FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

For the past several years, John Upton has operated a part-time consulting business from his home. As of July 1, 2019, Jolene decided to move to rented quarters and to operate the business, which was to be known as Gourmet Consulting, on a full-time basis. Gourmet Consulting entered into the following transactions in July:

INSTRUCTIONS;

- Journalize each transaction in a two column journal utilizing the following chart of accounts.

- Insurance expired during July is $510

- Supplies on hand on July 31 are $3,900

Depreciation of Office Equipment for July is $540- Accrued receptionist salary on July 31 is $190

- Rent expired during July is $2,700

- Unearned fees on July 31 are $4,100

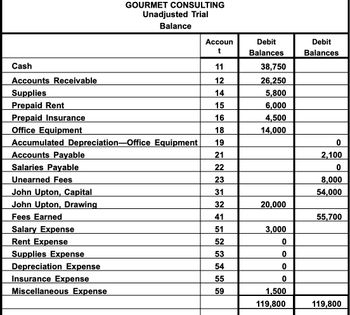

Transcribed Image Text:**Gourmet Consulting: Unadjusted Trial Balance**

This table displays the unadjusted trial balance for Gourmet Consulting, providing a snapshot of the company's financial status before any adjustments. The table is divided into columns for account names, account numbers, debit balances, and credit balances. The goal of this trial balance is to ensure that the total debits equal the total credits, indicating balanced accounts before adjustments.

**Table Breakdown:**

- **Account Names and Numbers:** Each account is listed with a unique identifying number. These accounts include assets, liabilities, owner's equity, revenue, and expenses.

- **Debit Balances:** Accounts with amounts recorded in the debit column include:

- **Cash (Account 11):** $38,750

- **Accounts Receivable (Account 12):** $26,250

- **Supplies (Account 14):** $5,800

- **Prepaid Rent (Account 15):** $6,000

- **Prepaid Insurance (Account 16):** $4,500

- **Office Equipment (Account 18):** $14,000

- **John Upton, Drawing (Account 32):** $20,000

- **Salary Expense (Account 51):** $3,000

- **Miscellaneous Expense (Account 59):** $1,500

- **Credit Balances:** Accounts with amounts recorded in the credit column include:

- **Accounts Payable (Account 21):** $2,100

- **Unearned Fees (Account 23):** $8,000

- **John Upton, Capital (Account 31):** $54,000

- **Fees Earned (Account 41):** $55,700

- **Total Balances:**

- **Total Debit Balances:** $119,800

- **Total Credit Balances:** $119,800

**Analysis:**

The total debits equal the total credits, confirming that the accounts are initially balanced, which is crucial for the integrity of the financial statements. This unadjusted trial balance serves as a preliminary step before adjustments are made for accrued revenues, expenses, and depreciation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An employee is required to use her own automobile for employment duties. She acquired a new car at the beginning of the year for $40000 (including GST and HST of 8 %) and during the year she incurred the following expenses. Gasoline $2200, repairs and maintenance $400, insurance and registration $800, meals while away from the office $420 ($200 relates to out of town travel), parking during employment duties $ 300 and interest on loan to acquire car $3900. During the year, the employee drove 26000 km of which 14000 were for employment duties and the remaining were personal. Compute the personal and employment expenses.arrow_forwardBrianna Whitman works for Schaum, Whitney, & Matte, LLP, in Washington, D.C., which pays employees on a biweekly basis. Brianna's annual salary is $162,600. The company started in 2021. Required: Calculate the following: (Do not round intermediate calculations. Round your answers to 2 decimal places.) Prior YTD Earnings Social Security Taxable Wages Medicare Taxable Wages Employer Share Social Security Tax Employer Share Medicare Tax Pay Period End September 24 December 31arrow_forwardWai Yeung is a self-employed insurance Salesperson. She started her business on January 1, 2022, and ended her first taxation year on December 31, 2022. On July 1, she purchased a car for $36,000 plus 13% HST. The car is financed with a bank loan and interest costs amounted to $1,970 from July 1 to December 31. Wai incurred the following additional expenses relating to her automobile: Repairs and maintenance $ 400 Insurance 1,200 Gasoline 1,900 Parking while on business 500 During the period, Wai drove 16,000 Km, of which 12,000 Km were for business. Assume the car is not designated as immediate expensing property. Required: Complete the table below to answer the following questions. a. Determine the maximum amount that Wai can deduct from her business income for tax purposes in 2022. Show expenses as negative numbers. b. Calculate the maximum CCA that Wai can deduct in 2023 and 2024, assuming that business kilometres driven and total kilometres driven both remain constant and that she…arrow_forward

- Justin Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. Calculate his net take home pay assuming the employer withheld federal income tax ( wage - bracket, married filing jointly), social security taxes, and state income tax (2 %). Enter deductions beginning with a minus sign (-). As we go to press, the federal income tax rates for 2024 are being determined by budget talks in Washington, and are not available for publication. For this edition, the 2023 federal income tax tables for Manual Systems with Forms W-4 From 2020 or Later with Standard Withholding and 2023 FICA rates have been used.Gross pay Federal income tax Social security taxes - OASDI Social security taxes - HI State income tax Net payarrow_forwardLatan is an employee of Giant Computers where the job responsibilities include selling computers and software to customers. Latan is married filing jointly with two dependents under 17. The annual salary is $49,200 and receives a 3 percent commission on all sales. During the semimonthly pay period ending September 30, Latan sold $21,200 of computers and software. Required: Complete the payroll register for the September 30 pay period with a pay date of October 5. P/R End Date: Check Date: Latan Totals Name 9/30/2022 10/5/2022 Filing Status Dependents Hourly Rate or Period Wage Company Name: Number of Regular Hours Number of Overtime Hours Giant Computers Commissions $ 0 Regular Earnings $ 0 Overtime Earnings Gross Earnings $arrow_forwardCan I do a general journal entry on this scenario, if so how do i do it? Master Flow’s first employee, Emma Stone starts at the Company. She will be responsible for Warehouse Management. She will be paid $20 / Hour. Emma works 30 Hours / Pay Period (every two weeks). The pay period ends on 12-31-20. Emma’s Federal Tax Withholding is $50, based on her W4, and all other standard payroll taxes apply at their appropriate rates. She does not receive benefits and does not have any contributions of any type withheld from her pay.arrow_forward

- Crown Properties leases its units for $3,500 per month, payable on the first day of the month. One tenant is having some financial difficulties. Crown Properties has agreed to allow the tenant to pay half of December’s rent on the last day of December and the other half sometime in January. Prepare Crown Properties journal entry for this tenant on December 31, 2022.arrow_forwardAudrey Martin and Beth James are partners in the Country Gift Shop, which employs the individuals listed below. Paychecks are distributed every Friday to all employees. Based on the information given, compute the amounts listed below for a weekly payroll period. Name and Position Zena Vertin, Office Nicole Norge, Sales Bob Mert, Delivery Audrey Martin, Partner Beth James, Partner Employer's QASDI Tax Employer's Hi Tax S Salary $ 700 per week 2,980 per month 650 per week 950 per week 950 per week Totals 5 OASDI Taxable Earnings OASDI Tax HI Taxable Earnings HI Taxarrow_forwardIman purchased an electric lawn mower, an edger, and an extension cord from her neighborhood yard and garden store. Immediately thereafter, the store emailed her a bill for these items. The bill stated that payment was due within 30 days. The bill is called a(n): Multiple Choice ledger statement. warranty. indenture. receipt. invoice.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education