Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

PLEASE HELP ME WITH THIS ACCOUNTING PROBLEM!!!

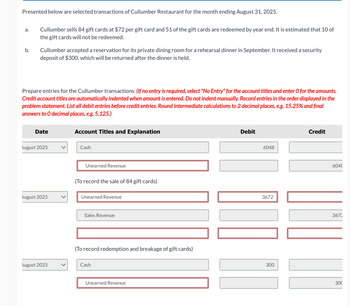

Transcribed Image Text:Presented below are selected transactions of Cullumber Restaurant for the month ending August 31, 2025.

a.

b.

Cullumber sells 84 gift cards at $72 per gift card and 51 of the gift cards are redeemed by year end. It is estimated that 10 of

the gift cards will not be redeemed.

Cullumber accepted a reservation for its private dining room for a rehearsal dinner in September. It received a security

deposit of $300, which will be returned after the dinner is held.

Prepare entries for the Cullumber transactions. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts.

Credit account titles are automatically indented when amount is entered. Do not indent manually. Record entries in the order displayed in the

problem statement. List all debit entries before credit entries. Round intermediate calculations to 2 decimal places, e.g. 15.25% and final

answers to O decimal places, e.g. 5,125.)

Date

August 2025

August 2025

Account Titles and Explanation

Cash

Unearned Revenue

(To record the sale of 84 gift cards)

Unearned Revenue

Sales Revenue

August 2025

(To record redemption and breakage of gift cards)

Cash

Unearned Revenue

Debit

6048

3672

300

Credit

6048

3672

300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On December 1, 2019, AwakcAllNight Inc. sells 5,000 super caffeinated candy bars to Campus Grocers. The candy bars sell for 3 per bar. In addition, AwakcAllNight pays Campus Grocers a 900placement fee to ensure that its candy bars are always stocked prominently by the cash register. The 900 is paid at the end of each month based on the results of random inspections of Campus Grocers by AwakcAllNight to ensure that the terms of the contract are being followed. Required: 1. Determine the transaction price for Awake AllNights revenue contract. 2. Prepare AwakeAllNights journal entries to recognize sales revenue and pay Campus Grocers the placement fee.arrow_forwardBavarian Bar and Grill opened for business in November 2021. During its first two months of operation, the restaurant sold gift cards in various amounts totaling $5,200, mostly as Christmas presents. They are redeemable for meals within two years of the purchase date, although experience within the industry indicates that 80% of gift cards are redeemed within one year. Gift cards totaling $1,300 were presented for redemption during 2021 for meals having a total price of $2,100. The sales tax rate on restaurant sales is 4%, assessed at the time meals (not gift cards) are purchased. Sales taxes will be remitted in January.Required:1. Prepare the appropriate journal entries (in summary form) for the gift cards and meals sold during 2021 (keeping in mind that, in actuality, each sale of a gift card or a meal would be recorded individually).2. Determine the liability for gift cards to be reported on the December 31, 2021, balance sheet.3. What is the appropriate classification (current or…arrow_forwardBavarian Bar and Grill opened for business in November 2021. During its first two months of operation, the restaurant sold gift cards in various amounts totaling $5,200, mostly as Christmas presents. They are redeemable for meals within two years of the purchase date, although experience within the industry indicates that 80% of gift cards are redeemed within one year. Gift cards totaling $1,300 were presented for redemption during 2021 for meals having a total price of $2,100. The sales tax rate on restaurant sales is 4%, assessed at the time meals (not gift cards) are purchased. Sales taxes will be remitted in January. Required: 1. Prepare the appropriate journal entries (in summary form) for the gift cards and meals sold during 2021 (keeping in mind that, in actuality, each sale of a gift card or a meal would be recorded individually). 2. Determine the liability for gift cards to be reported on the December 31, 2021, balance sheet. 3. What is the appropriate classification (current…arrow_forward

- RPS co-op introduced a loyalty program in 2020. every customer who signed up would receive 3% of their total purchases as a cheque, each February for the previuos year, that could br used in sotre on any merchandise eithin the next nine months. customers could look online during the year and check their balance at any time. Laura signed up for the program in 2020. when she purchased a kayak in July for 1100. later in september she purchased a mountain bike for 2200. in March 2021 she purchased a paddle board for 2100 and used her cheque toward the purchase. A) Record the sale of Kayak and loyalty points. B)Record sale of mountain bike and loyalty points C) Record the sales of paddleboard, use of rewards points, cheque towards its purchase and the rewards points earned on sale. D) In 2020 RPS Co-op had a total pf 497,000 in sales to customers who had signed up with the loyalty program. What is the amount of liability that woudl be created by these sale?arrow_forwardEscargot Inc. is a 5-star restaurant in Cincinnati. The restaurant sells 500 gift cards during January, Year 1. Each gift card has a face value of $300. The gift cards never expire, although based on industry experience, Escargot expects that 12% of the balances will never be redeemed. During February Year 1, S 45,000 of gift cards are redeemed, and in March Year 1, another $80, 000 is redeemed. Required: 1. Prepare journal entries for Escargot's gift card transactions for January through March. 2. Assume that at the end of April, due to the popularity of the restaurant, Escargot reduces its estimate of the amount of gift cards that will go unused to 8%. During April, gift cards worth $10, 000 are used. Prepare any necessary journal entries.arrow_forwardThe accountant for Eastern Appliances manages the “no money down” arrangements offered to its customers. A customer purchased a refrigerator normally priced at $1,284.53 with all taxes included. Using a required rate of return of 9% compounded quarterly, the accountant determined that, after a deferral period, the customer should make 12 monthly payments of $119.16, with the first payment due on November 1, 2020. On what date was the refrigerator purchased?arrow_forward

- Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.arrow_forwardLogan’s Roadhouse opened a new restaurant in November. During its first two months of operation, the restaurant sold gift cards in various amounts totaling $2,300. The cards are redeemable for meals within one year of the purchase date. Gift cards totaling $742 were presented for redemption during the first two months of operation prior to year-end on December 31. The sales tax rate on restaurant sales is 6%, assessed at the time meals (not gift cards) are purchased. Logan’s will remit sales taxes in January.Required:1. Record (in summary form) the $2,300 in gift cards sold (keeping in mind that, in actuality, each sale of a gift card or a meal would be recorded individually).2. Record the $742 in gift cards redeemed. (Hint: The $742 includes a 6% sales tax of $42.)3. Determine the balance in the Deferred Revenue account (remaining liability for gift cards) to be reported on the December 31 balance sheet.arrow_forwardAugust 2025. Cheyenne sells 80 gift cards at $70 per gift card and 53 of the gift cards are redeemed by year end. It is estimated that 10 of the gift cards will not be redeemed. How do you record redemption and breakage of gift cards?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT