Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

PLEASE HELP ME WITH THIS ACCOUNTING PROBLEM

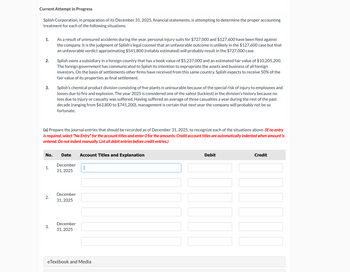

Transcribed Image Text:Current Attempt in Progress

Splish Corporation, in preparation of its December 31, 2025, financial statements, is attempting to determine the proper accounting

treatment for each of the following situations.

1.

2.

3.

As a result of uninsured accidents during the year, personal injury suits for $727,000 and $127,600 have been filed against

the company. It is the judgment of Splish's legal counsel that an unfavorable outcome is unlikely in the $127,600 case but that

an unfavorable verdict approximating $541,800 (reliably estimated) will probably result in the $727,000 case.

Splish owns a subsidiary in a foreign country that has a book value of $5,237,000 and an estimated fair value of $10,205,200.

The foreign government has communicated to Splish its intention to expropriate the assets and business of all foreign

investors. On the basis of settlements other firms have received from this same country, Splish expects to receive 50% of the

fair value of its properties as final settlement.

Splish's chemical product division consisting of five plants is uninsurable because of the special risk of injury to employees and

losses due to fire and explosion. The year 2025 is considered one of the safest (luckiest) in the division's history because no

loss due to injury or casualty was suffered. Having suffered an average of three casualties a year during the rest of the past

decade (ranging from $63,800 to $741,200), management is certain that next year the company will probably not be so

fortunate.

(a) Prepare the journal entries that should be recorded as of December 31, 2025, to recognize each of the situations above. (If no entry

is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is

entered. Do not indent manually. List all debit entries before credit entries.)

No.

Date

Account Titles and Explanation

December

1.

31, 2025

2.

3.

December

31, 2025

December

31, 2025

eTextbook and Media

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Xing Fu ltd., in preparation of its December 31, 2019, financial statements, is attempting to determine the proper accounting treatment for each of the following situations.1. As a result of uninsured accidents during the year, personal injury suits for €175,000 and €50,000 have been filed against the company. It is the judgment of Xing Fu's legal counsel that an unfavorable outcome is unlikely in the €50,000 case but that an unfavorable verdict approximating €150,000 will probably result in the €175,000 case.2. Xing Fu owns a subsidiary in a foreign country that has a book value of €6,500,000 and an estimated fair value of €10,000,000. The foreign government has communicated to Xing Fu its intention to expropriate the assets and business of all foreign investors. On the basis of settlements other firms have received from this same country, it is virtually certain that Xing Fu will receive 50% of the fair value of its properties as final settlement.3. Xing Fu operates profitably from a…arrow_forwardPolska Corporation, in preparation of its December 31, 2020, financial statements, is attempting to determine the proper accounting treatment for each of the following situations. 1. As a result of uninsured accidents during the year, personal injury suits for $350,000 and $60,000 have been filed against the company. It is the judgment of Polska’s legal counsel that an unfavorable outcome is unlikely in the $60,000 case but that an unfavorable verdict approximating $250,000 will probably result in the $350,000 case. 2. Polska owns a subsidiary in a foreign country that has a book value of $5,725,000 and an estimated fair value of $9,500,000. The foreign government has communicated to Polska its intention to expropriate the assets and business of all foreign investors. On the basis of settlements other firms have received from this same country, Polska expects to receive 40% of the fair value of its properties as final settlement. 3. Polska’s chemical product division consisting…arrow_forwardSunshine Limited, in preparation of its December 31, 2020, financial statements, is attempting to determine theproper accounting treatment for each of the following situations.1. As a result of uninsured accidents during the year, personal injury suits for $350,000 and $60,000 have beenfiled against the company. It is the judgement of Sunshine’s legal counsel that an unfavourable outcome isunlikely in the $60,000 case but that an unfavourable verdict approximating $250,000 will probably result in the$350,000 case.2. Sunshine Limited owns a subsidiary in a foreign country that has a book value of $5,725,000 and an estimatedfair value of $9,500,000. The foreign government has communicated to Sunshine its intention to expropriate theassets and business of all foreign investors. On the basis of settlements other firms have received from this samecountry, it is virtually certain that Sunshine will receive 40% of the fair value of its properties as final settlement.3. Sunshine’s chemical…arrow_forward

- Angel Company is preparing its December 31, 2022 financial statements. On February 1, 2023, a customer had an accident in one of the company’s stores and subsequently filed a negligence lawsuit on February 6 of that year. The company’s lawyer has advised Angel that the company could likely settle the lawsuit for $50,000. The company’s financial statements were issued on March 10, 2023. Which of the following is correct regarding this lawsuit? Answer a. The liability should not be accrued but it should be disclosed in the notes to the 2022 financial statements regardless of whether it is material. b. This is not a recognized subsequent event. c. The loss of $50,000 will be reported in the 2022 financial statements if the lawsuit is settled before the financial statements are issued. d. The company should accrue a contingent liability and report it in the 2022 financial statements. Net income for 2022 will decrease by $50,000 (ignoring taxes).arrow_forwardABC Inc. has is being sued by a customer. The plaintiff (customer) claims $50,000 for product deficiencies. The controller discussed the claim with legal counsel and the lawyer notes that the company is likely to lose the suit with an estimated payout of $50,000. The controller has identified this as a contingent loss (liability) and has accrued it in the financial statements and prepared the note disclosure. The financial statement note disclosure states the following: "During the year, ABC Inc. received a claim for an alleged product deficiency. ABC Inc. is defending the action however legal advice at this time indicated that is likely the claim could result in a loss for ABC İnc." ABC Inc. reports under ASPE. Required: a) Provide the path to the appropriate reference in the Handbook assuming the entity follows ASPE. b) Indicate what is missing from the note disclosure, if anything, for ABC Inc.arrow_forwardThe following selected circumstances relate to pending lawsuits for Erismus, Inc. Erismus’s fiscal year ends onDecember 31. Financial statements are issued in March 2019. Erismus prepares its financial statements accordingto U.S. GAAP.Required:Indicate the amount of asset or liability that Erismus would record, and explain your answer.1. Erismus is defending against a lawsuit. Erismus’s management believes the company has a slightly worse than50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,000,000.2. Erismus is defending against a lawsuit. Erismus’s management believes it is probable that the company willlose in court. If it loses, management believes that damages could fall anywhere in the range of $2,000,000 to$4,000,000, with any damage in that range equally likely.3. Erismus is defending against a lawsuit. Erismus’s management believes it is probable that the company willlose in court. If it loses, management believes that damages will…arrow_forward

- Eastern Manufacturing is involved with several situations that possibly involve contingencies. Each is described below. Eastern's fiscal year ends December 31, and the 2024 financial statements are issued on March 15, 2025, a. Eastern is involved in a lawsuit resulting from a dispute with a supplier. On February 3, 2025, judgment was rendered against Eastern in the amount of $118 million plus interest, a total of $133 million. Eastern plans to appeal the judgment and is unable to predict its outcome though it is not expected to have a material adverse effect on the company. b. In November 2023, the State of Nevada filed suit against Eastern, seeking civil penalties and injunctive relief for violations of environmental laws regulating hazardous waste. On January 12, 2025, Eastern reached a settlement with state authorities. Based upon discussions with legal counsel, the Company feels it is probable that $151 million will be required to cover the cost of violations. Eastern believes that…arrow_forwardEastern Manufacturing is involved with several situations that possibly involve contingencies. Each is described below. Eastern's fiscal year ends December 31, and the 2024 financial statements are issued on March 15, 2025. a. Eastern is involved in a lawsuit resulting from a dispute with a supplier. On February 3, 2025, judgment was rendered against Eastern in the amount of $114 million plus interest, a total of $129 million. Eastern plans to appeal the judgment and is unable to predict its outcome though it is not expected to have a material adverse effect on the company. b. In November 2023, the State of Nevada filed suit against Eastern, seeking civil penalties and injunctive relief for violations of environmental laws regulating hazardous waste. On January 12, 2025, Eastern reached a settlement with state authorities. Based upon discussions with legal counsel, the Company feels it is probable that $147 million will be required to cover the cost of violations. Eastern believes that…arrow_forwardLee Manufacturing Corporation was incorporated on January 3, 2021. The corporation's financial statement for its first-year operations were not examined by a CPA. You have been engaged to examine the financial statements for the year ended December 31, 2022 and your examination is substantially completed. The corporation's trial balance at December 31, 2022 appears as follows: Account Name Debit Credit Cash 61,000 92,500 Accounts receivable Allowance for doubtful accounts Inventories Machinery Equipment Accumulated depreciation 500 38,500 75,000 29,000 10,000 Patents 85,000 Leasehold improvements Prepaid expenses Organization costs Goodwill Licensing Agreement No. 1 Licensing Agreement No. 2 Accounts payable Unearned revenue Share capital Retained earnings, January 1, 2022 Sales 26,000 10,500 29,000 24,000 50,000 49,000 147,500 12,500 300,000 27,000 768,500 Cost of goods sold Selling and marketing expenses General and administrative expenses Interest expense Extraordinary losses Total…arrow_forward

- Lara Croft has been hired as a new auditor for Jolie Inc. Ms. Croft has suggested thefollowing accounting changes in regards to the company’s financial statements.1. At December 31, 2019, Jolie Inc. had a receivable of $500,000 from Relic Inc. on itsstatement of financial position. Relic had gone bankrupt, and no recovery is expected.Jolie proposes to write off the receivable as a prior period item.2. The client proposes the following changes in depreciation policies. (a) For officefurniture and fixtures, it proposes to change from a 10-year useful life to an 8-yearlife. If this change had been made in prior years, retained earnings at December 31, 2019,would have been $250,000 less. The effect of the change on 2020 income alone is areduction of $60,000.(b) For its equipment in the leasing division, the client proposes to adopt the sum-of-theyears’-digits depreciation method. The client had never used SYD before. The first yearthe client operated a leasing division was 2020. If…arrow_forwardEastern Manufacturing is involved with several situations that possibly involve contingencies. Each is described below. Eastern's fiscal year ends December 31, and the 2021 financial statements are issued on March 15, 2022 a Eastern is involved in a lawsuit resulting from a dispute with a supplier. On February 3, 2022, judgment was rendered against Eastern in the amount of $111 million plus interest, a total of $126 million. Eastern plans to appeal the judgment and is unable to predict its outcome though it is not expected to have a material adverse effect on the company. b. In November 2020, the State of Nevada filed suit against Eastern, seeking civil penalties and injunctive relief for violations of environmental laws regulating hazardous waste. On January 12, 2022, Eastern reached a settlement with state authorities. Based upon discussions with legal counsel, the Company feels it is probable that $144 million will be required to cover the cost of violations. Eastern believes that…arrow_forwardEastern Manufacturing is involved with several situations that possibly involve contingencies. Each is described below. Eastern's fiscal year ends December 31, and the 2021 financial statements are issued on March 15, 2022. a. Eastern is involved in a lawsuit resulting from a dispute with a supplier On February 3, 2022, judgment was rendered against Eastern in the amount of $111 million plus interest, a total of $126 million. Eastern plans to appeal the judgment and is unable to predict its outcome though it is not expected to have a material adverse effect on the company. b. In November 2020, the State of Nevada filed suit against Eastern, seeking civil penalties and injunctive relief for violations of environmental laws regulating hazardous waste. On January 12, 2022, Eastern reached a settlement with state authorities. Based upon discussions with legal counsel, the Company feels it is probable that $144 million will be required to cover the cost of violations. Eastern believes that…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub