FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

On September 8, 2020, Holly purchased a residential apartment building. The cost basis assigned to the building is $197,400. Holly also owns another residential apartment building that she purchased on November 15, 2020, with a cost basis of $214,000.

a. Calculate Holly's total

b. Calculate Holly's total depreciation deduction for the apartments for 2021 using MACRS.

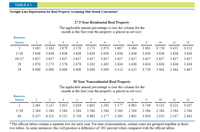

Transcribed Image Text:TABLE 8.5

Straight-Line Depreciation for Real Property Assuming Mid-Month Convention*

27.5-Year Residential Real Property

The applicable annual percentage is (use the column for the

month in the first year the property is placed in service):

Recovery

Year(s)

11

1.

2

3

4

6

7

9

10

12

1

3.485

3.182

2.879

2.576

2.273

1.970

1.667

1.364

1.061

0.758

0.455

0.152

2-18

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

19–27

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

28

1.970

2.273

2.576

2.879

3.182

3.485

3.636

3.636

3.636

3.636

3.636

3.636

29

0.000

0.000

0.000

0.000

0.000

0.000

0.152

0.455

0.758

1.061

1.364

1.667

39-Year Nonresidential Real Property

The applicable annual percentage is (use the column for the

month in the first year the property is placed in service):

Recovery

Year(s)

1

2

3

4

6

7

8

9

10

11

12

1

2.461

2.247

2.033

1.819

1.605

1.391

1.177

0.963

0.749

0.535

0.321

0.107

2-39

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

40

0.107

0.321

0.535

0.749

0.963

1.177

1.391

1.605

1.819

2.033

2.247

2.461

*The official tables contain a separate row for each year. For ease of presentation, certain years are grouped together in these

two tables. In some instances, this will produce a difference of .001 percent when compared with the official tables.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jennifer installed a new enery-efficient tankless water heater in 2021 at a cost of $5,000. She replaced a similar unit in 2006 and claimed a nonbusiness energy property credit of $400 at that time. What is the amount of her nonbusiess energy property credit for 2021?arrow_forwardTerry purchased a machine for $12,000; the seller is holding the note. Terry paid $2,400 for the required wiring and installation. Terry has deducted depreciation on the machine for 3 years totaling $3,600. Terry owes $8,000 to the Seller. What is Terry’s adjusted basis in the machine? Group of answer choices $10,800 $8,400 $2,800 $16,400arrow_forwardMona owns a rental house that she has rented to various tenants since September of 2001. The backyard fence fell into disrepair in June of 2018. She had it replaced June 27th, 2018 for $8,399. lf Mona elects to use special depreciation for the new fence, what is the amount of current depreciation (excluding the amount of current special depreciation) for thisasset? a) $0b) $210c) $315d) $420arrow_forward

- Please calculate the rental income for tax purposes. In July 2022, an individual acquires a rental property for $20,000. $110,000 is allocated to the land and $160,000 is allocated to the building. The property is rented for $1,800 per month. Condo fees are $50 per month, property taxes are $1,000 per year and interest expense for 2022 is $6,100. Note: the building was acquired after 1987 for residential use; therefore, a class 1 asset (CCA rate = 4%)arrow_forwardSubject : Accountingarrow_forwardNancy purchased new business computers (7-year property) in January for a total of $1,200,000. She plans to take advantage of §179 expensing and MACRS depreciation (but not first year additional depreciation). What is the total amount of her depreciation deduction?arrow_forward

- Please show the worksarrow_forwardHazel purchased a new business asset (five-year asset) on September 30, 2021, at a cost of $100,000. On October 4, 2021, she placed the asset in service. This was the only asset she placed in service in 2021. Hazel did not elect § 179 or additional first-year depreciation. On August 20, 2022, Hazel sold the asset. Determine the cost recovery for 2022 for the asset. $38,000 Ob $14,250 O $23,750 Od $19,000arrow_forwardYasmin purchased two assets during the current year. On May 26th Yasmin placed in service computer equipment (five-year property) with a basis of $17,000 and on December 9th placed in service machinery (seven-year property) with a basis of $17,000. Calculate the maximum depreciation deduction (ignoring §179 and bonus depreciation). (Use MACRS Table 2.)arrow_forward

- Alexandra purchased a $55,800 automobile during 2020. The business use was 70 percent. What is the allowable depreciation for the current year? (Ignore any possible bonus depreciation.)arrow_forwardNancy purchased a projector screen on July 15, 2019, for $1,200. The screen was used 70% of the time in her business and the rest of the time her children used the screen to watch movies. In 2019, the computer was used 40% for business and 60% for personal use. What are the cost recovery deductions for 2019 and 2020? (No §179 or bonus). Is there any recapture of depreciation in 2020?arrow_forwardA residential rental apartment complex is placed in service by a calendar-year taxpayer on February 27 for $530,000. The apartments are kept for slightly more than 6 years and sold on March 6. a. What is the MACRS-GDS property class? b. Determine the depreciation deduction during each of the 7 yearsinvolved. c. Determine the unrecovered investment during each of the 7 yearsinvolved.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education