Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

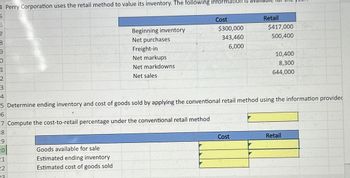

Transcribed Image Text:4 Perry Corporation uses the retail method to value its inventory. The following information is ava

5

6

7

8

9

0

1

2

3

4

Beginning inventory

Net purchases

Freight-in

Net markups

Net markdowns

Net sales

Cost

$300,000

343,460

Retail

$417,000

500,400

6,000

10,400

8,300

644,000

5 Determine ending inventory and cost of goods sold by applying the conventional retail method using the information provided

6

7 Compute the cost-to-retail percentage under the conventional retail method

8

Cost

Retail

19

20

21

22

23.

Goods available for sale

Estimated ending inventory

Estimated cost of goods sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Perpetual and Periodic Inventory Systems Below is a list of inventory systems options. a. Perpetual inventory system b. Periodic inventory system c. Both perpetual and periodic inventory systems Required: Match each option with one of the following: 1. Only revenue is recorded as sales are made during the period; the cost of goods sold is recorded at the end of the period. 2. Cost of goods sold is determined as each sale is made. 3. Inventory purchases are recorded in an inventory account. 4. Inventory purchases are recorded in a purchases account. 5. Cost of goods sold is determined only at the end of the period by subtracting the cost of ending inventory from the cost of goods available for sale. 6. Both revenue and cost of goods sold are recorded during the period as sales are made. 7. The inventory is verified by a physical count.arrow_forwardPerpetual inventory using FIFO Assume that the business in Exercise 6-5 maintains a perpetual inventory system, costing by the first-in, first-out method. Determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3.arrow_forwardCalculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for first-in, first-out (FIFO).arrow_forward

- Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for last-in, first-out (LIFO).arrow_forwardPerpetual versus Periodic Inventory Systems Graham Company is trying to select an inventory system. Below are several statements that pertain to inventory systems. 1. Cost of goods sold is only determined at the end of the period after a physical count of inventory. 2. A physical count of inventory is performed. 3. Purchases of inventory are recorded in a purchases account. 4. Cost of goods sold is determined continually during the period as sales are made. 5. Greater control over inventory is possible. 6. This inventory system is relatively inexpensive to operate. Required: Select the inventory system, perpetual or periodic, that is best represented by each statement. If the statement applies to both systems, select both.arrow_forwardExplain why a company might want to utilize the gross profit method or the retail inventory method for inventory valuation.arrow_forward

- ( Appendix 6B) Inventory Costing Methods: Periodic Inventory System The inventory accounting records for Lee Enterprises contained the following data: Required: 1. Calculate the cost of ending inventory and the cost of goods sold using the FIFO, LIFO, and average cost methods. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) 2. CONCEPTUAL CONNECTION Compare the ending inventory and cost of goods sold computed under all three methods. What can you conclude about the effects of the inventory costing methods on the balance sheet and the income statement?arrow_forwardUse the first-in, first-out (FIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forwardUse the first-in, first-out method (FIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for B75 Company, considering the following transactions.arrow_forward

- ( Appendix 6B) Inventory Costing Methods: Periodic FIFO Refer to the information for Filimonov Inc. (p. 337) and assume that the company uses a periodic inventory system. Required: Calculate the cost of goods sold and the cost of ending inventory using the FIFO inventory costing method.arrow_forwardInventory Write-Down The following information is taken from Aden Companys records: Required: 1. What is the correct inventory value if the company applies the LCNRV rule to each of the following? a. individual items b. groups of items c. the inventory as a whole 2. Next Level Are there any conditions under which a company may ignore the decline in the value of inventory below its cost?arrow_forward( Appendix 6B) Refer to the information for Morgan Inc. above. If Morgan uses a periodic inventory system, what is the cost of goods sold under FIFO at April 30? a. $32,800 b. $38,400 c. $63,600 d. $69,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Accounting Information Systems

Finance

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Cengage Learning