Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

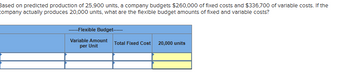

Transcribed Image Text:Based on predicted production of 25,900 units, a company budgets $260,000 of fixed costs and $336,700 of variable costs. If the

company actually produces 20,000 units, what are the flexible budget amounts of fixed and variable costs?

---Flexible Budget-----

Variable Amount

per Unit

Total Fixed Cost 20,000 units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nashler Company has the following budgeted variable costs per unit produced: Budgeted fixed overhead costs per month include supervision of 98,000, depreciation of 76,000, and other overhead of 245,000. Required: 1. Prepare a flexible budget for all costs of production for the following levels of production: 160,000 units, 170,000 units, and 175,000 units. 2. What is the per-unit total product cost for each of the production levels from Requirement 1? (Round each unit cost to the nearest cent.) 3. What if Nashler Companys cost of maintenance rose to 0.22 per unit? How would that affect the unit product costs calculated in Requirement 2?arrow_forwardVariable Cost Ratio, Contribution Margin Ratio Chillmax Company plans to sell 3,500 pairs of shoes at 60 each in the coming year. Unit variable cost is 21 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Fixed factory overhead is 30,000 and fixed selling and administrative expense is 48,000. Required: 1. Calculate the variable cost ratio. 2. Calculate the contribution margin ratio. 3. Prepare a contribution margin income statement based on the budgeted figures for next year. In a column next to the income statement, show the percentages based on sales for sales, total variable cost, and total contribution margin.arrow_forwardJudges Gavel uses this information when preparing their flexible budget: direct materials of $3 per unit, direct labor of $2.50 per unit, and manufacturing overhead of $1.25 per unit. Fixed costs are $49,000. What would be the budgeted amounts for 33,000 and 35,000 units?arrow_forward

- Taylor Corporation is analyzing the cost behavior of three cost items, A, B, and C, to budget for the upcoming year. Past trends have indicated the following dollars were spent at three different levels of output: In establishing a budget for 14,000 units, Taylor should treat A, B, and C costs as: a. semivariable, fixed, and variable, respectively. b. variable, fixed, and variable, respectively. c. semivariable, semivariable, and semivariable, respectively. d. variable, semivariable, and semivariable, respectively.arrow_forwardBased on predicted production of 24,300 units, a company budgets $320,000 of fixed costs and $461,700 of variable costs. If the company actually produces 19,100 units, what are the flexible budget amounts of fixed and variable costs?arrow_forwardHardevarrow_forward

- The fixed budget for 20,300 units of production shows sales of $609,000; variable costs of $60,900; and fixed costs of $141,000. If the company actually produces and sells 26,100 units, calculate the flexible budget income.arrow_forwardRequired Information [The following information applies to the questions displayed below.] The fixed budget for 21,500 units of production shows sales of $559,000; variable costs of $64,500; and fixed costs of $142,000. If the company actually produces and sells 26,500 units, calculate the flexible budget Income. Sales Variable costs Contribution margin Fixed costs Income ------Flexible Budget-..... Variable Amount Total Fixed per Unit Cost $ 689,000 689,000 ------Flexible Budget at 21,500 units $ $ 0 0 26,500 units $ $ 0 0arrow_forward! Required information [The following information applies to the questions displayed below.] The fixed budget for 21,300 units of production shows sales of $617,700; variable costs of $63,900; and fixed costs of $143,000. If the company actually produces and sells 26,800 units, calculate the flexible budget income Sales Variable costs Contribution margin Fixed costs Income ------Flexible Budget------ Variable Amount per Unit $ 0 ▶▶▶ Total Fixed Cost 21,300 units $ ------Flexible Budget at $ 0 0 26,800 units $ $ 0 0arrow_forward

- Required Information [The following information applies to the questions displayed below.] The fixed budget for 21,300 units of production shows sales of $489,900; variable costs of $63,900; and fixed costs of $144,000. If the company actually produces and sells 27,300 units, calculate the flexible budget Income. Contribution margin ------Flexible Budget------ Variable Amount per Unit Total Fixed Cost ------Flexible Budget at- 21,300 units 27,300 unitsarrow_forwardProvide answerarrow_forwardF Based on predicted production of 25,000 units, a company budgets $280,000 of fixed costs and $275,000 of variable costs. If the company actually produces 19,800 units, what are the flexible budget amounts of fixed and variable costs? -----Flexible Budget------ Variable Amount per Unit Total Fixed Cost 19,800 units $ 275,000 Variable cost Fixed costs 280,000 2 W S # 3 E D $ 4 $ D R F 4 U 8 J 9 Karrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub