FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

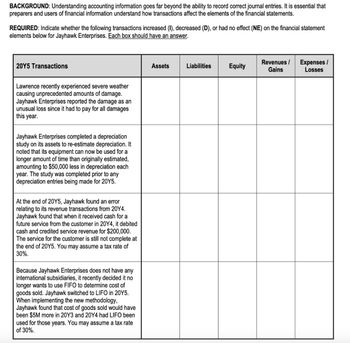

Transcribed Image Text:BACKGROUND: Understanding accounting information goes far beyond the ability to record correct journal entries. It is essential that

preparers and users of financial information understand how transactions affect the elements of the financial statements.

REQUIRED: Indicate whether the following transactions increased (I), decreased (D), or had no effect (NE) on the financial statement

elements below for Jayhawk Enterprises. Each box should have an answer.

20Y5 Transactions

Lawrence recently experienced severe weather

causing unprecedented amounts of damage.

Jayhawk Enterprises reported the damage as an

unusual loss since it had to pay for all damages

this year.

Jayhawk Enterprises completed a depreciation

study on its assets to re-estimate depreciation. It

noted that its equipment can now be used for a

longer amount of time than originally estimated,

amounting to $50,000 less in depreciation each

year. The study was completed prior to any

depreciation entries being made for 20Y5.

At the end of 20Y5, Jayhawk found an error

relating to its revenue transactions from 20Y4.

Jayhawk found that when it received cash for a

future service from the customer in 20Y4, it debited

cash and credited service revenue for $200,000.

The service for the customer is still not complete at

the end of 20Y5. You may assume a tax rate of

30%.

Because Jayhawk Enterprises does not have any

international subsidiaries, it recently decided it no

longer wants to use FIFO to determine cost of

goods sold. Jayhawk switched to LIFO in 20Y5.

When implementing the new methodology,

Jayhawk found that cost of goods sold would have

been $5M more in 20Y3 and 20Y4 had LIFO been

used for those years. You may assume a tax rate

of 30%.

Assets

Liabilities

Equity

Revenues/ Expenses/

Gains

Losses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- please answer all the following and give the complete solutions on how you come up with that .arrow_forwardNote:- • Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. • Answer completely. • You will get up vote for sure.arrow_forwardPlease give me answer general accounting questionarrow_forward

- Alert for not submit AI generated answer. I need unique and correct answer. Don't try to copy from anywhere. Do not give answer in image formet and hand writingarrow_forwardNeed help with this accounting questionsarrow_forwardTB MC Qu. 02-148 (Static) Which of the following... Which of the following is not a step in the process to go from transactions and events to the financial statements? Multiple Choice Analyze each transaction and event using the accounting equation. Identify each transaction and event from source documents. Record relevant transactions and events in a journal. Post journal information to ledger accounts. Ensure the cash account balance is reduced to $0 at the end of each period. 21 of 26 Next.arrow_forward

- Quick answer of this accounting questionsarrow_forwardvnt34arrow_forwardListen Time: 8 minutes For the following statements identify the assertion related to the risk of material misstatement. Explain your choice. Statement 1: "I am concerned that several of the significant accounts receivable balances on the Balance Sheet are uncollectible" Statement 2: "I am concerned that several of the revenue transactions that were recorded during the year didn't actually happen" Statement 3: "I am concerned that there is a significant unrecorded liability that should be recorded on the Balance Sheet" Statement 4: "I am concerned that assets that don't actually exist were recored on the Balance Sheet!" BIU Format tvarrow_forward

- Need help with this accounting question not use aiarrow_forwardCan someone please help me solve part (C) please? Parts A & B are already solved. Thank you!arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education