Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Wildhorse Inc.'s only temporary difference at the beginning and end of 2024 is caused by a $3.33 million deferred gain for tax

purposes for an installment sale of a plant asset, and the related receivable (only one-half of which is classified as a current asset) is

due in equal installments in 2025 and 2026. The related deferred tax liability at the beginning of the year is $999,000. In the third

quarter of 2024, a new tax rate of 20% is enacted into law and is scheduled to become effective for 2026. Taxable income for 2024 is

$5,550,000, and taxable income is expected in all future years.

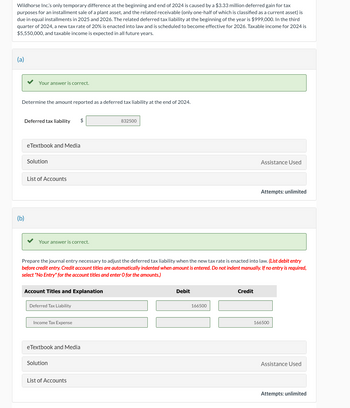

(a)

(b)

Your answer is correct.

Determine the amount reported as a deferred tax liability at the end of 2024.

Deferred tax liability

eTextbook and Media

Solution

List of Accounts

Your answer is correct.

832500

Assistance Used

Attempts: unlimited

Prepare the journal entry necessary to adjust the deferred tax liability when the new tax rate is enacted into law. (List debit entry

before credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required,

select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

Deferred Tax Liability

Debit

166500

Credit

Income Tax Expense

eTextbook and Media

Solution

List of Accounts

166500

Assistance Used

Attempts: unlimited

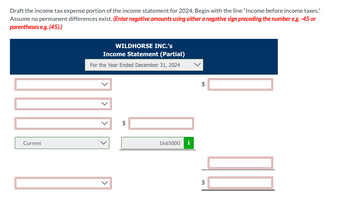

Transcribed Image Text:Draft the income tax expense portion of the income statement for 2024. Begin with the line "Income before income taxes."

Assume no permanent differences exist. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or

parentheses e.g. (45).)

Current

WILDHORSE INC.'s

Income Statement (Partial)

For the Year Ended December 31, 2024

+A

+A

1665000

i

+A

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cullumber Inc.'s only temporary difference at the beginning and end of 2024 is caused by a $3.75 million deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable (only one-half of which is classified as a current asset) is due in equal installments in 2025 and 2026. The related deferred tax liability at the beginning of the year is $1,125,000. In the third quarter of 2024, a new tax rate of 20% is enacted into law and is scheduled to become effective for 2026. Taxable income for 2024 is $6,250,000, and taxable income is expected in all future years.arrow_forwardDraft the income tax expense portion of the income statement for 2024. Begin with the line "Income before income taxes." Assume no permanent differences exist. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) WILDHORSE INC.'s Income Statement (Partial) For the Year Ended December 31, 2024 Income before Income Taxes Income Tax Expense Adjustment Current Net Income/(Loss) +A +A 1665000 i LA 5550000arrow_forwardThe before-tax income for Kingbird Co. for 2025 was $107,000 and $77,200 for 2026. However, the accountant noted that the following errors had been made: 1. 2 3. 4. Sales for 2025 included amounts of $41,300 which had been received in cash during 2025, but for which the related products were delivered in 2026. Title did not pass to the purchaser until 2026. The inventory on December 31, 2025, was understated by $9,000. The bookkeeper in recording interest expense for both 2025 and 2026 on bonds payable made the following entry on an annual basis. Interest Expense 14,400 Cash 14,400 The bonds have a face value of $240,000 and pay a stated interest rate of 6%. They were issued at a discount of $16,000 on January 1, 2025, to yield an effective-interest rate of 7%. (Assume that the effective-interest method should be used.) Ordinary repairs to equipment had been erroneously charged to the Equipment account during 2025 and 2026. Repairs in the amount of $8,600 in 2025 and $9,000 in 2026…arrow_forward

- Sh27arrow_forwardNash reported the following pretax financial income (loss) for the years 2020-2022. 2020 $98,400 2021 (116,000) 2022 147,600 Pretax financial income (loss) and taxable income (loss) were the same for all years involved. The enacted tax rate was 20% for 2020-2022. Prepare the journal entries for the years 2020-2022 to record income tax expense, income taxes payable, and the tax effects of the loss carryforward, assuming that based on the weight of available evidence, it is more likely than not that one-fifth of the benefits of the loss carryforward will not be realized. (Credit account titles are automatically indented when amount is entered. Do not indent manualy. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit 2020 2021 (To record refund) (To record allowance) 2022 (To record income taxes) (To adjust allowance)arrow_forwardThe information that follows pertains to Richards Refrigeration, Inc.: a. At December 31, 2021, temporary differences existed between the financial statement book values and the tax bases of the following: ($ in millions) Future Taxable Book Value Таx (Deductible) Basis Amount Buildings and equipment (net of accumulated depreciation) Prepaid insurance Liability-loss contingency $146 $103 $ $ 43 63 63 38 (38) b. No temporary differences existed at the beginning of 2021. c. Pretax accounting income was $213 million and taxable income was $145 million for the year ended December 31, 2021. The tax rate is 25%. Required: 1. Complete the following table given below and prepare the appropriate to record income taxes for 2021. 2. What is the 2021 net income? Complete this question by entering your answers in the tabs below. Required 1 Calculation Required 1 G) Required 2 Complete the following table given below to record income taxes for 2021. (Enter your answers in millions rounded to 2…arrow_forward

- Please answer all questionsarrow_forwardPrepare the bottom portion of Sheridan's 2021 income statement, beginning with “Income from continuing operations before income taxes." (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Sheridan Corporation Income Statement (Partial) 2$ $ $arrow_forwardA company makes the following journal entry for 2021: Dr. Income Tax Expense xxxx Dr. Deferred Tax Asset 80,000 Cr. Deferred Tax Liability 16,000 Cr. Income Tax Payable 200,000 On the income statement, the amount for deferred portion of income tax expense for 2021 appears as: _______________. (Very important: Just enter the amount. DO NOT put a plus or minus sign in front of the amount.)arrow_forward

- Prepare the income statement for 2023, beginning with the line "income before income taxes.arrow_forwardBrush Company has the following income before income tax and estimated effective annual income tax rates for the first three quarters of 2019.(Photo)Required:What should be Brush company estimated income for "First" quarter income statement? Select one:a. $54,600b. $39,000c. $46,800d. None of the other pointsarrow_forwardSee attached picture 1. Prepare the journal entries to record income tax expense, deferred income taxes, and income taxes payable for 2017 and 2018. Assume taxable income was $980,000 in 2018 2. Prepare the income tax expense section of the income statement for 2017, beginning with "Income before income taxes"arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning