FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

PLEASE HELP. FILL ALL EMPTY CELLS AND FIX THE RED INCORRECT CELLS!

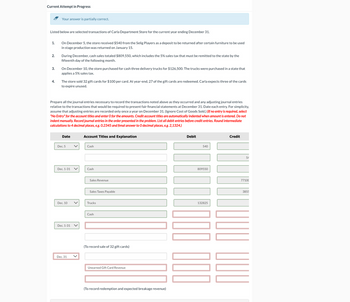

Transcribed Image Text:Current Attempt in Progress

Your answer is partially correct.

Listed below are selected transactions of Carla Department Store for the current year ending December 31.

1.

On December 5, the store received $540 from the Selig Players as a deposit to be returned after certain furniture to be used

in stage production was returned on January 15.

2.

During December, cash sales totaled $809,550, which includes the 5% sales tax that must be remitted to the state by the

fifteenth day of the following month.

3.

4.

On December 10, the store purchased for cash three delivery trucks for $126,500. The trucks were purchased in a state that

applies a 5% sales tax.

The store sold 32 gift cards for $100 per card. At year-end, 27 of the gift cards are redeemed. Carla expects three of the cards

to expire unused.

Prepare all the journal entries necessary to record the transactions noted above as they occurred and any adjusting journal entries

relative to the transactions that would be required to present fair financial statements at December 31. Date each entry. For simplicity,

assume that adjusting entries are recorded only once a year on December 31. (Ignore Cost of Goods Sold.) (If no entry is required, select

"No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not

indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries. Round intermediate

calculations to 4 decimal places, e.g. 0.2345 and fimal answer to O decimal places, e.g. 2,1324.)

Date

Account Titles and Explanation

Dec. 5

✓

Cash

Dec. 1-31

Cash

Sales Revenue

Sales Taxes Payable

Dec. 10

Trucks

Dec. 1-31

Dec. 31

<

Cash

(To record sale of 32 gift cards)

Unearned Gift Card Revenue

(To record redemption and expected breakage revenue)

Debit

540

809550

132825

Credit

54

77100

3855

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Listed below are selected transactions of Splish Department Store for the current year ending December 31. On December 5, the store received $470 from the Selig Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. 1. 2. 3. 4. During December, cash sales totaled $802.200, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. On December 10, the store purchased for cash three delivery trucks for $121.600. The trucks were purchased in a state that applies a 5% sales tax The store sold 30 gift cards for $100 per card. At year-end, 25 of the gift cards are redeemed. Splish expects three of the cards to expire unused. Prepare all the journal entries necessary to record the transactions noted above as they occurred and any adjusting journal entries relative to the transactions that would be required to present fair financial statements at December 31. Date each entry.…arrow_forwardPLEASEEEE HELP!arrow_forwardListed below are selected transactions of Schultz Department Store for the current year ending December 31. 1. On December 5, the store received $500 from the Selig Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. 2. During December, cash sales totaled $798,000, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. 3. 4. On December 10, the store purchased for cash three delivery trucks for $120,000. The trucks were purchased in a state that applies a 5% sales tax. The store sold 25 gift cards for $100 per card. At year-end, 20 of the gift cards are redeemed. Schultz expects three of the cards to expire unused. Prepare all the journal entries necessary to record the transactions noted above as they occurred and any adjusting journal entries relative to the transactions that would be required to present fair financial statements at December 31. Date each entry.…arrow_forward

- Listed below are selected transactions of Crane Department Store for the current year ending December 31. On December 5, the store received $490 from the Selig Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. 1. 2. During December, cash sales totaled $803,250, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. On December 10, the store purchased for cash three delivery trucks for $119,200. The trucks were purchased in a state that applies a 5% sales tax. 3. The store determined it will cost $91,600 to restore the area (considered a land improvement) surrounding one of its store parking lots, when the store is closed in 2 years. Crane estimates the fair value of the obligation at December 31 is $82,900. 4. Prepare all the journal entries necessary to record the transactions noted above as they occurred and any adjusting journal entries relative to the…arrow_forwardListed below are selected transactions of Schultz Department Store for the current year ending December 31. 1. On December 5, the store received $500 from the Selig Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. 2. During December, cash sales totaled $798,000, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. 3. On December 10, the store purchased for cash three delivery trucks for $120,000. The trucks were purchased in a state that applies a 5% sales tax. 4. The store sold 25 gift cards for $100 per card. At year-end, 20 of the gift cards are redeemed. Schultz expects three of the cards to expire unused. Prepare all the journal entries necessary to record the transactions noted above as they occurred and any adjusting journal entries relative to the transactions that would be required to present fair financial statements at December…arrow_forwardListed below are selected transactions of Baileys’ Department Store for the current year ending December 31.1. On December 5, the store received $500 from the Jackson Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15.2. During December, cash sales totaled $798,000, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month.3. On December 10, the store purchased for cash three delivery trucks for $120,000. The trucks were purchased in a state that applies a 5% sales tax.4. The store determined it will cost $100,000 to restore the area (considered a land improvement) surrounding one of its store parking lots, when the store is closed in 2 years. Baileys’ estimates the fair value of the obligation at December 31 is $84,000.5. As a result of uninsured accidents during the year, personal injury suits for $350,000 and $60,000 have been filed against the company. It is the…arrow_forward

- Listed below are selected transactions of Baileys’ Department Store for the current year ending December 31. 1. On December 5, the store received $500 from the Jackson Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. 2. During December, cash sales totaled $798,000, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. 3. On December 10, the store purchased for cash three delivery trucks for $120,000. The trucks were purchased in a state that applies a 5% sales tax. 4. The store determined it will cost $100,000 to restore the area (considered a land improvement) surrounding one of its store parking lots, when the store is closed in 2 years. Baileys’ estimates the fair value of the obligation at December 31 is $84,000. 5. As a result of uninsured accidents during the year, personal injury suits for $350,000 and $60,000 have been filed against the…arrow_forwardPrepare the journal entriesarrow_forwardnot use ai pleasearrow_forward

- PRACTICE PROBLEM Listed below are selected transactions of Scultz Department Store for the current year ending December 31. On December 5, the store received $500 from the Jackson Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. During December, cash sales totaled $798,000, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. On December 10, the store purchased for cash three delivery trucks for $120,000. The trucks were purchased in a state that applies a 5% sales tax. The store determined it will cost $100,000 to restore the area (considered a land improvement) surrounding one of its store parking lots, when the store is closed in 2 years. Schultz’ estimates the fair value of the obligation at December 31 is $84,000. As a result of uninsured accidents during the year, personal injury suits for $350,000 and $60,000 have been filed against the…arrow_forwardTo record redemption and expected breakage revenue)arrow_forwardListed below are selected transactions of Ben’s HomeGoods Store for the current year ending December 31, 2022. a) During December, credit card sales totaled $675,000, which includes the 8% sales tax that must be remitted to the state by the fifteenth day of the following month. (At time of sale, the total amount is recorded in Sales.) b) On December 1, the store received $5,000 from the local community theater for the rental of certain furniture to be used in a stage production during December and January. The furniture will be returned on February 1. c) On December 31 the store was notified it will be required to restore the area (considered a land improvement) surrounding one of its parking lots, when the store moves in 5 years. Ben determined it will cost $78,000 in 2027. Ben estimates the fair value of the asset retirement obligation on December 31, 2022 is $61,500. Prepare the necessary journal entries necessary to record the above transactions as they occurred and any adjusting…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education