co. acquired 80% of the outstanding common stock of Shade Co. for ₱1,344,000 with no goodwill resulting from the acquisition. The following selected account balances were taken from the accounting records of XYZ Co. Details shown doe XYZ Co. in the image. The building has an estimated useful life of 10 years and the equipment is expected to last for 5 years. For the year 2019, ABC Co. reported net income from own operations of ₱2,240,000 and XYZ Co. reported ₱600,000 net income from own operations. ABC Co. accounts its investment in XYZ Co. using the cost method. What is the consolidated income statement for the year 2019. NCI in the consolidated FS for the year 2019.arrow_forwardM On January 1, 2023, Stream Company acquired 21 percent of the outstanding voting shares of Q-Video, Incorporated, for $718,000. Q- Video manufactures specialty cables for computer monitors. On that date, Q-Video reported assets and liabilities with book values of $2.6 million and $768,000, respectively. A customer list compiled by Q-Video had an appraised value of $312,000, although it was not recorded on its books. The expected remaining life of the customer list was six years with straight-line amortization deemed appropriate. Any remaining excess cost was not identifiable with any particular asset and thus was considered goodwill Q-Video generated net income of $284,000 in 2023 and a net loss of $108,000 in 2024 In each of these two years, Q-Video declared and paid a cash dividend of $10,000 to its stockholders During 2023, Q-Video sold inventory that had an original cost of $80,000 to Stream for $160,000. Of this balance, $77,000 was resold to outsiders during 2023, and the…arrow_forwardOn January 1, 2022, Matsui Co. purchased 42% of the outstanding voting common stock of Yankee, Inc. for $300,500. The book value of the acquired shares was $275,500. The excess of cost over book value is attributable to an intangible asset on Yankee's books that was undervalued and had a remaining useful life of five years. For the year ended December 31, 2022, Yankee reported net income of $125,750 and paid cash dividends of $25,700. What is the carrying value of Matsui's investment in Yankee at December 31, 2022? Multiple Choice $342,521. $337,521. $289,706. $300,500.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub