Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Using the table please show step by step how to solve a and b using excel.

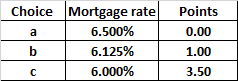

Bob decides to buy a house with price of $750,000. He puts 20% down payment and considers a 15-year fixed rate mortgage to pay the remaining balance. The lender offers Bob three choices of the mortgage with monthly payments. Suppose that the origination cost is $5,500.

a. If the loan will be outstanding for 15 years, what is the effective cost for each choice? Which choice should Bob make and why?

b. Which mortgage choices (i.e., b and c) are not properly priced and Why?

Transcribed Image Text:Choice Mortgage rate

Points

a

6.500%

0.00

b

6.125%

1.00

с

6.000%

3.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hh1.arrow_forwarder A https://player-ui.mheducation.com/#/epub/sn_7cac#epubcfi(%2F6%2F326%5Bdata-uuid-ab153a0624d544c2822 6. Comparing Total Mortgage Payments. Which mortgage would result in higher total payments? Mortgage A: $970 a month for 30 years Mortgage B: $760 a month for 5 years and $1,005 for 25 years 1.1 20 far $120.000 storts ot 4.01arrow_forwardAa 120.arrow_forward

- X + A https://player-ui.mheducation.com/#/epub/sn_7cac#epubcfi(%2F6%2F326%5Bdata-uuid-ab153a0624d544c282287e02 5. Calculating Monthly Mortgage Payments. Based on U Exhibit 9-9, or using a financial calculator, what would be the monthly mortgage payments for each of the following situations? a. $120,000, 15-year loan at 4.5 percent. b. $86,000, 30-year loan at 5 percent. c. $105,000, 20-year loan at 6 percent. d. What relationship exists between the length of the loan and the monthly payment? How does the mortgage rate affect the monthly payment?arrow_forwardA e N Y ll 36% Ô 14:24 Vo) LTE Question 4/10 Using the examples from the videos, which of these types of loans require that some principal be repaid prior to maturity (i.e., before the end of the loan period)? (check all that apply) Mortgage loan Bank loan Capital lease Zero-coupon bond Coupon bond NEXTarrow_forwardWhat type of loan requires both principal and interest payments as you go by making equal payments each period? 13 Your choice: 13/15 Qs A: Amortized loan B: Interest-only loan C: Discount loan D: Compound loanarrow_forward

- Q4arrow_forwardattached in ss below thanks or help h 1lph14l p1hp1 5h aprepreciate ti pi13tp 13tarrow_forwardrive loan is below. Payments of $1,987.26 are made monthly. Payment # Payment 1 1,987.26 2 1,987.26 3 1,987.26 Interest Debt Payment Balance 1,604.17 383.09 1,602.41 384.85 1,600.65 386.61 Provide your answer below: X Y Z Calculate the value of z, the balance of the loan at the end of month 3. Give your answer to the nearest dollar. Do not include commas or the dollar sign in your answer.arrow_forward

- Stepwise pls thanksarrow_forwardWhat is the right answer from A to D? Please help mearrow_forwardCrab Company is considering a project with an initial investment of $600,000 that is expected to produce cash inflows of $129,500 for ten years. Crab's required rate of return is 16%. (Click on the icon to view Present Value of $1 table.) E (Click on the icon to view Present Value of Ordinary Annuity of $1 table.) 14. What is the NPV of the project? 15. What is the IRR of the project? 16. Is this an acceptable project for Crab? 14. What is the NPV of the project? (Enter the factor amount to three decimal places, X.XXX. Round the present value of the annuity to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) Net Cash Annuity PV Factor Present (i-16%, n=10) Value Years Inflow 1- 10 Present value of annuity Investment Net present valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education