FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

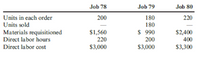

During March, Aragon Company worked on three jobs. Data relating to these three jobs follows:

Over head is assigned on the basis of direct labor hours at a rate of $8.40 per direct labor hour during march, Jobs78 and 79 were completed and transferred to Finished goods inventory. Job 79 was sold by the end of the month. Job 80 was the only unfinished job at the end of the month.

Required

1. Calculate the per unit cost of Jobs 78 and 79

2. Compute the ending balance in the work in process inventory account

3. Prepare the

Transcribed Image Text:Job 78

Job 79

Job 80

Units in each order

180

180

$ 990

200

220

Units sold

Materials requisitioned

$1,560

220

$2,400

Direct labor hours

200

400

Direct labor cost

$3,000

$3,000

$3,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Arrow Enterprises uses a standard costing system. The standard cost sheet for product no. 549 follows: Direct materials: 4 units @ $6.50 $26.00 Direct Labor: 8 hours @ $8.50 68 Variable factory overhead: 8 hours @ $7.00 56 Fixed factory overhead: 8 hours @ $25 20 Total standard cost per unit $170,000 The following information pertains to activity for December: 1. Direct materials acquired during the month amounted to 26,350 units at $6.40 per unit. All materials were consumed in operations. 2. Arrow incurred an average wage rate of $8.75 for 51,400 hours of activity. 3. Total overhead incurred amounted to $508,400. Budgeted fixed overhead totals $1.8 million and is spread evenly throughout the year. 4. Actual production amounted to 6,500 completed units. Compute Arrow's direct labor variances.arrow_forwardMetropolitans Manufacturing generated the following activity for July for its current jobs. Total costs accumulated in the Work-in-Process account. Manufacturing overhead was allocated at $32 per machine hour used.1. Complete the Job Costs for each job listed below. Job 123 Job 124 Job 125 Total July 1 Balance $16,230 $12,680 $11,170 $40,080 Direct Materials Used $11,710 $18,920 $11,990 $42,620 Direct Labor Assigned to Jobs $14,520 $21,460 $7,480 $43,460 Manufacturing Overhead allocated to jobs Total Cost per Job Machine Hours used per job 410 390 70 2. Prepare the journal entry for completion of jobs 123 and 124 in July.Journal Date Description Debit Credit Open a T-account for Work-in-Process Inventory.3. Post the journal entry made in above. Compute the ending balance in the Work-in-Process Inventory account on July 31.Work-in-Process Debit Credit Double line Double line 4.…arrow_forwardDirect Labor Costs August, Carrothers Company accumulated 790 hours of direct labor costs on Job 50 and 500 hours on Job 56. The total direct labor was incurred at a rate of $15 per direct labor hour for Job 50 and $13 per direct labor hour for Job During 56. Journalize the entry to record the flow of labor costs into production during August. If an amount box does not require an entry, leave it blank.arrow_forward

- Required information [The following information applies to the questions displayed below.] At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. At June 30 Direct materials Direct labor Overhead applied Additional Information Job 5 $ 18,400 11, 400 5,700 Job 6 $ 34,700 17,600 8,800 Job 7 $ 28,700 24,400 12, 200 a. Job 5 was started in May, and the following costs were assigned to it in May: direct materials, $7,700; direct labor, $3,500; and applied overhead, $2,600. Job 5 was finished in June. b. Job 6 and Job 7 were started in June; Job 6 was finished in June, and Job 7 is to be completed in July. Total transferred cost c. Overhead cost is applied with a predetermined rate based on direct bor cost. The predetermined overhead rate did not change across these months. 4. What is the total cost transferred to Finished Goods Inventory in June?arrow_forwardNonearrow_forwardI want answerarrow_forward

- Ivanhoe Company begins operations on April 1. Information from job cost sheets shows the following: Manufacturing Costs Assigned Job Number April May June Month Completed 10 $6,700 $4,600 May 11 4,400 4,200 $3,200 June 12 1,400 April 13 4,900 3,500 June 14 5,600 3,600 Not complete Each job was sold for 25% above its cost in the month following completion. (a) Calculate the balance in Work in Process Inventory at the end of each month. Work in Process Inventory April 30 $enter a dollar amount May 31 $enter a dollar amount June 30 $enter a dollar amountarrow_forwardA Company issued $5,00,000/- new capital divided into $.10/- shares at a premium of $4/- per share payable as On Application $1/- per share On Allotment $4/- per share & $.2/- premium On Final Payment $.5/- per share & $.2/- premium Overpayments on application were to be applied towards sum due on allotment. Where no allotment was made money was to be returned in full. The issue was oversubscribed to the extent of 13,000 shares. Applicants for 12,000 shares were allotted only 1,000 shares and applicants for 2,000 were sent letters of regret. All money due on allotment and final call was duly received. Make the necessary entries in the company‟s book.arrow_forwardIn December, one of the processing departments at Bonine Corporation had ending work in process inventory of $32,000. During the month, $264,000 of costs were added to production and the cost of units transferred out from the department was $257,000. The company uses the FIFO method in its process costing system. Required: Construct a cost reconciliation report for the department for the month of December. Essay Toolbar navigation BIVS Il hil !!!arrow_forwardQuestion: At the end of April, Almerinda Company had completed Jobs 50 and 51. Job 50 is for 23,040 units, and Job 51 is for 26,000 units. The following data relate to these two jobs: On April 6, Almerinda Company purchased on account 60,000 units of raw materials at $12 per unit. On April 21, raw materials were requisitioned for production as follows: 25,000 units for Job 50 at $10 per unit and 27,000 units for Job 51 at $12 per unit. During April, Almerinda Company accumulated 20,000 hours of direct labor costs on Job 50 and 24,000 hours on Job 51. The total direct labor was incurred at a rate of $20.00 per direct labor hour for Job 50 and $22.00 per direct labor hour for Job 51. Almerinda Company estimates that total factory overhead costs will be $1,750,000 for the year. Direct labor hours are estimated to be 500,000. a. Determine the balance on the account in the work in process subsidiary ledger in which the costs charged to a particular job order are recorded on job cost sheets…arrow_forwardThe April Work in Process account for Coventry Co. contained the following: Beginning balance -- $19,000 debit Direct materials -- $11,000 debit Direct labor -- $8,000 debit Overhead -- $13,000 debit Transfer to finished goods -- $3,000 credit Overhead is applied at a rate of 125% of direct labor cost. The only job in process at April 30, Job #897, has been charged with direct labor cost of $4,000. What amount of direct materials cost has been charged to Job 897? $____________arrow_forwardkindly answer and provide solutionarrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education