ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

I believe the

Transcribed Image Text:Price (dollars per ton)

1,000

800

600

400

200

0

1

2

3

4

5

D

6

Steel (millions of tons per year)

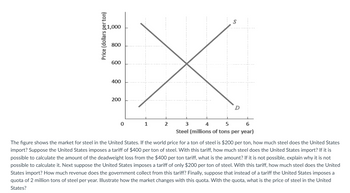

The figure shows the market for steel in the United States. If the world price for a ton of steel is $200 per ton, how much steel does the United States

import? Suppose the United States imposes a tariff of $400 per ton of steel. With this tariff, how much steel does the United States import? If it is

possible to calculate the amount of the deadweight loss from the $400 per ton tariff, what is the amount? If it is not possible, explain why it is not

possible to calculate it. Next suppose the United States imposes a tariff of only $200 per ton of steel. With this tariff, how much steel does the United

States import? How much revenue does the government collect from this tariff? Finally, suppose that instead of a tariff the United States imposes a

quota of 2 million tons of steel per year. Illustrate how the market changes with this quota. With the quota, what is the price of steel in the United

States?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Price per Saddle Domeslic Supply P2 Tariff World Price P1 G Domestic Demand Q3 Q4 Quantity of Saddles Q1 Q2 With the tariff in place, the deadweight loss is denoted by OD+F OD + E + F OC+D + E+ Farrow_forwardTariffs cause deadweight loss because they move the price of an imported product closer to the equilibrium without trade, thus reducing the gains from trade. A. True B. Falsearrow_forwardThe graph above is the U.S. market for some imported good. Supply is a flat curve. The U.S. can import the Chinese good for $40 and the Mexican good for $48. Assume the U.S. imposes $10 tariffs on each unit of the imported good. What will be the quantity imported? From which country? How your answer will change if the U.S. keep the $10 tariffs but join a trade bloc with Mexico? Will the country’s wellbeing increase or decrease? By how much (hint find the change in consumer surplus and the change in government revenue)? Explain your answers.arrow_forward

- Price P1 P3 Y V P2 U D Quantity Q1 Q4 Qs Q3 Figure 4 Domestic market for a good Figure 4 shows a country's domestic market for a good. There is perfect competition. The supply curve, S, is the domestic producers' supply curve for the good. D is the domestic consumers' demand curve. With free trade, the price in the domestic economy equals the world price, P2. However the domestic government has imposed a tariff on imports that has raised the price of the good in the domestic economy from P2 to P3. Which area or areas of the diagram show the government's tariff revenue? Select one answer. Select one: O Z O w plus Y ох O X plus Z Narrow_forwardThe following is not the cost of the tariff a. area a b. area b c. area d d. area a+b+c+darrow_forwardThe US, the domestic country, is currently operating a price of $14 per hammer. The US and China are not engaging in international trade. A new treaty is signed, and the world price and domestic price of the product are now $10 per unit. The US producers claim that this new treaty will harm them. The world price of hammers is $10 per hammer before and after the treaty. A. Calculate the consumer surplus before international trade is allowed. Show your work. A. Calculate the consumer surplus after international trade is allowed. Show your work. C. Will the producers in the domestic economy support or argue against opening up to international trade? Briefly explain and support your answer.arrow_forward

- Why do low income countries have higher tariffs than high income countries?arrow_forwardPrice of Wagons gain by $240 lose by $240 gain by $120 lose by $75 $18.5 8 5 1 0 40 70 90 Domestic Supply World Price Domestic Demand Quantity of Wagons Refer to the figure above. If this country allows free trade in wagons, how much will consumers gain or lose?arrow_forwardIf Indonesia (which is a small country) imposes an import tariff on textile imports, we can conclude that:(a) The world price of textile rises, and Indonesia imports less.(b) The world price of textile stays constant, and Indonesia imports less.(c) The world price of textile falls, and Indonesia imports less.(d) The world price of textile stays constant, and Indonesia imports the same as before. Explain why.arrow_forward

- The figure provided shows the Canadian domestic market for calculators. Price of calculators $450 40 30 20 25 10 S world price with tariff world price Fore 50 100 200 300 400 500 600 700 800 900 Quantity of calculators If the world price is $5 and an import quota of 600 is imposed, the price after the quota, in numerals, isarrow_forwardWhat are the benefits and costs of import tariffs?arrow_forwardIs it good or bad for American consumers when the United states puts tariffs on imports?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education