Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

You must use formulas and cell references PV of Payments when computing all values in the green cells

Problem 1: Calculate the duration of a $1,000, 6% coupon bond with three years to maturity. Assume that all market interest rates are 7%

Problem 1b: Consider the bond in Problem 1a. Calculate

the expected price change if interest rates

drop to 6.75% using the duration approximation.

Also calculate the actual price change using discounted cash flow.

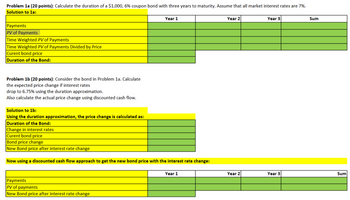

Transcribed Image Text:Problem 1a (20 points): Calculate the duration of a $1,000, 6% coupon bond with three years to maturity. Assume that all market interest rates are 7%.

Solution to 1a:

Payments

PV of Payments

Year 1

Year 2

Year 3

Time Weighted PV of Payments

Time Weighted PV of Payments Divided by Price

Curent bond price

Duration of the Bond:

Problem 1b (20 points): Consider the bond in Problem 1a. Calculate

the expected price change if interest rates

drop to 6.75% using the duration approximation.

Also calculate the actual price change using discounted cash flow.

Solution to 1b:

Using the duration approximation, the price change is calculated as:

Duration of the Bond:

Change in interest rates

Curent bond price

Bond price change

New Bond price after interest rate change

Now using a discounted cash flow approach to get the new bond price with the interest rate change:

Payments

PV of payments

New Bond price after interest rate change

Year 1

Sum

Year 2

Year 3

Sum

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider the following bonds: •Bond A: A 2-year zero-coupon bond with a face value of $100 and 6% YTM. •Bond B: A 2-year par-value bond with a face value of $100 and 6% coupon rate. *Bond C: A 2-year par-value bond with a face value of $100 and 7% coupon rate. Suppose the yield curve shifts upwards by one percent. Which bond among bonds A, B, and C will experience the largest percentage price change? Which will have the lowest percentage price change? O a. Bond A; Bond C O b. Bond A; Bond B O c. Bond B; Bond C O d. Bond C; Bond Barrow_forwardConsider a 10-year bond with a face value of $1,000 that has a coupon rate of 5.8%, with semiannual payments.arrow_forwardBonds have a maturity risk premium that can be modeled as the following:MRP = (t-1) 0.3%were t represents the years to maturity. What is the Maturity risk premium of a bond that matures in 8 years? answer in % without the symbolarrow_forward

- Need help finding the current yield for both bond P and D, & the capital yield gains for both bonds P and D. Thank you in advancearrow_forwardQ2. Duration and Convexity Bond A has face value at $1,000, coupon rate of 6% paid semi-annually, 5 years to maturity, and a yield to maturity of 7%. a. Using the bond pricing formula, calculate the price of the bond and duration. ABC b. Calculate the convexity of the bond. c. Using the calculations from above, what is the "approximated bond price change" using duration and convexity, if the interest rate increases by 1%? d. What is the actual change in the bond price if the interest rate increases by 1%? e. Based on c) and d) above, discuss the roles of duration and convexity in estimating the price change. Which risk measure plays a bigger role? f. Suppose you have two bonds with the same maturity date but one bond has a 10% coupon rate while the other has a 5% coupon rate. Which of these two bonds would have a higher duration?arrow_forward2. Consider a bond with a 7.5% annual coupon rate and a face value of $1,000. Calculate the bond price and duration & show your work. Years to Maturity Interest rate Bond Price Duration 4 6. 6. 9. What relationship do you observe between yield to maturity and the current market value? What is the relationship between YTM and duration?arrow_forward

- Subject:- financearrow_forwardA fixed rate bond with notional 1 pays annual coupons of c at times T1,T2,...,Tn whereTi+1 =Ti+1andnotional1attimeTn. a) Write down the bond price Bc^(FXD)(t) at time t ≤ T in terms of ZCBs.arrow_forwardIf you have a coupon bond, its face value is $1,000 and the coupon rate is 4%. Complete the following table, then calculate the rate of return for the bond. If you know that it was purchased at the nominal value, comment on the results. due date return at maturity the price 2 0.02 3 0.04 5 0.06 Present Value Annuity value % n value % n 0.961 0.02 2 1.97 0.02 2 0.925 0.04 2 1.89 0.04 2 0.889 0.04 3 2.78 0.04 3 0.906 0.02 5 4.71 0.02 5 0.747 0.06 5 4.21 0.06 5arrow_forward

- K Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): 0 2 5 Period $19.53 a. What is the maturity of the bond (in years)? b. What is the coupon rate (as a percentage)? c. What is the face value? Cash Flows View an example Get more help. ★ a. What is the maturity of the bond (in years)? The maturity is years. (Round to the nearest integer.) A 6 1 MacBook Pro & 7 $19.53 * 8 9 C 59 $19.53 60 $19.53+$1,000 Clear all BUB 0 {arrow_forwardExercise: Dirty/cleanPrice calculation A bond has face value of $1000. The bond’s yield to maturityis 6% andthe annual coupon rate is 8% with semiannual coupon payments.The maturity of the bond is 5years. The bond was issued on 1/1/2017, and one bought on 4/1/2018. Answer the following three questions: a.What is the dirty price of the bond? b.What is the accrual interest of the bond? c.What is its clean price?arrow_forwardSee attached question: Thank you.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education