Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

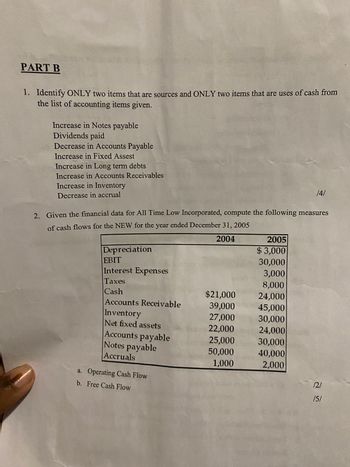

Transcribed Image Text:PART B

1. Identify ONLY two items that are sources and ONLY two items that are uses of cash from

the list of accounting items given.

Increase in Notes payable

Dividends paid

Decrease in Accounts Payable

Increase in Fixed Assest

Increase in Long term debts

Increase in Accounts Receivables

Increase in Inventory

Decrease in accrual

/4/

2. Given the financial data for All Time Low Incorporated, compute the following measures

of cash flows for the NEW for the year ended December 31, 2005

2004

Depreciation

EBIT

2005

$3,000

30,000

Interest Expenses

3,000

Taxes

8,000

Cash

$21,000

24,000

Accounts Receivable

39,000

45,000

Inventory

27,000

30,000

Net fixed assets

22,000

24,000

Accounts payable

25,000

30,000

Notes payable

50,000

40,000

Accruals

1,000

2,000

a. Operating Cash Flow

/2/

b. Free Cash Flow

/5/

25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Subject :- Accountingarrow_forwardhelp me answer these pleasearrow_forwardatio of Cash to Monthly Cash Expenses Financial data for Abrams Company follow: For Year EndedDecember 31 Cash on December 31 $54,270 Cash flow from operations (97,200) a. Compute the ratio of cash to monthly cash expenses. Round your answer to one decimal place.fill in the blank 1 months b. Interpret the results computed in (a).arrow_forward

- Using the Exhibit below, assume that the balance of Accounts Payable was $60,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Payable is $65,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts payable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on disposal of…arrow_forwardThe item listed below belongs on the Statement of Cash Flows. Using formulas and cell links, complete the Statement of Cash Flows. Items for the Statement of Cash Flowws 01/01/21 12/31/21 Increase (Decrease) Davidson Company Statment of Cash Flow For the Year Ended Dec, 31,2021 Cash 42,000 60,000 Accounts Recevable 254,000 314,200 Cash Flows from operation activities Inventory 78,500 117,100 Accounts Payable 164,200 204,800 Net Cash Provided used by operating Activities Short-term notes Payable 65,000 27,200 Cash Flows from investing Activities Net income for 2021 230,200 Purchase of Equipment 84,000 Net Cash Provided used by investing Activities Depreciation Expense 26,600 Payments of Cash Dividends 91,600 Cash Flows from Financing…arrow_forwardConcord Corporation had the following transactions that took place during the year: I. Recorded credit sales of $3050 I. Collected $1830 from customers III. Recorded sales returns of $610 and credited the customer's account. What is the total effect of these transactions on free cash flow? Cannot be determined O Increase Decrease O No Effectarrow_forward

- Using the Exhibit below, assume that the balance of Accounts Payable was $50,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Payable is $35,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts payable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on disposal of…arrow_forwardThe following items appeared on the financial statements of Washington Company. Line Item Description Amount Accounts receivable, January 1 $13,395 Accounts receivable, December 31 6,901 Accounts payable, January 1 5,645 Accounts payable, December 31 8,721 Inventory, January 1 6,686 Inventory, December 31 16,260 Sales 73,071 Cost of goods sold 34,443 Washington Company uses the direct method to report cash flows from (used for) operating activities. Assume that all accounts payable are owed to merchandise suppliers. Cash payments for merchandise werearrow_forwardCalculate the operating cash index for the below quarter.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education