Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

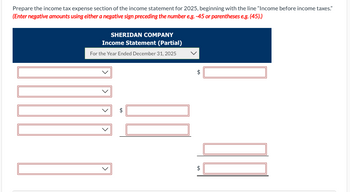

Transcribed Image Text:Prepare the income tax expense section of the income statement for 2025, beginning with the line "Income before income taxes."

(Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

SHERIDAN COMPANY

Income Statement (Partial)

For the Year Ended December 31, 2025

$

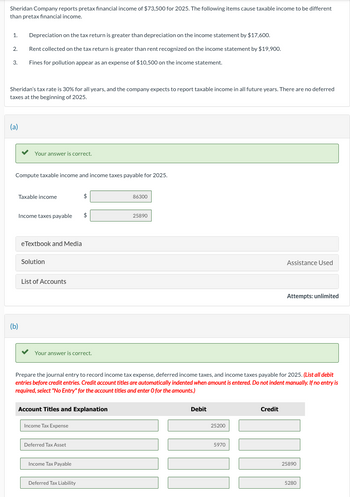

Transcribed Image Text:Sheridan Company reports pretax financial income of $73,500 for 2025. The following items cause taxable income to be different

than pretax financial income.

1.

Depreciation on the tax return is greater than depreciation on the income statement by $17,600.

2.

Rent collected on the tax return is greater than rent recognized on the income statement by $19,900.

3.

Fines for pollution appear as an expense of $10,500 on the income statement.

Sheridan's tax rate is 30% for all years, and the company expects to report taxable income in all future years. There are no deferred

taxes at the beginning of 2025.

(a)

Your answer is correct.

Compute taxable income and income taxes payable for 2025.

(b)

Taxable income

86300

Income taxes payable

$

25890

eTextbook and Media

Solution

List of Accounts

Your answer is correct.

Assistance Used

Attempts: unlimited

Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2025. (List all debit

entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is

required, select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

Income Tax Expense

Deferred Tax Asset

Income Tax Payable

Deferred Tax Liability

Debit

25200

5970

Credit

25890

5280

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Draft the income tax expense portion of the income statement for 2024. Begin with the line "Income before income taxes." Assume no permanent differences exist. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Current WILDHORSE INC.'s Income Statement (Partial) For the Year Ended December 31, 2024 +A +A 1665000 i +A $arrow_forwardCullumber Inc.'s only temporary difference at the beginning and end of 2024 is caused by a $3.75 million deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable (only one-half of which is classified as a current asset) is due in equal installments in 2025 and 2026. The related deferred tax liability at the beginning of the year is $1,125,000. In the third quarter of 2024, a new tax rate of 20% is enacted into law and is scheduled to become effective for 2026. Taxable income for 2024 is $6,250,000, and taxable income is expected in all future years.arrow_forwardDraft the income tax expense portion of the income statement for 2024. Begin with the line "Income before income taxes." Assume no permanent differences exist. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) WILDHORSE INC.'s Income Statement (Partial) For the Year Ended December 31, 2024 Income before Income Taxes Income Tax Expense Adjustment Current Net Income/(Loss) +A +A 1665000 i LA 5550000arrow_forward

- Prepare the income statement for 2023, beginning with the line "income before income taxes.arrow_forwardBlossom Inc reports the following pre-tax incomes (losses) for both financial reporting purposes and tax purposes Accounting Income Year (Loss) Tax Rate i 2021 $124,000 2022 91,000 2023 (287,000) 2024 218,000 The tax rates lated were all enacted by the beginning of 2021. Blossom reports under the ASPE future Income tavas method. Prepare the journal entries for each of the years 2021 to 2024 to record Income tax. Assume the texclosa la first carried back and that at the end of 2023, the loss carry forward benefits are judged more likely than not to be realized in the future. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem) Date Account Titles and Explanation (To record benefit from losa canryback) (To record deferred benefit from loss…arrow_forwardPlease answer all questionsarrow_forward

- Prepare the bottom portion of Sheridan's 2021 income statement, beginning with “Income from continuing operations before income taxes." (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Sheridan Corporation Income Statement (Partial) 2$ $ $arrow_forwardRequired: Prepare an accrual basis income statement for 2021. (Ignore income taxes.) STANLEY AND JONES LAWN SERVICE COMPANY Income Statement For the Year Ended December 31, 2021 Service revenue 410,000 %24arrow_forwardUsing the attached financial statement footnote. Explain why the application of time value is appropriate to account for the transaction.arrow_forward

- K McDaniel and Associates, Inc. reported the following amounts on its 2024 income statement: Year Ended December 31, 2024 Net income Income tax expense Interest expense $ 22,950 6,600 3,000 What was McDaniel's times-interest-earned ratio for 2024? OA. 7.65 OB. 10.85 OC. 9.85 OD. 8.65 point(s) possible ...arrow_forwardThe before-tax income for Kingbird Co. for 2025 was $107,000 and $77,200 for 2026. However, the accountant noted that the following errors had been made: 1. 2 3. 4. Sales for 2025 included amounts of $41,300 which had been received in cash during 2025, but for which the related products were delivered in 2026. Title did not pass to the purchaser until 2026. The inventory on December 31, 2025, was understated by $9,000. The bookkeeper in recording interest expense for both 2025 and 2026 on bonds payable made the following entry on an annual basis. Interest Expense 14,400 Cash 14,400 The bonds have a face value of $240,000 and pay a stated interest rate of 6%. They were issued at a discount of $16,000 on January 1, 2025, to yield an effective-interest rate of 7%. (Assume that the effective-interest method should be used.) Ordinary repairs to equipment had been erroneously charged to the Equipment account during 2025 and 2026. Repairs in the amount of $8,600 in 2025 and $9,000 in 2026…arrow_forwardFor its fiscal year ending October 31, 2020, Antonio Corporation reports the following partial data. Income before income taxes $423.000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning